Asset allocation makes earnings more stable

01 get started with asset allocation to make the revenue experience better

Financial markets are unpredictable, and if you only invest in a single asset, you will inevitably encounter a downward phase of the cycle, and it will be difficult to resist the impact of the "black swan".

In addition, the volatility of investment income often affects the earnings experience. According to the Insight report on Investor earnings of Public Equity funds jointly issued by Jingshun Great Wall, Wells Fargo Fund and BoCom Schroeder in 2021, although there is no significant linear relationship between fund volatility and the average rate of return of investors, however, higher fund volatility will have a negative impact on its base experience, thus affecting the holding time of fund investors and further affecting the average rate of return.

Therefore, from the perspective of security and stability, asset allocation is worth considering by investors.

To put it simply, asset allocation is based on investment demand, allocating funds to different assets, through diversification to reduce the overall volatility of the portfolio, and strive for a more stable return.

Through the ages, the idea of asset allocation has existed:

Thousands of years ago, Jews mentioned in the Talmud: "one should always preserve his property in three forms: one for real estate, another for commodities, and the remaining one for liquid assets."

By the middle of the 20th century, the American economist Benjamin Graham, in his book Smart Investor, suggested that the simplest allocation should be split between stocks and bonds.

The portfolio investment theory put forward by Nobel laureate Markowitz lays the theoretical foundation of asset allocation and becomes the learning content of portfolio management in business school.

Today, asset allocation can be seen in the investment practices of institutions such as the Bridge Water Fund, the Yale Endowment Fund and GIC.

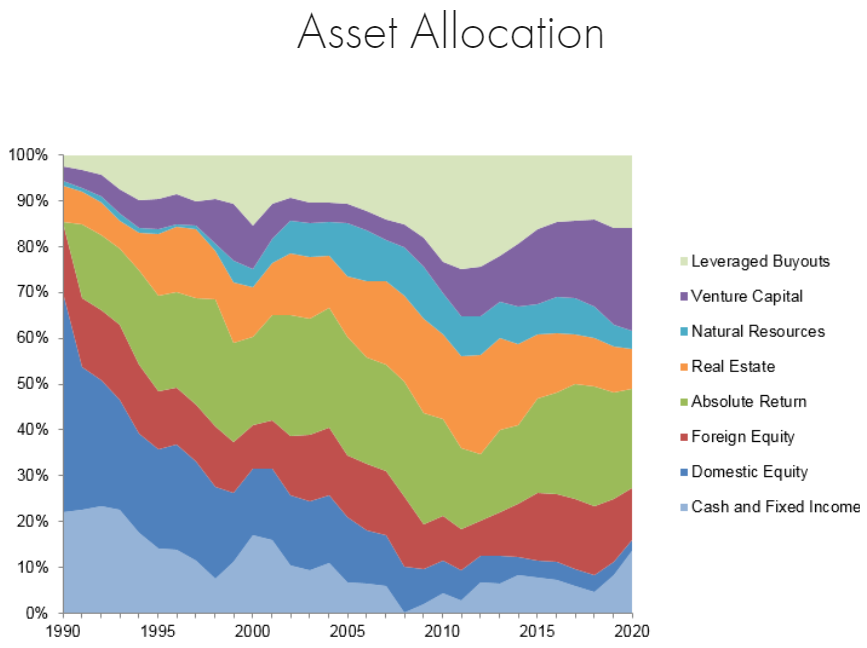

Photo: Yale Endowment Fund, asset allocation category and ratio, 1990-2020

Is asset allocation the same as we often say: "Don't put eggs in the same basket"? To be exact, asset allocation has more to consider. For example, to divide into several baskets, what is the relevance of each basket, and whether you have to adjust the number of eggs in each basket after a period of time.

After understanding the role and history of asset allocation, we will next learn the common steps of planning asset allocation, how to determine the specific proportion of the major assets in the portfolio, and how to take shock City as an example to consider asset allocation adjustment.