Star Company's performance strategy period.

In 【2024.11】, surged more than 0.04 million times, achieving the title of stock god Buffett! How do you view Berkshire's performance?

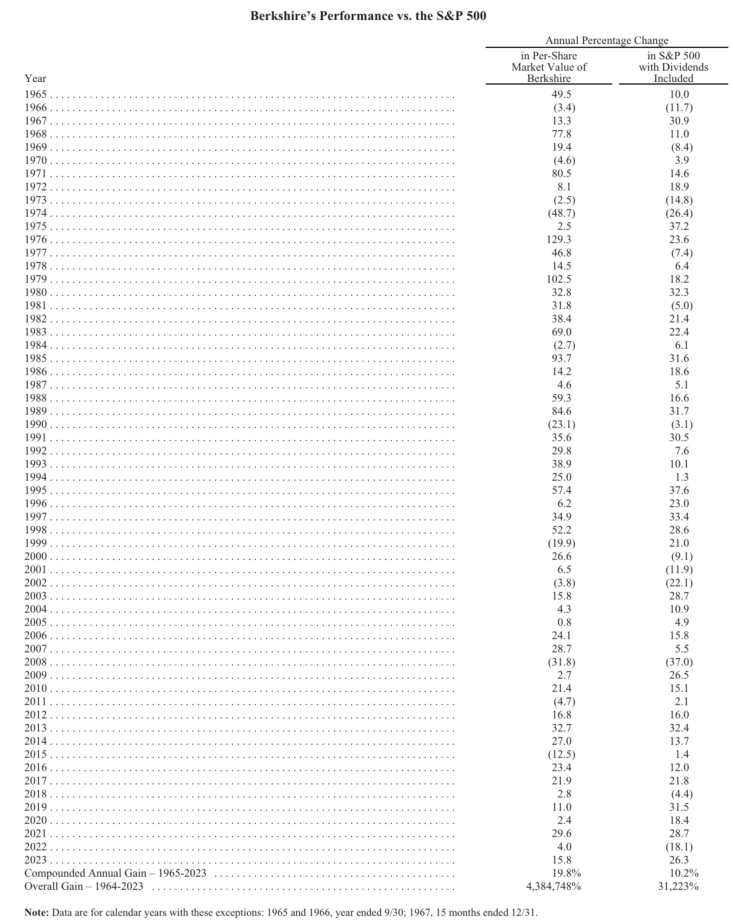

When it comes to legendary figures in the investment world, the name of Warren Buffett, the helm of Berkshire Hathaway, is definitely unavoidable. $Berkshire Hathaway-B (BRK.B.US)$ Berkshire Hathaway, led by Warren Buffett, is a name that cannot be overlooked when it comes to investment legends. With a return of up to 0.0438 million times from 1965 to 2023, Buffett has also earned the title of the stock god. Some major moves by Berkshire Hathaway have also influenced the nerves of the capital markets, becoming one of the market's trend indicators.

Each release of Berkshire Hathaway's performance naturally becomes a top priority for market attention. Every time the company releases its performance, it may also signify a good trading or investment opportunity. Before that, investors need to understand how to interpret its performance.

So how should we look at Berkshire Hathaway's performance? We can focus on three aspects: the stability of performance, changes in holdings and cash reserves, as well as cash flow and buyback situations.

1. Performance stability

Berkshire Hathaway's outstanding performance in the capital markets over the past few decades is inseparable from its steady long-term performance in terms of performance. We can track this from the perspectives of revenue and profit.

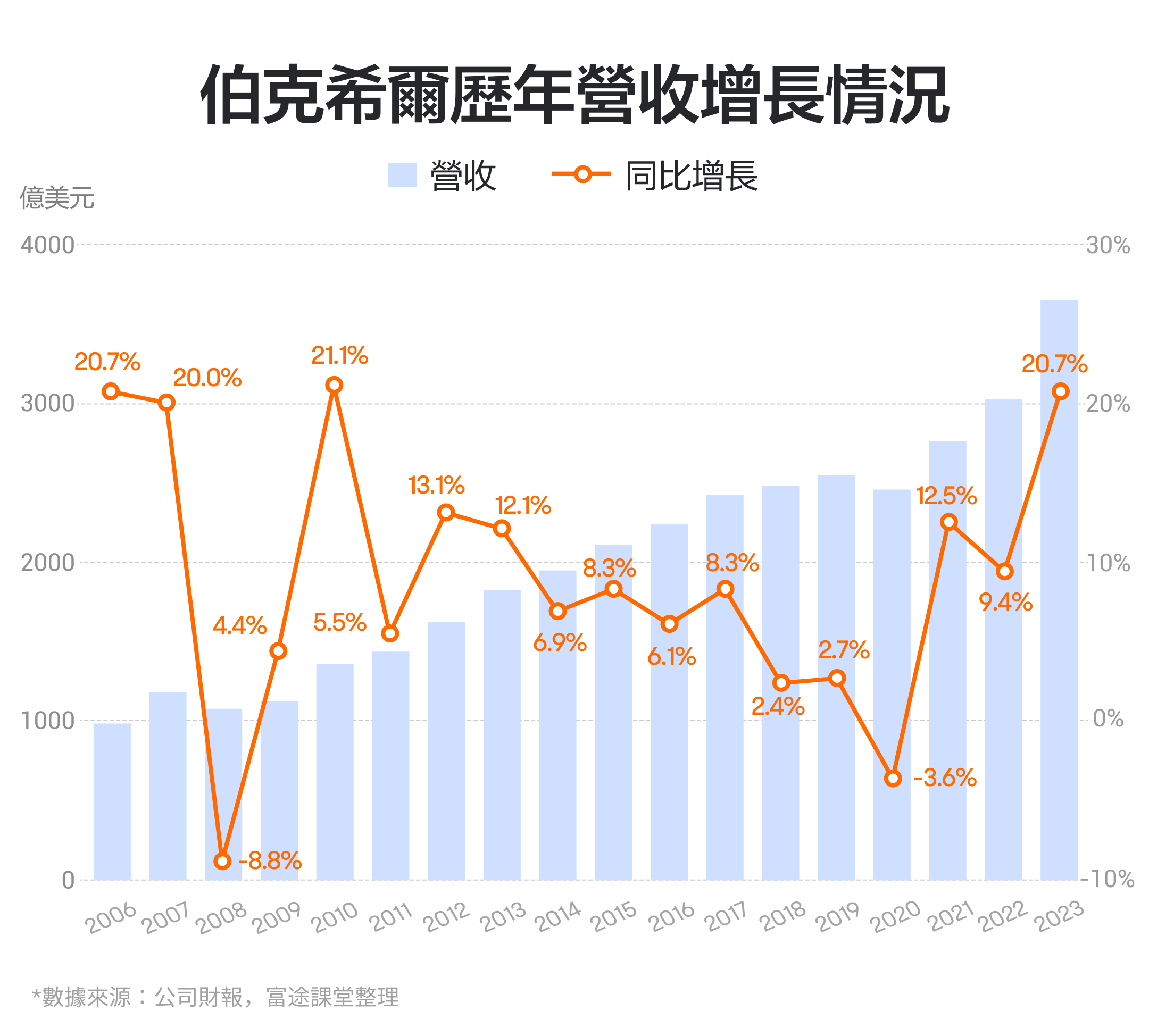

Many people's understanding of Berkshire Hathaway may be more based on its influence in the investment world. However, from the revenue perspective, Berkshire Hathaway's revenue is actually less related to the securities investment business, mainly coming from the consolidated income of its various subsidiary companies.

In addition to its core insurance business, Berkshire Hathaway's subsidiaries are also involved in various industries including retail, manufacturing, railroads, housing, electrical utilities, energy, etc. For example, See's Candies, once proudly mentioned by Buffett, is one of Berkshire Hathaway's subsidiaries. These subsidiaries currently contribute billions of dollars in revenue to Berkshire Hathaway each year.

From a long-term perspective, Berkshire's revenue has maintained very steady growth. For example, from 2006 to 2023, a period of 17 years, its revenue increased from $98.5 billion in 2006 to $364.4 billion in 2023, a cumulative growth of 2.7 times, with a compound annual growth rate of about 8%. During this nearly 20-year period, Berkshire only experienced revenue declines in two years, which were in the depths of the financial crisis in 2008 and the impact of the pandemic in 2020. Even in these two extremely challenging economic environments, Berkshire's revenue decline did not exceed 10%, demonstrating its stability.

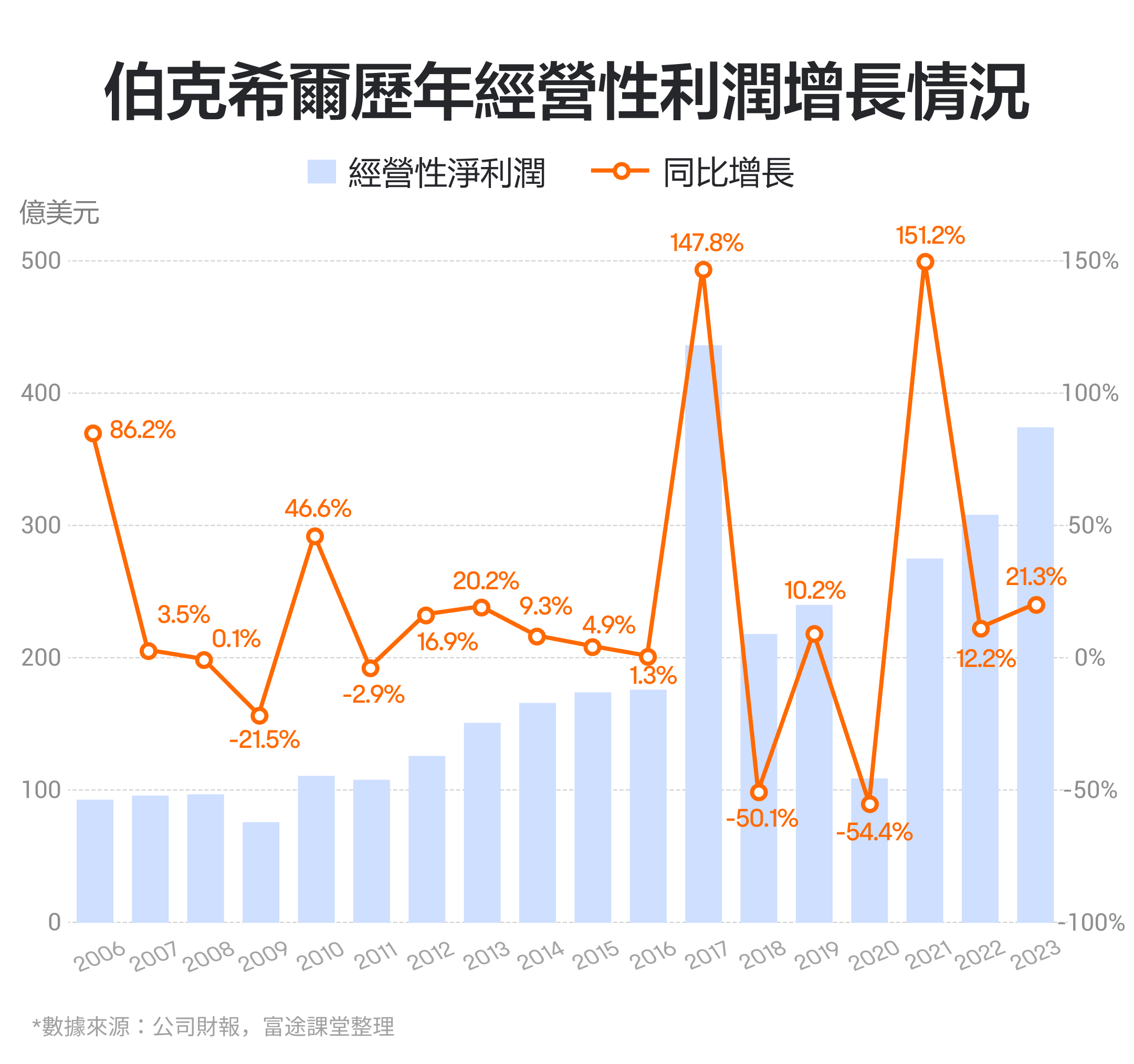

In terms of profit, Berkshire's net profit can be divided into two parts. One is the profit mainly generated by insurance and other operational businesses, which can be defined as operational net profit, and the other is investment profit.

The growth trend of Berkshire's operational profit is roughly in line with its revenue, increasing from $9.3 billion in 2006 to $37.4 billion in 2023, a cumulative growth of about 3 times with a compound annual growth rate of 8.5%, slightly higher than the revenue growth rate during the same period. Over the 17-year period, Berkshire's operational profit was profitable every year, with profit declines occurring only in four years, showing a consistently robust performance. The cumulative operational profit during this period reached approximately $338.1 billion, which is the main source of the company's overall net profit.

From an asset allocation perspective, if we define Berkshire's operational businesses and operational profit as defensive allocations, then Berkshire's equity investment positions and investment profit are considered offensive allocations.

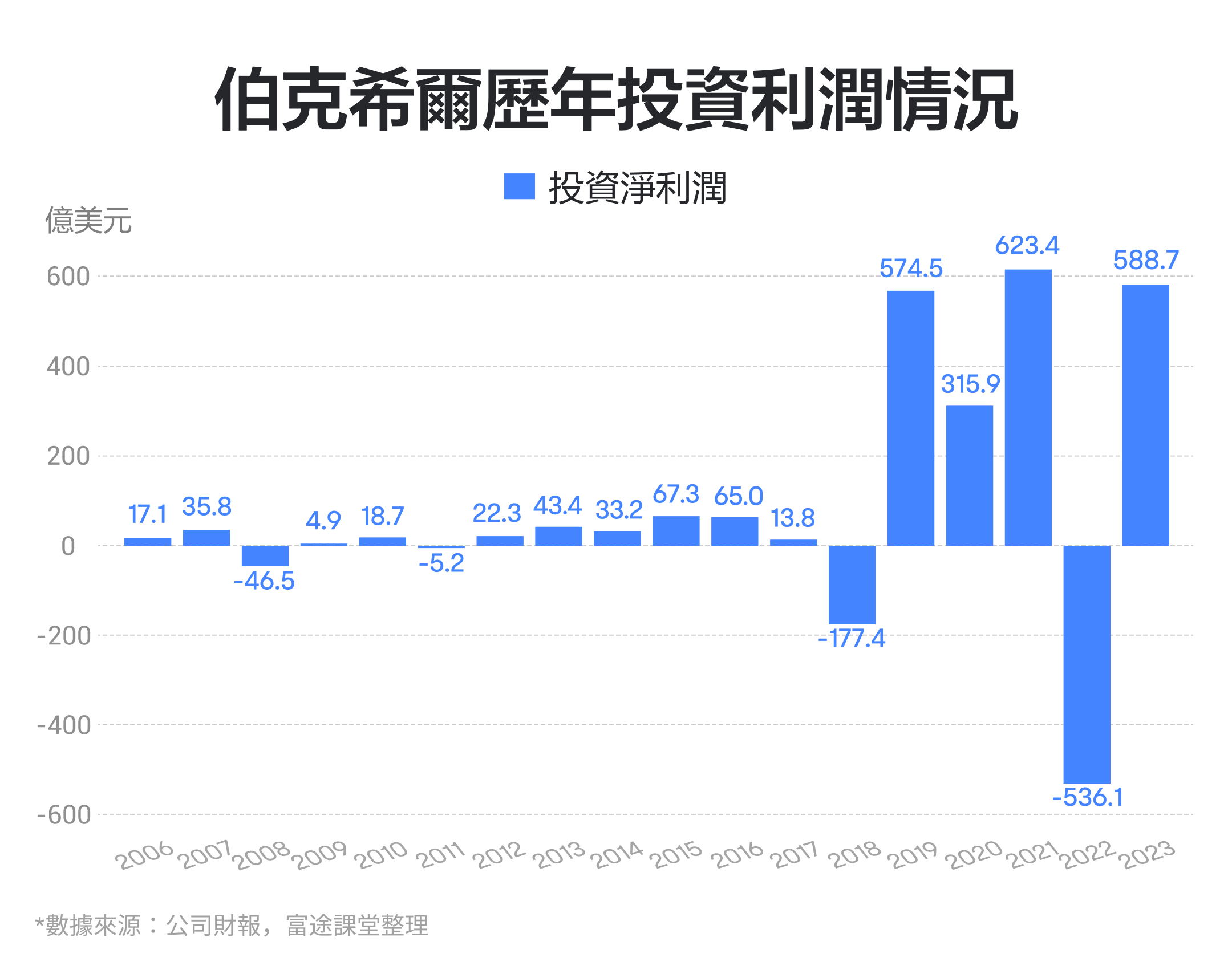

Relative to Berkshire's investment profit, which is more closely linked to the market and therefore attracts more market attention, Buffett's activities in the primarily U.S. capital markets are mainly reflected in this area. Stock market investments are largely influenced by market conditions, making it difficult to be profitable every year. As a result, the stability of investments is a relative concept.

In comparison to the S&P 500 index, over this 17-year period, Berkshire only had losses in 4 years, while the S&P 500 index had 5 years of decline. This reflects the stability in profitability.

In Berkshire's own historical performance, the cumulative investment net profit in the first nine years (2006-2015) was about $19.1 billion, while in the following 8 years, the cumulative investment net profit reached approximately $146.8 billion, which is 7.7 times that of the first half, showing an explosive growth in profitability in the later period.

Regarding Berkshire's future performance, we need to observe whether its operational revenue and net profit can maintain the same level of stability as before, and focus on the sustainability of investment profit. Particularly with respect to investment profit, as Munger ages and Buffett's advancing years, the issue of succession becomes an important variable affecting investment profit expectations, and this is a matter that deserves long-term attention.

2. Changes in Cash Reserves and Portfolio Holdings

The second focal point for Berkshire Hathaway is the situation regarding its cash reserves and changes in portfolio holdings.

We can define an indicator: Cash Ratio = (Cash + Short-term Investments) / (Cash + Short-term Investments + Equity Investments). The changes in this indicator will not only affect Berkshire Hathaway's investment profits but also serve as one of the market's indicators.

Firstly, from Berkshire Hathaway's perspective, as the cash ratio gradually decreases, it means an increase in the proportion of stock holdings for the company. The volatility of investment profits may also increase, indicating higher potential profitability along with higher potential risks. Conversely, when the cash ratio continues to decrease, it signifies a decrease in the company's risk preference, reducing the volatility of investment profits.

Berkshire Hathaway's trend in cash ratio over the past few quarters is currently in the latter scenario. Since the first quarter of 2023, Berkshire Hathaway's cash ratio has generally been increasing, reaching about 49% in 2024Q2, marking a new high since 2019.

At the same time, tracking the changes in cash ratio and Berkshire Hathaway's portfolio can provide insights into Buffett's and Berkshire Hathaway's market judgments. The continuous increase in Berkshire Hathaway's cash ratio over the past few quarters may also suggest that Buffett is not as optimistic about the future of the U.S. stock market, thus keeping sufficient cash to hedge potential market risks.

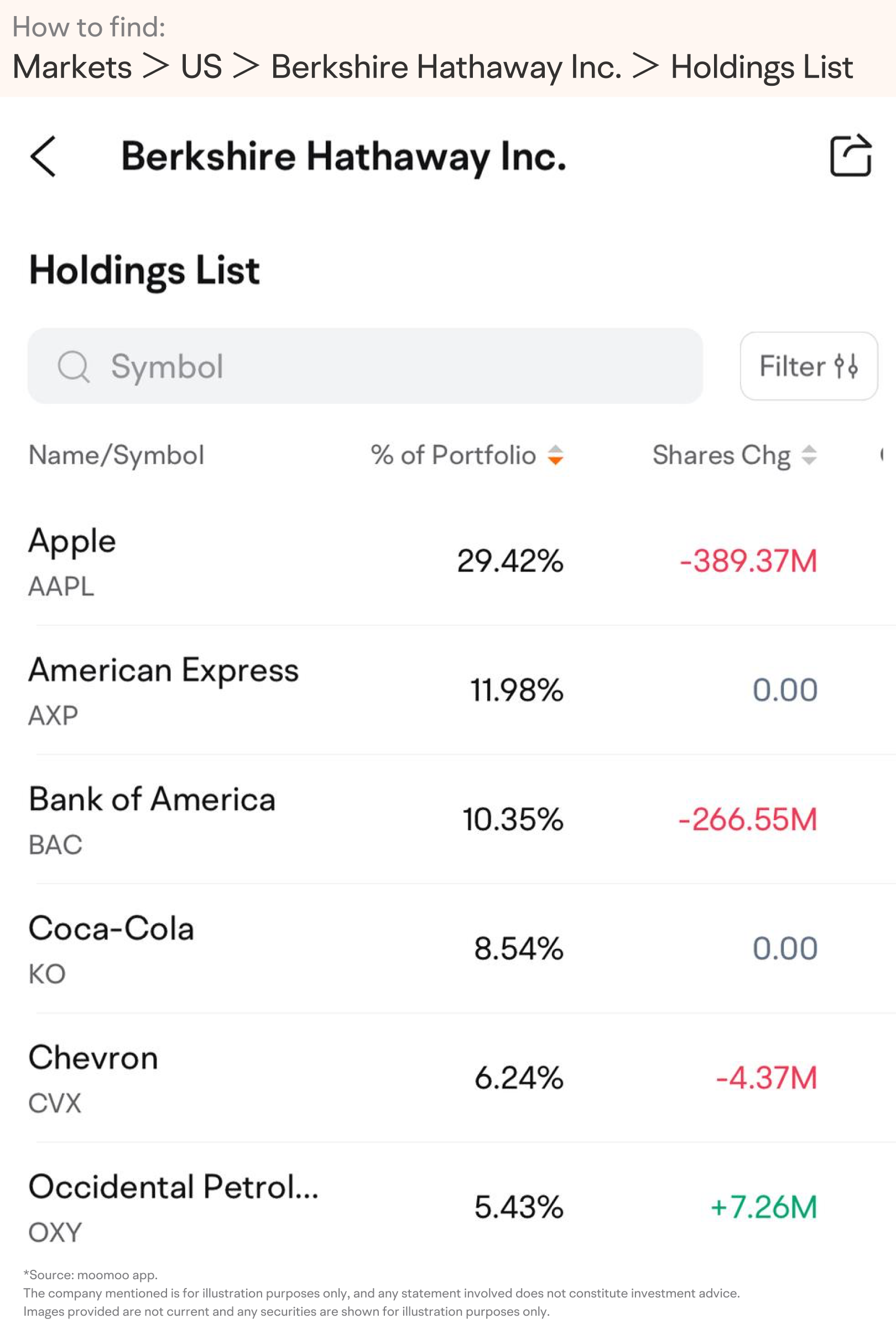

Looking at the changes in the portfolio holdings, Berkshire Hathaway discloses its portfolio holdings each quarter (Form 13F report), and any slight changes in its portfolio holdings become a focus of market attention.

For example, through the institutional tracking feature of the Futubull app, the 'Berkshire Hathaway 13F' report as of the end of the second quarter of 2024 shows that the company reduced its holdings of Apple by 0.389 billion shares in 2024Q2.

Since Berkshire Hathaway started buying Apple in 2016, it has never reduced its holdings. However, this is the third consecutive reduction after reducing by 116 million shares in the previous quarter. The reduction exceeds half of the holdings, which may indicate a significant weakening of Buffett's bullish view on Apple's future prospects, releasing a certain bearish signal.

3. Cash flow and repurchase situation.

Buffett once said that the intrinsic value of a listed company is the sum of the present value of the free cash flow the company can generate in the future. So how is Berkshire Hathaway's own free cash flow situation?

Looking at the data since 2006, Berkshire Hathaway's free cash flow has been positive every year and overall has been growing. The cumulative free cash flow during this period is approximately $316.9 billion. In comparison, Berkshire Hathaway's operating profit totals about $333.1 billion during the same period. Free cash flow and operating profit have remained relatively stable, indicating a healthy state.

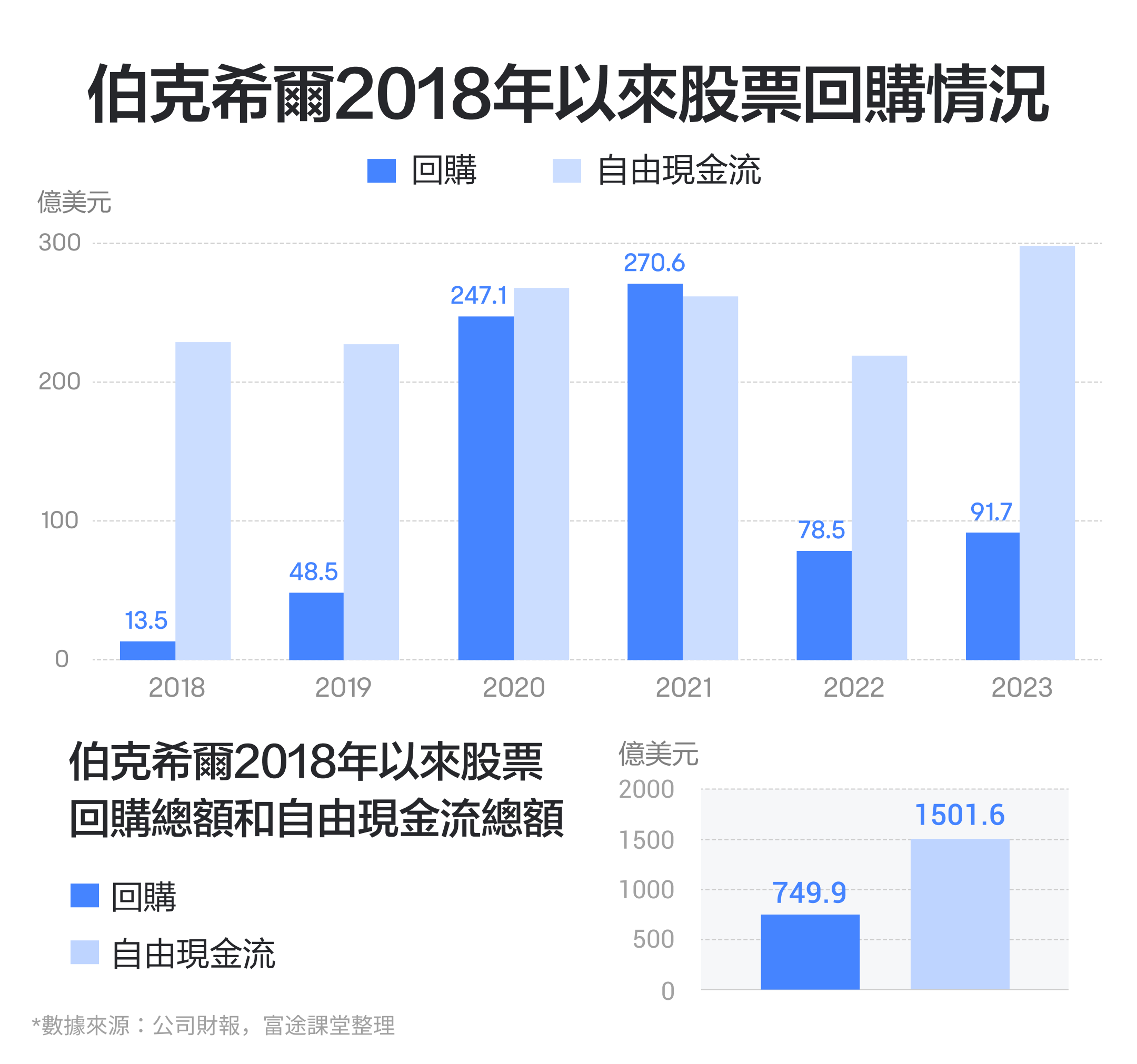

After a company earns profits, there are two common uses: expanding the business or rewarding shareholders. Before 2017, Berkshire Hathaway hardly paid dividends or repurchased shares to reward shareholders. The incoming cash was mainly used to expand physical operations or increase investment positions.

As early as 1985 in a shareholder letter, Buffett stated that Berkshire Hathaway would consider dividends only when its business model could no longer provide attractive returns to shareholders. Prior to 2017, Berkshire Hathaway's stock performance far exceeded the S&P 500 Index. Not paying dividends or repurchasing shares was a manifestation of Buffett's consistent actions and words.

However, in the years after 2018, while Berkshire Hathaway still outperformed the S&P 500 Index in terms of overall gains, the lead was not significant. During this period, Berkshire Hathaway also began to enhance shareholder returns, mainly through share buybacks.

In 2018, Berkshire Hathaway first repurchased $1.3 billion, and has continued repurchasing for the next 5 years, with a total repurchase amount of approximately $75 billion, which exactly accounts for half of the total free cash flow during this period.

In future performance, we can continue to observe whether Berkshire can maintain a healthy free cash flow status, and pay attention to its repurchase situation. If Berkshire continues to increase repurchases, it may mean that the company has lost the possibility of rapid development, but this may also be welcomed by conservative investors. In fact, at Berkshire's current scale, it may not be very realistic to return to a rapid growth track.

By now, you may have some new insights on how to interpret Berkshire's performance. It is worth mentioning that each time a star company releases its performance, it may represent a rare trading opportunity for different types of investors.

Please use your Futubull account to access the feature.

Conversely, if investors believe that the latest performance of a certain company will not be optimistic and will bring pressure on the short-term stock price, investors may consider short selling, which can be done by considering margin selling or buying put options.

Of course, if investors think that the bullish and bearish direction of a company's performance is unclear, but the stock price may experience significant fluctuations after the performance release, then investors may consider the straddle strategy of buying call and put options to capture potential opportunities.

Finally, to summarize,

For Berkshire's performance, we can focus on three aspects: the stability of performance, changes in holdings and cash reserves, and cash flow and repurchase situation.

For the stability of Berkshire's performance, we need to observe the stability of revenue and net profit from its regular business, as well as the continuity of investment profits.

By observing the changes in the proportion of cash in Berkshire Hathaway's holdings and cash reserves, we can gauge the volatility of Berkshire's investment profits and Warren Buffett's attitude towards the future market.

Regarding Berkshire Hathaway's cash flow and repurchase situation, we can observe the robustness of its free cash flow and the sustainability of repurchases.

Every time a company releases its business performance, it may bring potential trading opportunities. Investors can consider suitable trading varieties based on their personal risk tolerance.