From cognition to actual combat, reconstruct investment logic.

Can you really use the price-earnings ratio, a powerful tool for stock trading?

Author: Yang Jinqiao

Compared to valuation methods such as net market ratio (P/B), market sales ratio (P/S), and DCF, price-earnings ratio (P/E) is favored by investors due to its advantages of rich meaning, easy access to data, and easy calculation. It is no exaggeration to say that it is the most widely contacted and used investment method by investors.

Surprisingly, however, although the price-earnings ratio (P/E) may seem simple, many investors will misuse or misuse the price-earnings ratio (P/E), such as not knowing what kind of price-earnings ratio to use, making calculation errors, ignoring the scope of application or assumptions, and giving overestimated or underestimated conclusions directly based on the size of the price-earnings ratio.

Based on this, this article mainly wants to share with you the basic knowledge, scope of application, specific applications, advantages and disadvantages of price-earnings ratio using the beer giant and the largest brewery in Asia, as an example.

Without further ado, let's get straight to the topic.

I. Definition, formula, and types of price-earnings ratio

The price-to-earnings ratio (P/E) of a stock refers to the market price per share (P) divided by earnings per share (EPS). It is usually used as an indicator of whether a stock is overvalued or underestimated. Furthermore, the price-earnings ratio directly links the market value of an enterprise to its profitability, so in the capital market, it is widely used to evaluate whether the valuation of an enterprise is fair.

There are two formulas for calculating the price-earnings ratio:

The first one is most widely known, that is, price-earnings ratio (P/E) = market price per share (P) /earnings per share (EPS),

The second one is easily misused, that is, price-earnings ratio (P/E) = total market capitalization/profit attributable to common shareholders of the parent company (hereinafter referred to as net profit attributable to parent company).

However, in practical applications, many investors are either greedy for convenience, or because they don't have a deep understanding of the price-earnings ratio, they often directly divide the total market value by net profit to obtain the price-earnings ratio (P/E). However, this is actually incorrect, and sometimes there is a big error between the price-earnings ratio calculated in this way and the actual price-earnings ratio, because the net profit of a listed company can be divided into two parts. In addition to net profit attributed to the parent, there is also net profit attributable to minority shareholders, called minority shareholder profit and loss. Furthermore, it is not difficult to imagine that when the minority shareholders of a listed company account for a relatively large share of equity, minority shareholders' profit and loss will account for a large share of net profit and net profit, thus directly affecting the calculation results of net profit and price-earnings ratio.

Take CITIC Shares (026.7HK), which accounts for a large share of net profit among Hong Kong stocks, as an example. Its net profit in 2019 was HK$78.2 billion, of which net profit attributable to parent was HK$53.9 billion and minority shareholders' profit and loss was HK$24.3 billion. Based on the latest total market capitalization (July 27) of HK$217 billion,

i) If net profit of HK$78.2 billion was misused as the denominator, the static price-earnings ratio of CITIC shares = 2170/782 = 2.77 times;

ii) If a net profit of HK$53.9 billion is correctly used as the denominator, the static price-earnings ratio of CITIC shares = 2170/539 = 4.03 times. The difference between the two is 45%. It can be seen from this. When using total market capitalization/net profit to calculate the price-earnings ratio, it is important to note that the denominator item does not include profit and loss for minority shareholders.

So, why is the price-earnings ratio divided by total market capitalization by net profit rather than directly divided by net profit?

This is mainly because the total market value in the numerator item corresponds to the total value enjoyed by the common shareholders of the parent company; therefore, the denominator item in the price-earnings ratio formula should also be the net profit enjoyed by the common shareholders of the parent company, and should not include the net profit enjoyed by a minority of shareholders. Only in this way can the internal logic of the formula be consistent.

On the basis of preparing to use the price-earnings ratio calculation formula, investors also need to identify four different types of price-earnings ratios, namely:

i) Static price-earnings ratio, abbreviated as P/E LYR (P/E based on Last Year Ratio);

ii) Rolling price-earnings ratio, abbreviated as P/E TTM (P/E based on trailing 12 months);

iii) Dynamic price-earnings ratio, abbreviated as P/E 2020E (P/E based on expected);

and iv) annualized price-earnings ratio.

Next, let's take Budweiser Asia Pacific as an example to analyze the meaning and advantages and disadvantages of the four types of price-earnings ratios.

i) Static price-earnings ratio, which is equal to the current total market value divided by last year's net return to mother profit. Take Budweiser Asia Pacific as an example. Its static price-earnings ratio is equal to the current total market value (HK$317.2 billion), divided by last year's net return profit (2019 net profit was HK$6.993 billion), which is 45 times.

ii) Rolling price-earnings ratio, which is equal to the current total market value divided by net profit for the last 12 months. Take Budweiser Asia Pacific as an example. Its rolling price-earnings ratio is equal to the current total market value (HK$317.2 billion), divided by net profit attributable to the last 12 months ($4.791 billion from 2019Q2 to 2020Q1), which is equal to 66 times.

iii) Dynamic price-earnings ratio, which is equal to the current total market value divided by the estimated net profit for 2020. Take Budweiser Asia Pacific as an example. Its rolling price-earnings ratio is equal to the current total market value (HK$317.2 billion), divided by estimated net profit for 2020 (Wind analysts unanimously estimated net return to net profit of HK$5.153 billion in 2020), which is 62 times.

iv) Annualized price-earnings ratio, which is equal to the current total market value divided by the annualized value of net profit for the disclosed quarter. Taking Budweiser Asia Pacific as an example, its rolling price-earnings ratio is equal to the current total market value (HK$317.2 billion), divided by the annualized value of net gross profit according to Q1 2020 (2020 Q1 net profit was -318 million HK$318 million, annualized net profit was -1,272 million HK$1,272 million), which is equal to -249 times.

Overall, the price-earnings ratio is also calculated. There is a huge difference between the four types of price-earnings ratios of Budweiser Asia Pacific, which has a huge impact on investors' evaluation of Budweiser Asia Pacific's valuation. For example, investors analyze Budweiser Asia Pacific's valuation based on a static price-earnings ratio and annualized net profit, and the conclusions obtained will vary widely.

So, in practice, what kind of price-earnings ratio should investors base their investment decisions on?

This mainly involves analyzing the advantages and disadvantages of these four types of price-earnings ratios.

It is first concluded that when evaluating the valuation of listed companies, it is recommended that the dynamic price-earnings ratio be the main one, and that the rolling price-earnings ratio be used as an addition. It is not recommended to use the evaluation based on the static price-earnings ratio and the annualized price-earnings ratio. The specific reasons are as follows:

i) First, for the static price-earnings ratioThe reason the reference value is small is that last year's net profit is in the past, and there is no strong causal relationship with the company's profitability this year and the future. After all, investing is looking more at the future profitability of the enterprise;

ii) Second, for the annualized price-earnings ratio,The reference value is the lowest because, on the one hand, the calculation method for net profit attributable to parent is unscientific and has serious logical flaws. For example, as far as Budweiser Asia Pacific lost money in the first quarter of this year, looking at the whole year, Budweiser Asia Pacific's net return profit was just a probable event. However, the 2020 annualized net profit calculated based on net profit attributable to the first quarter of this year was -1,272 billion HKD (loss 1,272 billion HKD). This is not in line with the actual situation of Budweiser Asia Pacific, whether at a logical level or from an actual operating perspective. As a result, Budweiser Asia Pacific's annualized price-earnings ratio will only be -249 times, which is a ridiculous value.

On the other hand, in actual operation, some companies have obvious off-season and peak season. When some companies happen to be in the off-season, net profit for the current season will be very low or even negative, so the price-earnings ratio is inflated. This situation is likely to cause the price-earnings ratio to be unreasonable. It may be more than 100 times or -249 times like Budweiser Asia Pacific; similarly, when some enterprises enter the peak season, then net profit on the current quarter will increase dramatically. At this time, when converted to adult net profit, it will also cause the price-earnings ratio to appear very low, probably only 8 or 9 times, which is not reasonable.

Therefore, the defect in the annualized price-earnings ratio is very obvious. It is easy to clearly distort the company's annual net profit to parent, thereby distorting the net profit to the parent, resulting in the calculated price-earnings ratio having no meaning.

iii) For the rolling price-earnings ratio,It is a relatively objective reflection of the current level of price-earnings ratio, because it uses net profit from the last 12 months, and it is continuously updated on a rolling basis, reflecting the real profit situation of the enterprise in a relatively timely manner. However, its flaws still don't reflect the future. After all, investors buy stocks. Good current performance does not mean future performance will continue to grow. If future performance declines, then the rolling price-earnings ratio will increase, so the rolling price-earnings ratio is only suitable for enterprises whose performance continues to grow steadily. However, even an enterprise with stable performance may experience non-recurring profit and loss in a certain quarter, then the net profit attributable to the enterprise will be distorted, causing the price-earnings ratio to be distorted.

Therefore, it is recommended to supplement the rolling price-earnings ratio as one of the reference indicators for evaluating whether the valuation of the enterprise is fair.

iv) Finally, the dynamic price-earnings ratio.From a logical point of view, it is most reasonable to use estimated net profit as the denominator. After all, investors buy companies for the future; only when they are optimistic about their future profitability can they consider buying. However, the dynamic price-earnings ratio is a double-edged sword, requiring investors to correctly predict net profit attribution. Otherwise, if the prediction is wrong, it will mislead investment decisions.

Overall, if investors have a high degree of confidence that they can predict the net profit attributable to the target target, then they can consider using a dynamic price-earnings ratio as the main focus, complemented by a rolling price-earnings ratio.

II. Scope of application and specific application of the price-earnings ratio

After understanding the definition of the price-earnings ratio, the two calculation formulas, and the four types, it is more important for investors to grasp: i) the scope of application of the price-earnings ratio, that is, what type of enterprise is suitable for valuation by applying the price-earnings ratio; ii) what should be paid attention to when specifically applying the price-earnings ratio valuation method.

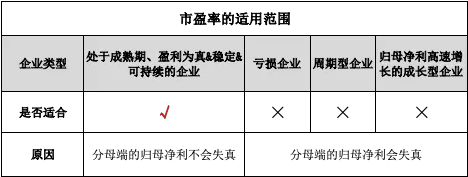

Regarding the scope of application of i) price-earnings ratio, it is generally believed that it is more applicable to mature enterprises with real, stable, and sustainable profits. In other words, companies that are in the loss stage or whose net profit is negative are not suitable for valuation using the price-earnings ratio, because a negative price-earnings ratio has no investment significance, just as Budweiser Asia Pacific's annualized price-earnings ratio of 249 times has no practical significance. Furthermore, cyclical enterprises with high profit fluctuations, such as steel, non-ferrous metals, cement, and petrochemicals, are not suitable for valuation using the price-earnings ratio, because net profit is often in the “distortion” stage. Finally, growth enterprises that are in a period of rapid growth of net income are also not suitable for valuation using the price-earnings ratio, because net profit as the denominator changes too fast in the short term.

As for ii) The specific application of the price-earnings ratio. Because the molecule in the price-earnings ratio method, that is, total market capitalization, exists objectively, and net profit as the denominator is extremely susceptible to accounting processing and can easily be adjusted or manipulated, the key to calculation is net profit attributable to mother, and understanding accurate calculation of net profit attributable to mother is extremely important. If you can't identify the means to manipulate or regulate profits, then when using the price-earnings ratio method, you can only be taken by listed companies.

Specifically, when actually using the price-earnings ratio valuation method, we need to pay special attention to the following three points:

First:After qualitatively evaluating the price-earnings ratio that an enterprise is suitable to use, the next step should be to select which type of price-earnings ratio to use. As described previously, it is recommended to use the expected price-earnings ratio, complemented by a rolling price-earnings ratio.

Second:Rationally analyze the profit quality of enterprises, embankment value trap (undervaluation trap).

Because net profit attribution can easily be manipulated, adjusted, and disguised, which in turn leads to distortion, which directly affects the reliability of the price-earnings ratio. Therefore, it is necessary to rationally analyze the profit quality of the enterprise and calculate the net profit attributable to the enterprise as conservatively as possible.

For example, when calculating the price-earnings ratio, it is necessary to use net profit attributed to the mother after deducting non-recurring profit and loss. Because there are too many ways for listed companies to regulate profits, it is necessary to pay attention to differentiation. In particular, net profit is mainly contributed by non-recurring profit and loss. This is to prevent falling into the undervaluation trap due to distorted net profit. For example, the valuation of Macalline, which Zhihu blogger Chu Shanjun once analyzed, is only 9 times the price-earnings ratio, but profits of 1.5 billion dollars or more are brought about by changes in the fair value of investment real estate; they cannot bring in cash flow; it is a hidden valuation trap.

Another example is that net profit due to downstream pressure is brought about by downstream pressure, so pay attention to changes in accounts receivable. The revenue and profit obtained from downstream pressure is clearly unsustainable. The statement shows that the growth rate of accounts receivable is greater than the growth rate of operating income. For example, Donga Ejiao, which experienced a thunderstorm in the 2019 mid-term report (loss of about 200 million yuan in a single quarter in 2019Q2), revenue for 2018 and the first quarter of 2019 fell by 0.46% and 24%, respectively, but accounts receivable increased by 118% and 17%, respectively. Sooner or later, this method of relying on pressurization of goods will thunderstorm.

Therefore, predicting the quality of profit is very important. This requires full system knowledge of reading financial reports.In the future, everyone can pay more attention to our Futu Niu Niu (nickname: Valuation Research).

Third:After calculating the price-earnings ratio, it is impossible to determine whether a company's valuation is expensive or cheap simply based on the size of the price-earnings ratio multiple. Nor is it that the larger the price-earnings ratio is better, nor is it that the smaller the price-earnings ratio, the better. It needs to be analyzed in conjunction with the company's business conditions, business model, and competitors' conditions. Therefore, investors need to compare the calculated price-earnings ratio multiples horizontally and vertically, that is, with competitors in the same industry, as well as with their own past price-earnings ratio. In addition, it is also possible to calculate the inverse of the price-earnings ratio - yield, and compare it with the risk-free yield (10-year US Treasury bonds) to see the cost performance ratio and risk compensation of investing in stocks.

3. Conclusion: Only by using the price-earnings ratio correctly can it be meaningful

As stated at the beginning of the main article, although the price-earnings ratio is easy to calculate and is also the most commonly used valuation indicator by investors, it is not as easy as one might think to actually make good use of the price-earnings ratio valuation method:

First, in the face of an enterprise, investors must first determine whether it is appropriate to use the price-earnings ratio method for valuation? Second, if appropriate, what kind of price-earnings ratio should be used? Next, when deciding to use a dynamic price-earnings ratio, how can we rationally analyze the profit quality of the enterprise, so that the “net profit attributable to mother”, which is the key to calculation, is not distorted? Finally, after calculating the dynamic price-earnings ratio, how exactly should the dynamic price-earnings ratio be used? Which comparisons should be made?

There are thousands of words that fall into proper nonsense, that is, it is only meaningful when using the price-earnings ratio correctly to evaluate the value of an enterprise.

Editor/Iris