Star company earnings season Raiders

【November 2024】The king of online shopping! How to view the performance of pdd holdings?

Over the two-year period from 2022 to 2023, PDD Holdings rose by 40% and 79%, with a total increase of 151%, and the stock price also briefly returned to nearly two-thirds of its highest point. In the overall decline of Chinese concept stocks, this performance can be said to be extremely rare. In contrast, during the same period, Alibaba fell by 34%, leaving its stock price at only one-fourth of its highest point, while JD.com fell by 57%, with its stock price also only at around one-fourth of its previous high.

On one side there is a significant increase, on the other side a dramatic decline. Under the two extremes, at the end of November 2023, PDD Holdings' market cap surpassed Alibaba's, temporarily becoming the largest company in market cap among domestic e-commerce platforms. However, after the release of the previous two quarterly reports, PDD Holdings' stock price plummeted, the market cap significantly shrunk, falling behind Alibaba once again.

In an environment where consumer confidence is low and the e-commerce industry is highly competitive, PDD Holdings has managed to overtake others in the curve. So, can PDD Holdings once again gain a leading edge? We can continue to pay attention to its earnings. On November 21, PDD Holdings will release its third-quarter earnings report. Each time a company releases its earnings, it may also mean a good trading or investment opportunity. Before that, investors need to understand how to interpret its earnings.

There are three key points we can focus on when considering PDD Holdings' performance: changes in revenue growth, changes in profitability, and comparing actual performance to expectations.

1. The change in business performance.

For PDD Holdings' revenue growth rate, two points can be considered, including its own revenue growth rate changes, and comparisons with competitors in the e-commerce sector.

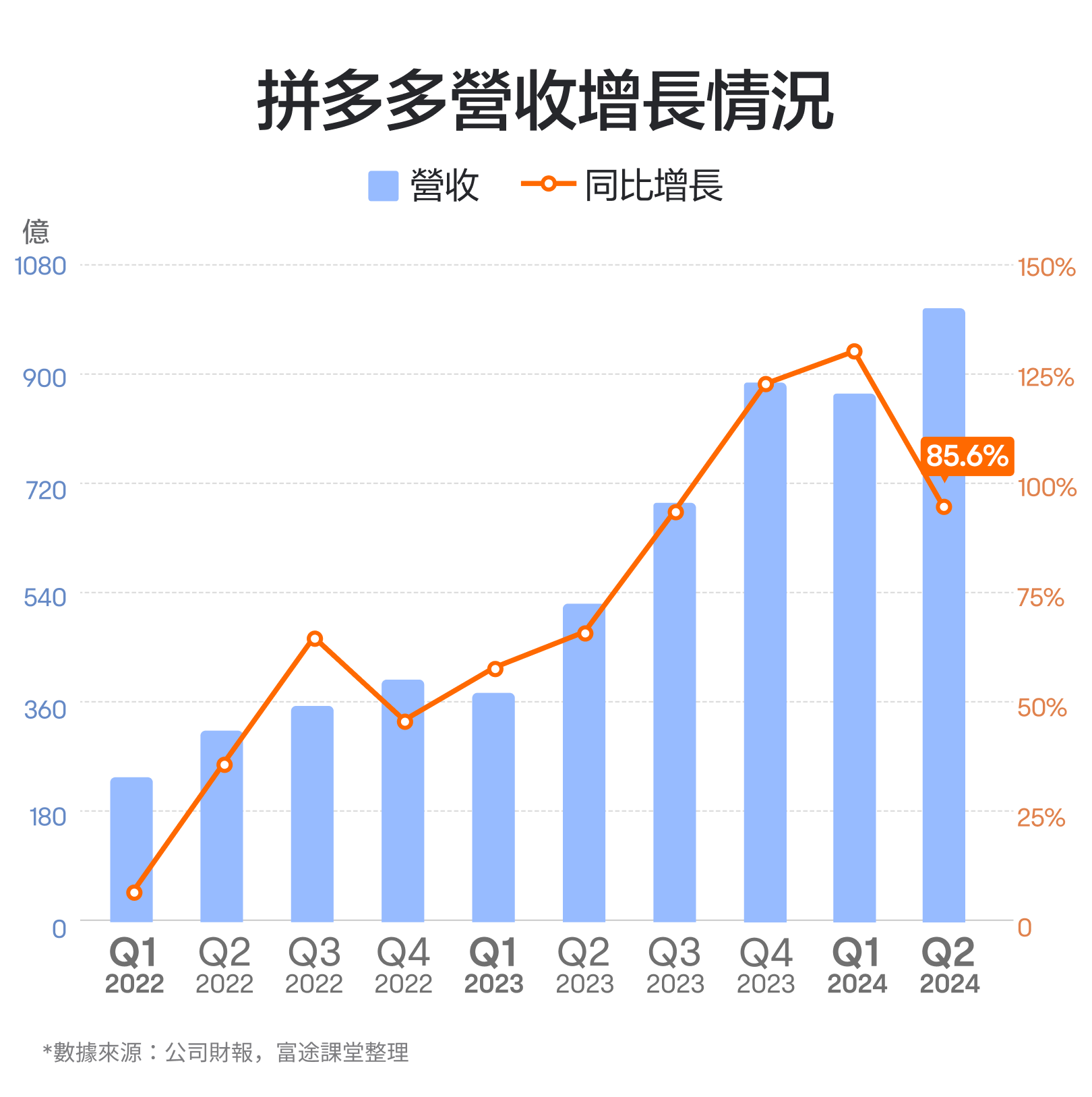

The most intuitive aspect of PDD Holdings' rise against the trend is reflected in its high-speed revenue growth. From Q1 of 2022 to Q1 of 2024, PDD Holdings' revenue growth rate mostly accelerated, with over 1.3 times year-on-year growth in Q1 of 2024 and nearly 90% year-on-year growth rate in Q2 of 2024. The rapid revenue growth has also been a significant driver behind its stock price surge.

There are two main engines behind the revenue growth of PDD, one in the early stage and one in the later stage. In the early stage, PDD thrived on people's downgraded consumption trend under the background of economic recession and became the largest beneficiary thereof just exactly in line with its reputation for low prices. Later on, under the impetus of Temu, PDD's international business saw a leap-forward increase, thus becoming another essential driving force behind the revenue growth.

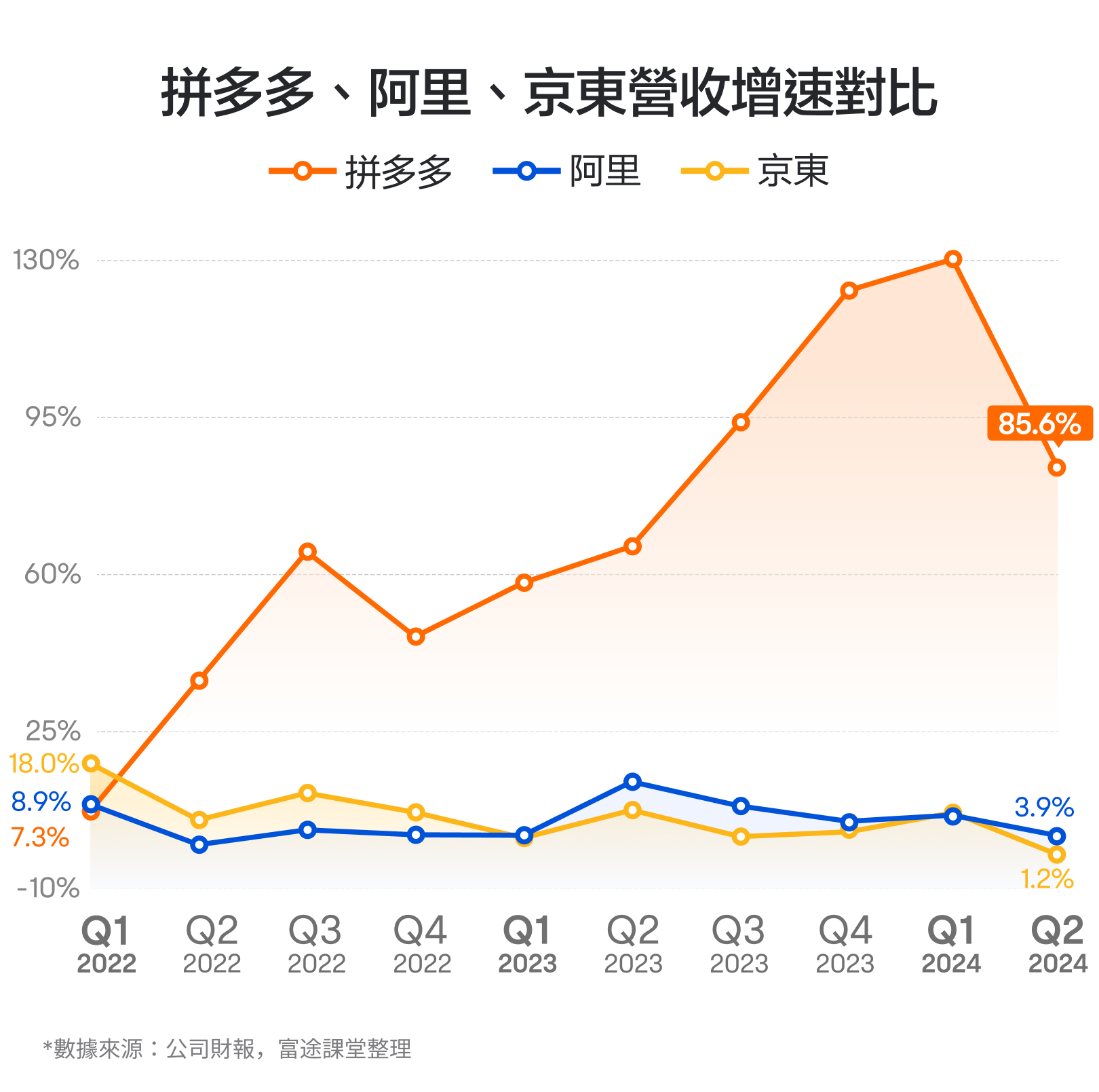

Then, how does PDD compare with its peers? Primarily by comparison with Alibaba and jd.com. Let us compare their revenue growth rates and sales expense rates, two essential indicators.

First, let's compare the revenue growth rates of three companies. The faster the revenue growth, the better the company's competitive position. We can see that since the start of the rise in stock price of PDD in the second quarter of 2022, PDD's revenue growth rate has significantly exceeded that of Alibaba and JD.com every quarter. While Alibaba and JD.com only maintained single-digit growth from 2023 to 2024 Q2, PDD took the opportunity to grab more market share in various industries and experienced rapid growth in each quarter.

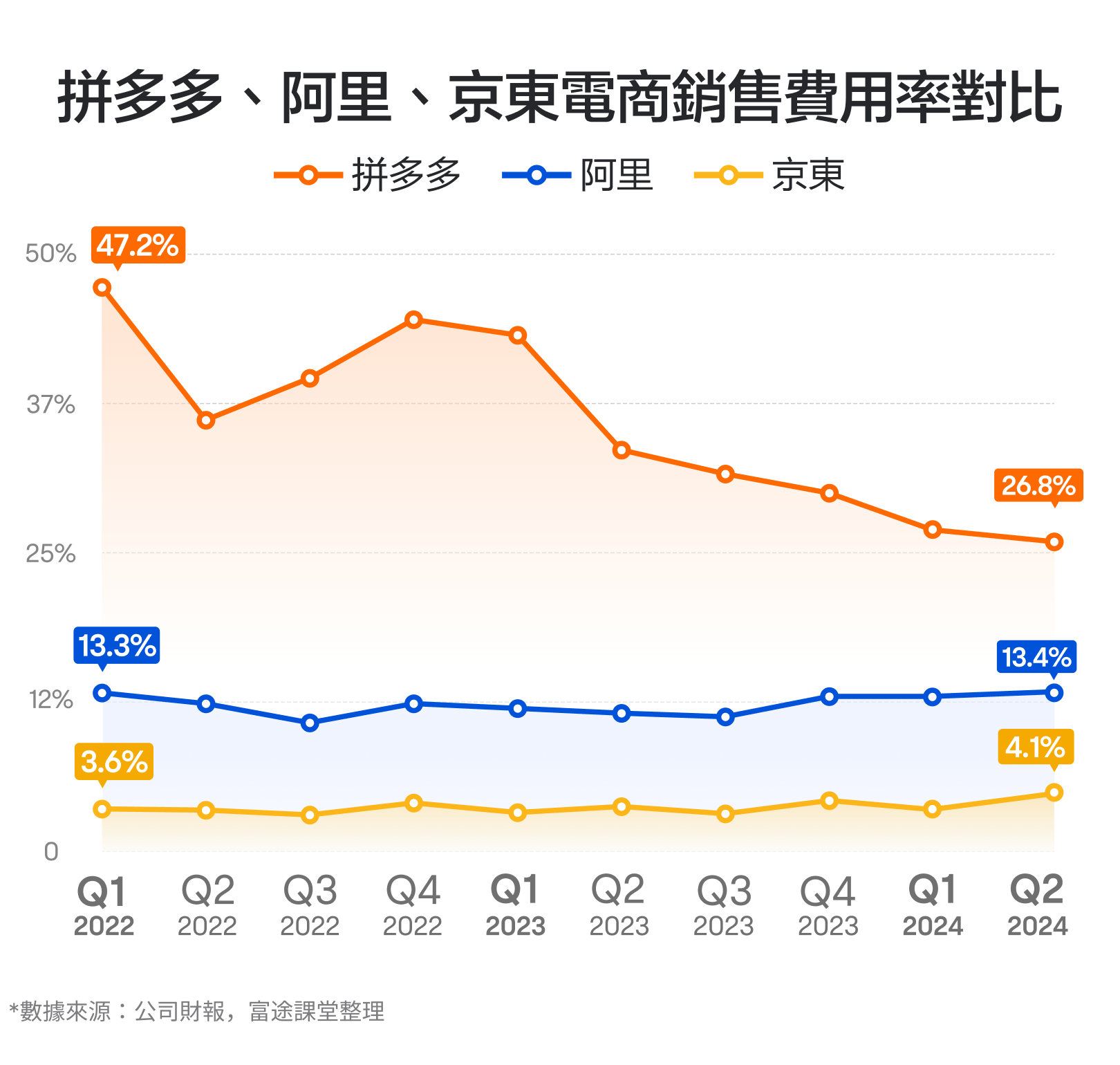

Next, we compare the expense ratio of each of the three companies. If this ratio tends to increase, it may confront a disadvantage in competition; if it maintains descent, then probably its competitive position has been optimized.

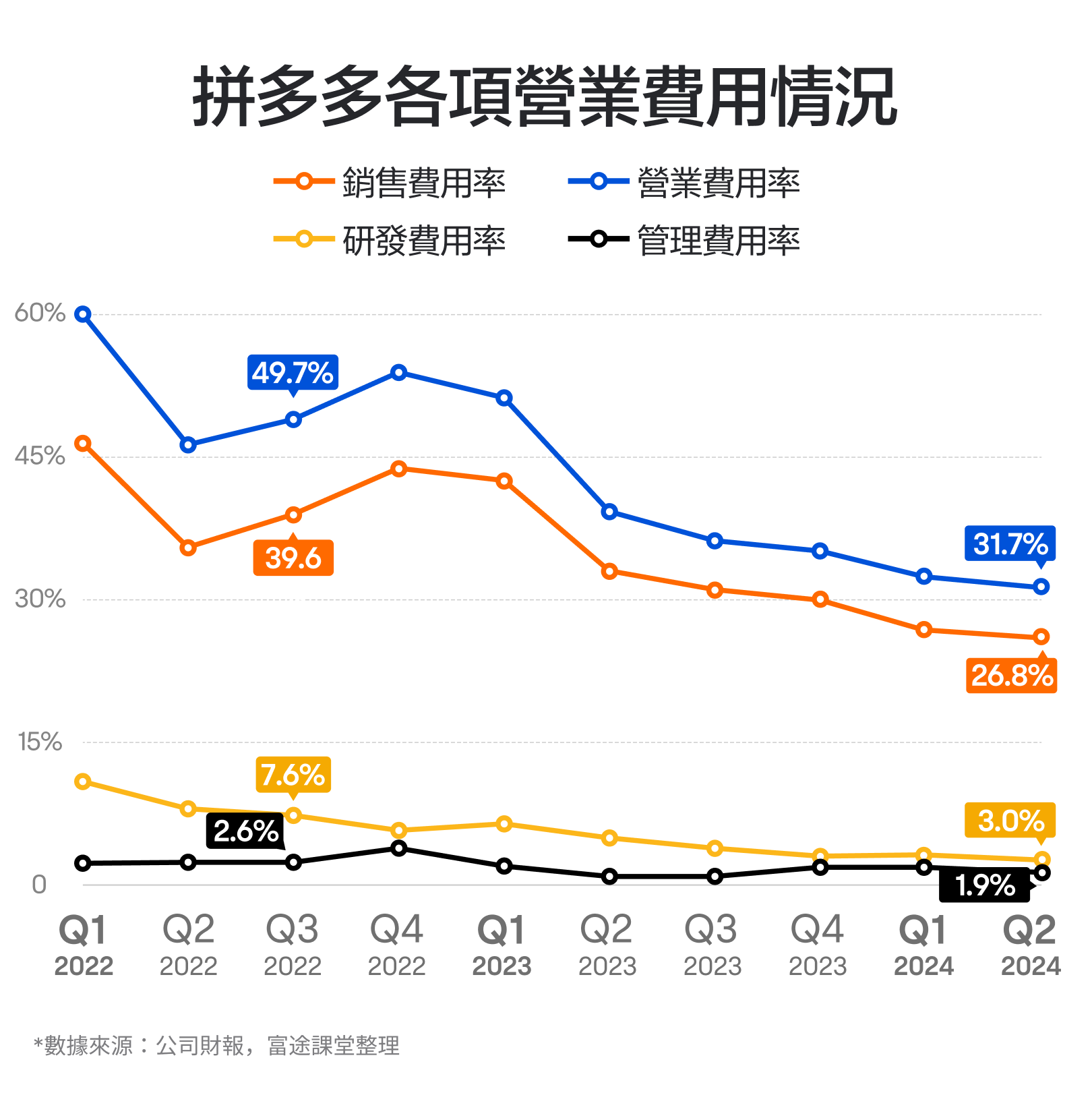

Since the first quarter of 2022, although PDD's sales expense ratio has experienced seasonal fluctuations due to events like 618 and Double 11, the overall trend is downward, decreasing from 47.2% in 2022 Q1 to 26.8% in 2024 Q2. Alibaba's sales expense ratio fluctuates around 10%-14% overall. JD.com's sales expense ratio remains stable overall.

For future performance, it may be difficult to expect PDD to continue to maintain close to doubling growth rates, and even achieving stable growth rates of over 30% may also be challenging. After all, in the context of potential tariff pressure, the explosive growth of Temu's international business still needs further observation.

What we truly need to pay attention to is how much longer PDD can maintain its lead in revenue growth over its peers and if its sales expense rate can keep a downward or stable trend. These factors will determine whether PDD can sustain itself in a relatively competitive position compared with its peers.

2. Changes in Profitability

For the second concern point of PDD's earnings report, we look into any blockage in profitability, primarily including gross margin and net profit margin.

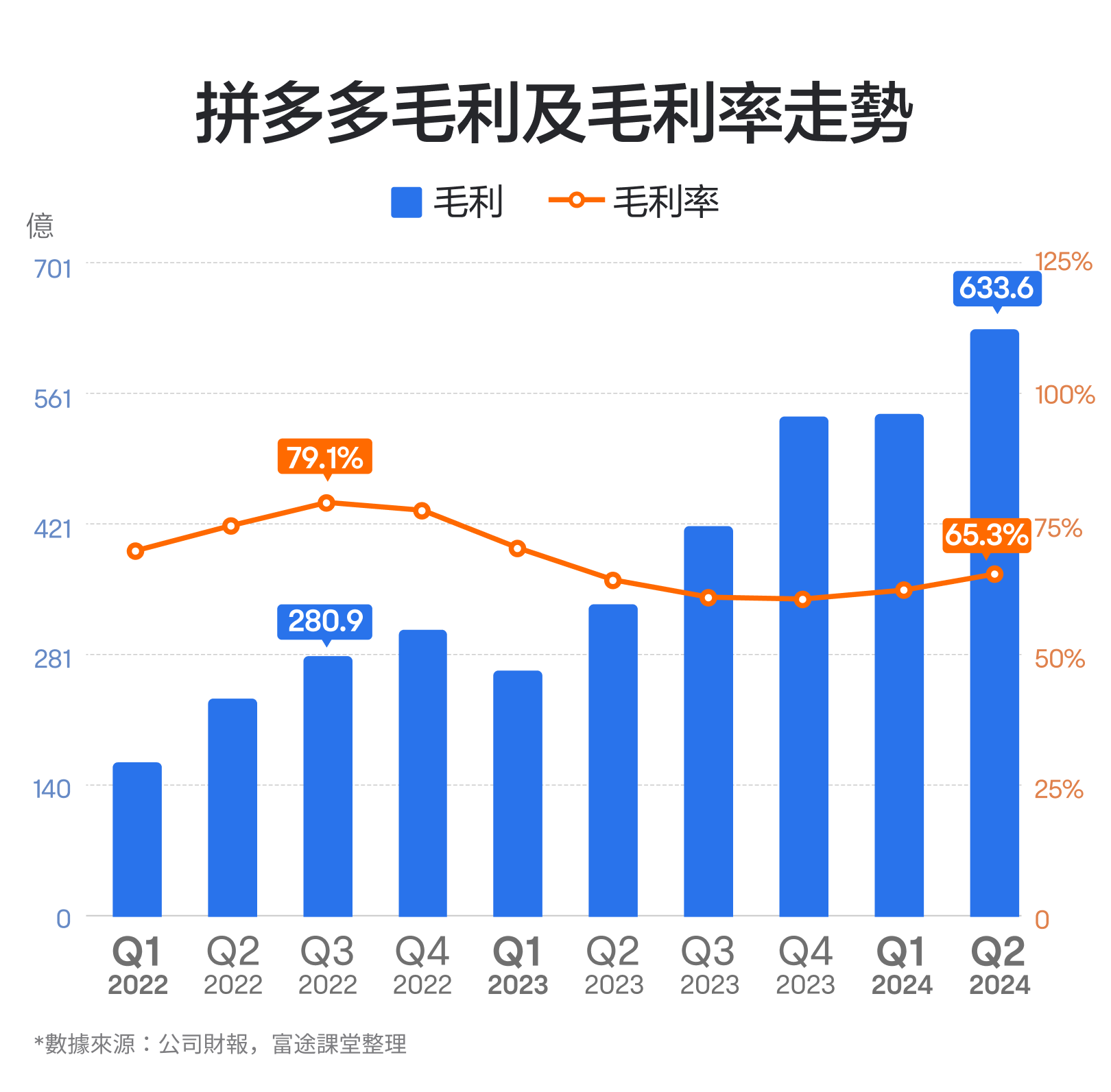

Judging from the gross margin, PDD's level has shown a tendency of first rising and then falling from Q1 2022. Its earlier increase owes a lot to the scale effect brought about by the rapid business growth. Starting from Q3 2022, PDD's gross margin began to decrease quarter by quarter, down from 79.1% to 60.5% in Q4 of 2023, plummeting by 18 percentage points in total.

The reason for the decline in Pinduoduo's gross margin is not that the domestic business is no longer profitable. The main reason is the strong promotion of Temu's international business that began in the fourth quarter of 2022, as well as the large amount of subsidies needed to expand the Duoduomai Cai business in the early stages. As for the performance of Pinduoduo's various business sectors, revenue and profit are not disclosed separately. However, from the perspective of business rules, the gross margin of this business is most likely negative and is in the early stage of increasing revenue without increasing profits, thereby lowering the overall gross margin performance.

However, in terms of gross margin, there are still two angles worth paying attention to in Pinduoduo. First is the overall change in gross margin. We can see that during the process of declining gross margin, Pinduoduo's gross profit level still increased. In 2023Q4, gross profit was 53.8 billion, a year-on-year increase of 74.2%. At the same time, we can also see the marginal improvement in the degree of decline in gross margin. We can see that in the four quarters of 2023, the degree of decline in Pinduoduo's gross margin was 7.1, 6.2, 3.2, and 0.5 percentage points respectively, and the overall decline was narrowing. If the decline continues to narrow or even begin to rebound, it may mean that the potential loss situation of Temu or Duoduomai Cai business is improving, or even turning losses into profits.

However, during this period, the overall gross profit level of pdd holdings also increased significantly. At the same time, the magnitude of the decline in pdd holdings' gross margin is marginally improving. We can see that in the four quarters of 2023, the decline in pdd holdings' gross margin was: 7.1, 6.2, 3.2, 0.5 percentage points respectively, with the overall decline continuously narrowing. By 2024Q1, pdd holdings' gross margin reached 62.3%, showing signs of stabilization and recovery, and further increased to 65.3% in 2024Q2, which may indicate that the potential loss situation of the Temu business or Duoduo Buy vegetables business is improving, and may even have achieved a turnaround from losses to profits.

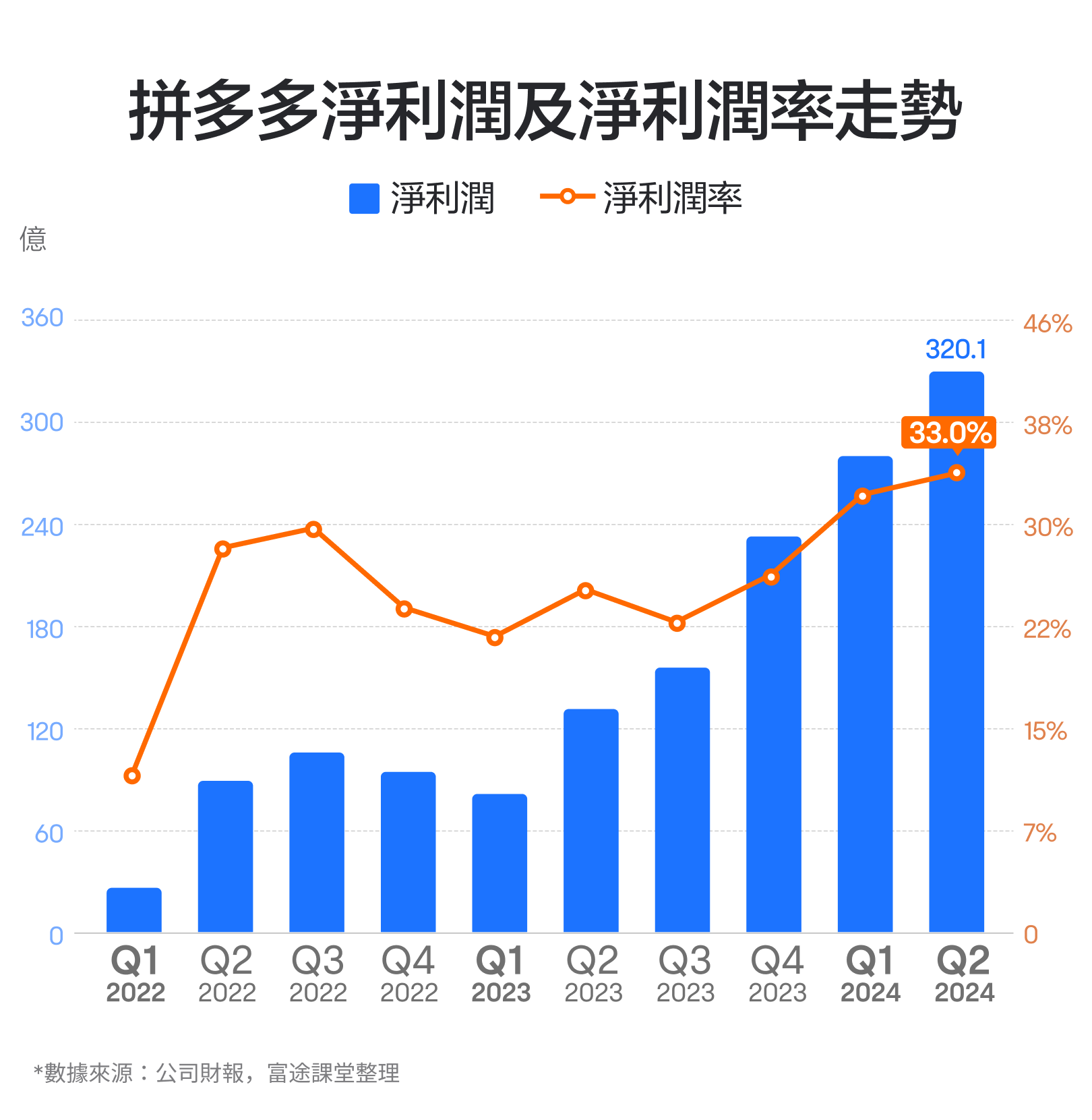

Looking at the net profit margin, pdd holdings also once showed an increase in net profit levels, but with an overall decline in net profit margin. The main reason for the decline in pdd holdings' net profit margin is naturally the significant decline in gross margin. However, we can also see that the decline in pdd holdings' net profit margin is far less than the decline in gross margin. By 2023Q4, pdd holdings' net profit margin reached approximately 26.2%, showing a rebound both year-on-year and quarter-on-quarter. By 2024Q2, pdd holdings' net profit margin further increased to 33%, reaching a historical high.

This is mainly due to pdd holdings' control over operating expenses. pdd holdings' sales expense ratio decreased from 39.6% in 2022Q3 to 26.8% in 2024Q2, research and development expense ratio decreased from 7.6% to 3%, and management expense ratio decreased from 2.6% to 1.9%. The overall operating expense ratio decreased from 49.7% to 31.7%, partially offsetting the impact of the gross margin decline on the net profit margin.

The decline in the operating expense ratio is largely a reflection of PDD's continuous improvement in operating efficiency. In the current intense competition within the e-commerce industry, this is an important competitive advantage. We can continue to pay attention to PDD's operating expense ratio and its impact on net profit margin in the future.

3. Comparison of actual performance with expected performance

Because PDD's revenue is not broken down into individual business sectors and the company's management rarely synchronously releases business data to the outside world, PDD's performance flexibility may be very large, and the actual performance announced each time may have significant deviations from the performance expectations of Wall Street analysts, which could lead to significant price fluctuations in PDD's stock after the performance announcement.

On the Futu Bull app, we can see the performance forecast and actual performance of PDD Holdings. Previously, PDD Holdings has significantly exceeded expectations for 5 consecutive times, and its stock price has surged in the short term after each performance release.

However, in 2024Q2, PDD Holdings' revenue showed a lower-than-expected performance for the first time. In addition, the management mentioned in the conference call that future revenue growth will face pressure and will continue to increase investment, sacrificing short-term profits. This stark contrast with the market's high expectations has led to a short-term sharp drop in stock price after the performance release.

Due to PDD Holdings' poor second-quarter performance, the performance of its latest results may become particularly important. Taking revenue as an example, according to the Futu Bull app, analysts currently forecast PDD Holdings' 2024 Q3 quarterly revenue to be 103.699 billion. If the actual performance exceeds this expectation, it may create a significantly bullish short-term impact on the stock price. Conversely, if the actual performance falls below expectations, it will result in a short-term bearish trend.

Seeing this, you may have some new insights on how to interpret PDD Holdings' performance. It is worth mentioning that each time a star company releases its performance, it may present a rare trading opportunity for different types of investors.

For example, if investors interpret the past performance and combine it with the latest developments and feel that a company's latest performance will release some positive signals and be bullish about the short-term stock price, they may consider going long. The way to go long could be considering buying common stock or consider buying call options, etc.

On the contrary, if investors think that a company's latest performance will not be optimistic and will put pressure on the short-term stock price, investors may consider going short. The way to go short could be considering selling short through margin trading or consider buying put options, etc.

Of course, if investors think that the long and short direction of a company's performance is not clear, but the stock price may fluctuate significantly after the performance is released, investors may consider making the volatility of the stock price long and buying both call and put options through the strategy of straddle to seize potential opportunities.

To sum up:

In terms of performance growth, PDD Holdings' revenue growth rate greatly exceeds that of its peers, and the sales expense ratio is also trending downward, indicating the company's continuous strengthening competitiveness in the industry. In the future, we can observe whether the company can sustain this trend.

In terms of profitability, PDD Holdings' gross margin has dropped significantly due to cash-burning businesses like Temu, but has currently stabilized and rebounded, while the operating expense ratio has shown significant improvement, driving the net profit margin to hit a historical high. In the future, we can pay attention to the rebound of the company's gross margin, as well as whether it can continue to maintain high operational efficiency to keep the net profit margin at a high level.

In terms of performance expectations, PDD Holdings' performance has significant elasticity. We can monitor the comparison between actual performance and performance expectations. If it significantly exceeds expectations, it may lead to a bullish impact on the stock price.

Each time the company announces its performance, it may bring potential trading opportunities. Investors can consider suitable trading varieties according to their personal risk tolerance.