Beginner's guide to Crypto that you must learn

A comprehensive review of crypto history

Have you heard the latest about Bitcoin? In 2024 H1, its value once surged by 68%. As the largest and most well-known cryptocurrency, Bitcoin has increased in value by millions of times since its inception.

The journey of cryptocurrencies from obscurity to household names is one of the most astonishing stories of the 21st century.

In this lesson, we'll dive into the origins and evolution of cryptocurrencies, which are crucial to understanding the current state and future trends. If you are interested, don't miss out.

Milestones

First, let's sort out some of the important milestones in the history of cryptocurrency.

Feel interested in the background and significance of these milestones? Next, we will explore them chronologically in the following discussion.

1982-2008: the origins of cryptocurrencies

Before Bitcoin emerged, top cryptographers around the world were already exploring the potential of digital currencies.

David Chaum from the University of California, Berkeley, is a pioneer in this area. He founded DigiCash in the 1990s and introduced a digital currency called "eCash." Although DigiCash went bankrupt in 1998 due to financial difficulties, the experiment had a positive impact on the evolution of cryptocurrencies by inspiring many developers.

2008-2010: the birth of Bitcoin

On October 31, 2008, a user named Satoshi Nakamoto published a paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System", introducing the concept of Bitcoin.

Satoshi Nakamoto's true identity remains one of the biggest mysteries in the crypto world, but Bitcoin's influence remains undiminished. Some people even feel more confident using Bitcoin because of the creator's anonymity.

In early 2009, Satoshi Nakamoto mined the first block of Bitcoin, known as the "Genesis Block." A year later, programmer Laszlo Hanyecz made the first real-world Bitcoin transaction by buying a Papa John's pizza for 10,000 BTC. Bitcoin enthusiasts now celebrate this day as "Bitcoin Pizza Day."

In its early years, Bitcoin was known to only a few, mainly tech enthusiasts who used it for experiments and exploration.

2010-2014: the first boom

Bitcoin captured widespread attention in 2011, when its price first experienced a dramatic surge.

In February, the price of Bitcoin surpassed $1 for the first time, achieving parity with the U.S. dollar. This milestone event caused a spike in website traffic, temporarily crashing Bitcoin's official site.

By April, following coverage in Time and Forbes magazines, the price skyrocketed from $1 to as high as $30.

By March 2013, Bitcoin's total market cap exceeded $1 billion for the first time.

As Bitcoin began to attract mainstream attention, an increasing number of blockchain enthusiasts entered the field. This led to the emergence of numerous innovations, including Bitcoin mining hardware, ATMs, exchanges, and altcoins.

2014-2016: Major turning points

This period saw two significant events that shaped the future of cryptocurrencies.

The first major event occurred in 2014 when Mt. Gox, the largest Bitcoin exchange at the time, was hacked, resulting in substantial financial losses for users and the eventual collapse of the platform. The incident caused Bitcoin's price to plummet by 80%.

In the aftermath, the industry began to implement stronger security measures, including enhanced encryption technologies, the use of cold storage (offline storage), and multi-signature transactions.

The second pivotal event happened in 2015 with the launch of Ethereum. Many believe that Ethereum addresses some of Bitcoin's network limitations, making it a second-generation blockchain platform.

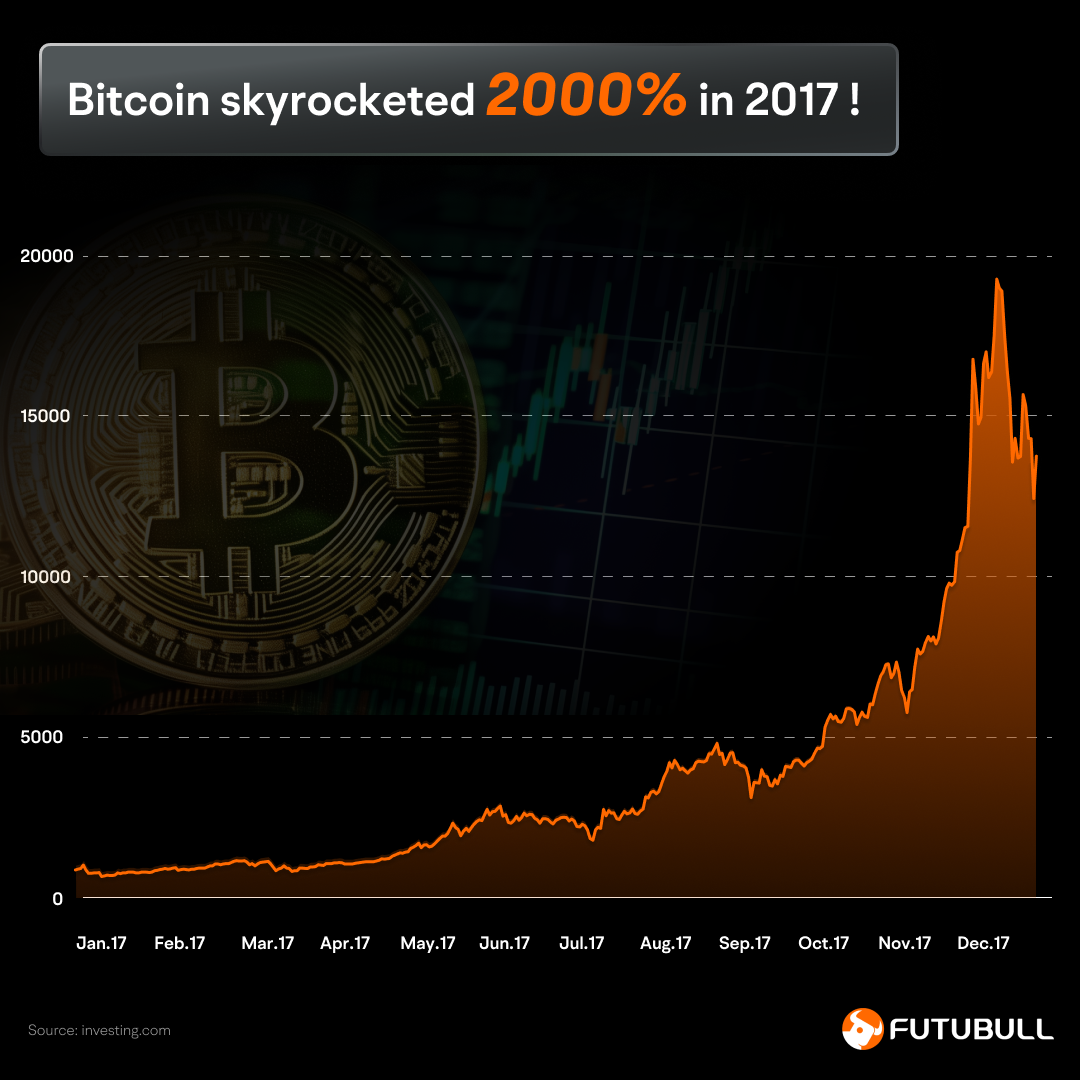

2017: A global frenzy

In 2017, Bitcoin experienced a massive bull market, skyrocketing from less than $1,000 at the beginning of the year to a peak of $19,870 by year’s end—a staggering 2000% increase! Remember the pizza bought with 10,000 Bitcoins? At 2017's peak prices, it would have been worth $200 million!

This year marked the beginning of a global cryptocurrency frenzy, with numerous new projects raising funds through Initial Coin Offerings (ICOs). According to Crunchbase's tracking of ICOs, the total amount raised through ICOs in 2017 was approximately $4.9 billion, a tenfold increase from the previous year.

The world's largest cryptocurrency exchange, Binance, was also founded in 2017. Towards the end of the year, the Chicago Mercantile Exchange (CME) launched the first Bitcoin futures contract, marking Bitcoin's entry into mainstream investment circles.

2018-2019: Crypto winter

As the popularity and investment in cryptocurrencies surged, so did associated illegal activities like scams, thefts, and financial crimes. This drew the attention of regulatory bodies worldwide.

2018 became known as the "Year of Regulatory Reckoning" for cryptocurrencies. China banned cryptocurrency trading and Bitcoin mining, while the United States tightened regulations and oversight. Many countries cracked down on or severely restricted ICOs.

During this period, Bitcoin's price plummeted, reaching lows of around $3,000.

2020 to Present: navigating through ups and downs

Since 2020, central banks around the world have injected massive liquidity into the markets, leading to another surge in cryptocurrency prices.

Bitcoin's price soared, reaching over $60,000 in 2021. Although it fell back below $20,000 in 2022, by 2024, it had not only recovered but also reached a new all-time high of $73,740.

Beyond the price surges, cryptocurrencies have experienced significant developmental breakthroughs in recent years.

1. Being embraced by the mainstream

For instance, Tesla included Bitcoin on its balance sheet, and El Salvador, a small Central American country, declared Bitcoin as an official legal tender.

2. Numerous innovations

Examples include DeFi (decentralized finance) projects that have proliferated and the NFT (non-fungible token) which has fueled global interest in the metaverse.

3. Prosper of stablecoins

According to CoinGecko, as of May 2024, the total market value of stablecoins has surpassed $160 billion.

On the other hand, cryptocurrencies have faced some setbacks in recent years. A notable example is the collapse of FTX, the world's second-largest cryptocurrency exchange. FTX users were unable to retrieve their assets, and several businesses associated with FTX suffered significant losses or even went bankrupt.