A Easy-to-understand Macro Course

Commercial real estate, a “time bomb” in the US economy

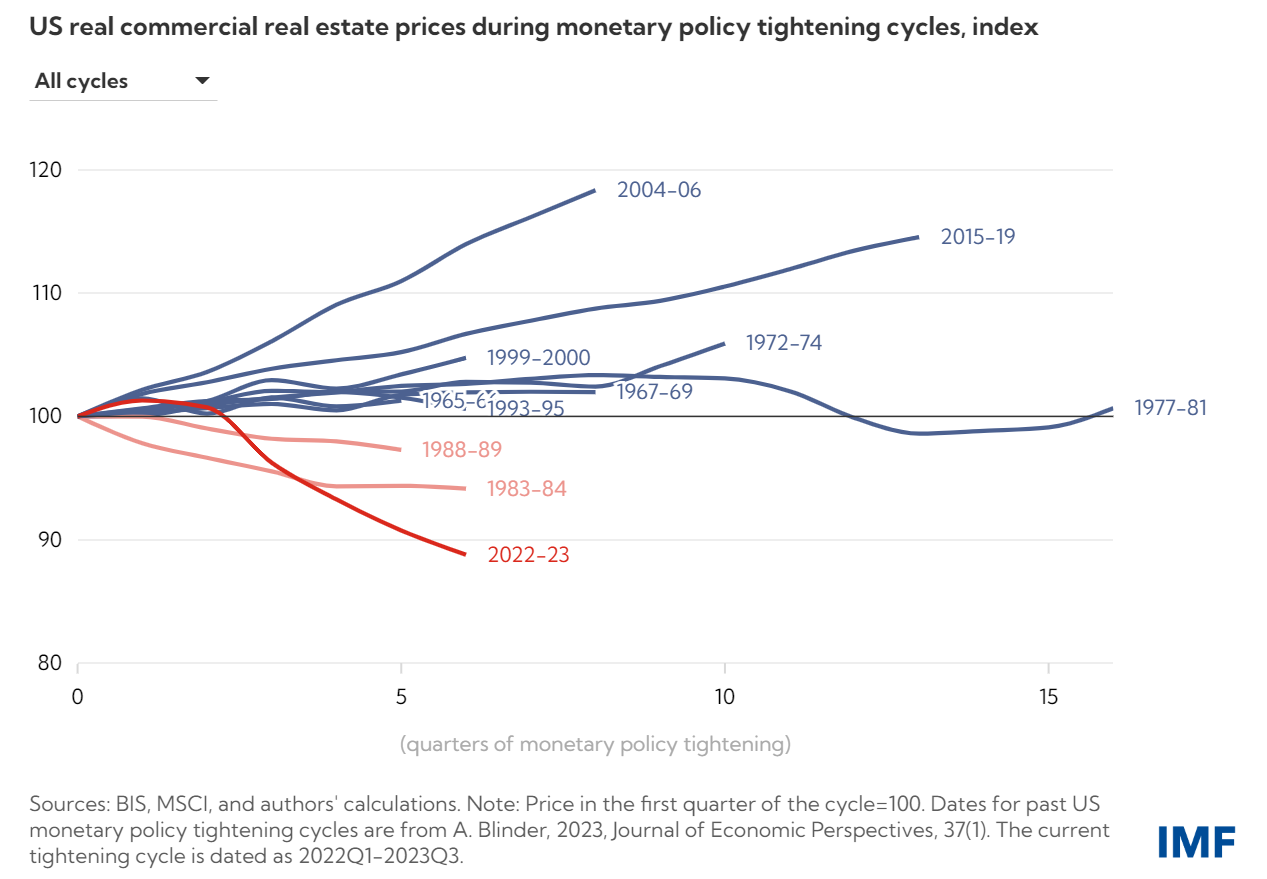

On January 18, 2024, the International Monetary Fund warned that U.S. commercial real estate is suffering one of the worst price declines in at least half a century, surpassing losses seen in the previous rate hike cycle. In fact, U.S. commercial real estate underperformed in 2023, setting a marked contrast to the blazing residential properties. The difficulties faced by commercial real estate in an environment of high interest rates are also risks that require extra vigilance in 2024.

Here's a look at why commercial real estate is in crisis and how it affects our investments.

Rising interest rates put commercial real estate in trouble

First of all, what is commercial real estate?

Unlike residential real estate that focuses on homes, apartments, and condos, commercial real estate (CRE) focuses on purchasing foreclosed properties that are leased to businesses. Commercial real estate includes multiple categories such as office space, hotels and resorts, shopping malls, restaurants, and healthcare facilities.

While owning or renting these properties can provide a stable source of income, the real estate industry is very sensitive to interest rates as the real estate industry tends to involve a lot of financing. If interest rates are too high, property owners are likely to face a foreclosure situation.

Over the past few years, developers, investors and banks have been able to finance and invest at extremely low interest rates, driving a huge boom in commercial real estate. But with the Fed raising rates too fast in 2022, mortgage rates and commercial mortgage-backed securities yields also rose sharply on the guidance of the rate hike.

Unlike residential loans, which have a term of 15 to 30 years, commercial real estate loans are usually between 5 and 10 years and require a large payment in the end. Therefore, owners of commercial real estate do not usually pay large lump sums, but rather refinance their property.

As a result, when a commercial real estate loan matures, owners need to make a decision: refinance at today's high borrowing costs, or wait to see if interest rates stabilize before the maturity date, or abandon the property altogether.

According to a report by the Mortgage Bankers Association in early 2023, the United States estimates that $1.2 trillion in commercial real estate debt will mature in the next two years. About 14% of commercial real estate debt has gone into negative equity — that is, the value of the property itself has fallen below the loan face value.

The time has come to 2024, which is when some commercial real estate is facing a choice.

Two of the biggest issues in commercial real estate today

Office vacancy rates are high: The legacy of COVID-19 — teleworking and e-commerce work patterns are still being used by some businesses. While this pattern has severely reduced demand in the office and retail industries, office building vacancy rates have increased significantly. According to Moody's, the nationwide office vacancy rate reached 19.2% in the third quarter of 2023, close to the historic peak of 19.3%.

Refinancing Challenges: Many commercial mortgages require refinancing, and as interest rates rise and vacancy rates increase, it may be difficult for owners to obtain favorable refinancing conditions. The commercial real estate market will face significant refinancing challenges in the coming years, which could lead to market defaults and financial instability.

The worst fall in the price of commercial real estate

These two factors add up to a clear consequence of last year's decline in commercial real estate prices.

As we started out, the International Monetary Fund warns that U.S. commercial real estate is suffering one of the worst price declines in at least half a century, exceeding the losses seen in the previous rate hike cycle.

According to Kaitou Macro, the value of commercial real estate is estimated to have fallen 11% last year and prices may fall by another 10% this year, which spells trouble for the huge debts supported by commercial construction. KAITOU MACRO BELIEVES THAT THE DILEMMA HAS JUST EMERGED, AND 2024 COULD BE THE YEAR OF THE DAM'S FINAL DAM. In addition, commercial real estate may face liquidation this year as real estate values continue to decline.

According to Macro Thoughts, real estate developers, construction and transportation companies are currently being forced out of the market, while SMEs have risen by 2%-3% as borrowing costs have risen far beyond their capacity to raise margins, resulting in increased operating pressure and difficult to maintain staff size.

Commercial Property Default Crisis

Although it is expected that the Federal Reserve will eventually start cutting rates this year, the current extremely high borrowing costs and plunging prices are affecting the solvency of commercial property holders compared to the low interest rates of a few years ago. As a result, Wall Street is increasingly worried that a wave of defaults will soon engulf commercial real estate.

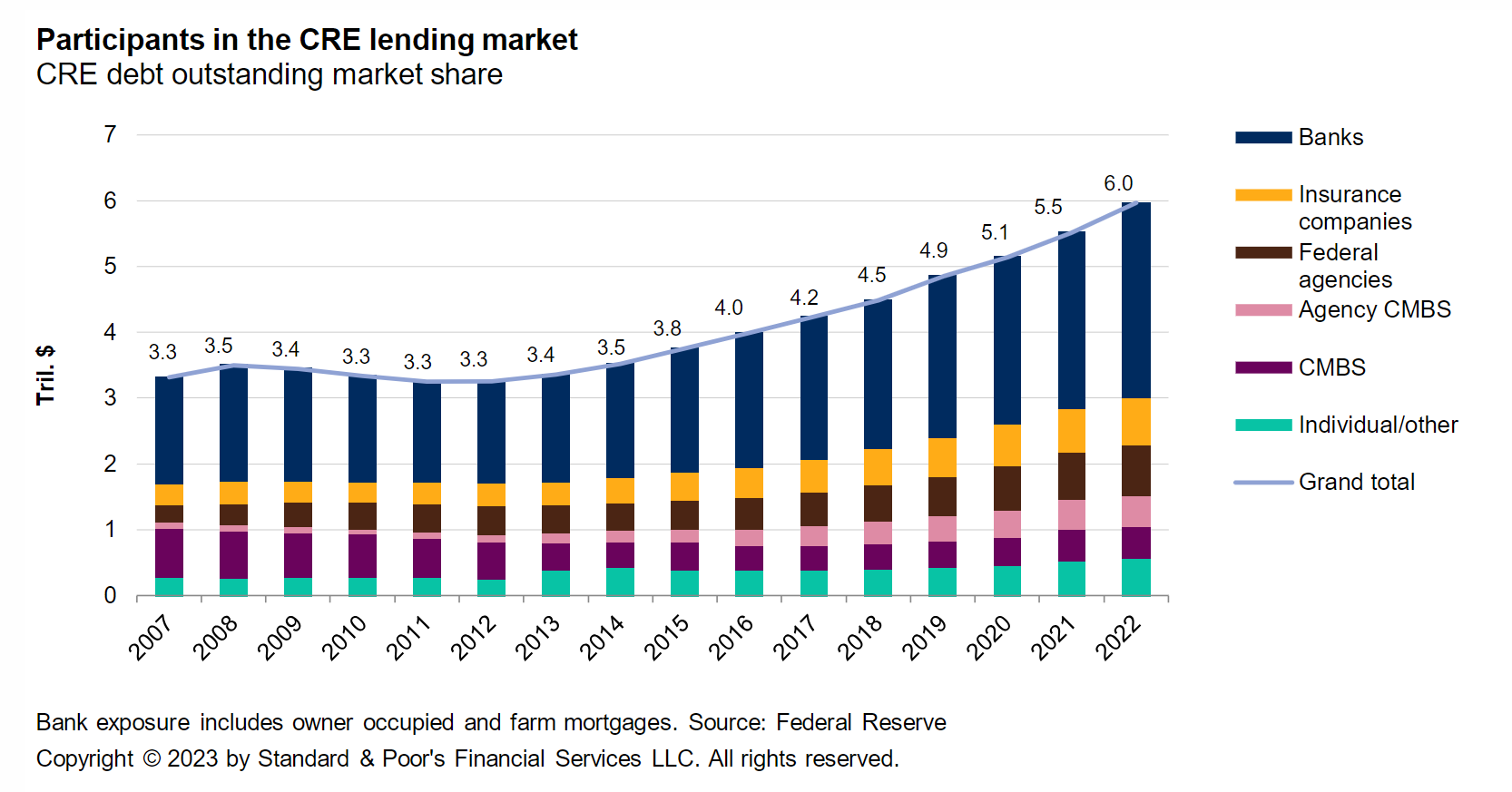

Approximately 20% of the approximately $425 billion of CMBS channel loans maturing in 2024 face a significantly high risk of default, and some of the $120 billion CMBS channel loans maturing this year or next year are already in default, requiring third parties to assist borrowers in finding solutions to avoid default. Nevertheless, investors are still attracted by yields of up to 10% or even higher on such loans.

In a worst-case scenario, the U.S. real estate market could see a $1 trillion wave of defaults, Cantor Fitzgerald CEO Howard Lutnick said.

The problem is not the only one — part of the financing of commercial real estate comes from banks called “Sunny Day Umbrella, Rainy Parasol”. A high risk of default also means that banks have a higher threshold for refinancing. For example, about two-thirds of U.S. banks have recently tightened lending standards for commercial construction and land development loans, up from less than 5% at the beginning of last year.

That's no surprise to the bank, which, according to a recent working paper from the National Bureau of Economic Affairs, could account for about a quarter of the bank's average assets due to a loss of about $1600 billion in commercial real estate. Small and regional banks have nearly five times the exposure to real estate risk than large banks.

When small banks face more defaults, they cut loans further, which puts pressure on landlords and exacerbates banking problems. This leverage effect and circulation between banks and commercial real estate may put tens or hundreds of smaller regional banks at risk of crowding out their solvency.

Wary of spillover effects on the economy

The market believes that the effects of a single rate hike will take around 12 months to feed through to the economy. As a result, the legacy of interest rate increases will continue to affect the economy throughout 2024, especially in the commercial and residential real estate sectors.

While tightening bank lending standards can protect yourself from potential risks, it has also intensified the credit squeeze. A further tightening of the credit environment has created a tightening effect for borrowers of all kinds, including commercial real estate projects, with a tightening effect. And from the case of Silicon Valley Bank in 2023, there is a certain probability of “systemic consequences through contagion” even for small and medium-sized banks in bankruptcy and expropriation.

Financial regulators must continue to remain vigilant, the International Monetary Fund said. The increase in delinquencies and defaults in the commercial real estate industry could limit lending and trigger a vicious cycle of tightening financing conditions, falling commercial property prices and losses from financial intermediaries. This has an adverse spillover effect on other sectors of the economy.

1. What is the impact on financial markets?

Stocks and real estate are the most volatile parts of U.S. residents' wealth, with a sharp drop in value that could result in lower than expected U.S. consumer growth through the wealth effect.

S&P downgraded some office-based REITs and expects the asset quality of these commercial real estate lenders involved in offices, retail malls and hotels to deteriorate during the economic downturn.

On 1 local time, data showed that as of November last year, redemptions of non-publicly traded REITs across the United States reached $174 billion, far exceeding the $120 billion in the full year of 2022.

2. So is there a risk of a financial crisis?

Let's have a meal first — all the current research shows that commercial real estate is extremely unlikely to cause a financial crisis.

The stress tests of JPMorgan and Strategas show that most US and European banks should be OK, even in extreme cases. They are well-capitalized, have healthy repayment coverage, and generally do not overexpose commercial real estate assets. In addition, risk is spread across participants such as banks, insurers, government agencies, and REITs, reducing the likelihood of single point failures. In addition, SMEs that mainly suffer from commercial property shocks are less closely related to other financial institutions, so even if small and medium-sized banks close, the impact on financial stability is relatively limited.

Written at the end

If you think it is interesting to observe the market from a macro perspective and want to learn more basic knowledge, you may wish to pay attention to our “macroeconomic class”, analyze the macro situation together and seize investment opportunities!