A Easy-to-understand Macro Course

How to Invest with Labor Market Indicators

For the American people, 2023 is destined to be an unpeaceful year: on the one hand, people need to cope with the rising borrowing costs caused by the Fed at a very fast rate hike; on the other hand, they should always care about their “rice bowls” and be wary of the risk of being layoff.

Someone may have to ask, why there is a phenomenon of layoffs? How Important Is Employment Data Exactly? After reading this course you may have the answer in mind!

● Why is the labor market so important? What are the indicators?

● How do investors observe and establish an analytical framework?

● What is the impact of employment on the stock market?

● Then let's fight it!

● Small knot

Is it important to analyze the labor market? The answer is,Very important!

The reason is simple, employment provides productivity and services that will affect every aspect of our lives.

For example, workers strike, the city will stop; farmers do not plant the land, supermarket vegetable prices will skyrocket...

Not only that, labor market indicators also affect investment in US stocks. Learning indicators help us to increase or decrease our stock positions by predicting what the Fed may take next steps.

Understanding the whole picture of the labor market requires a variety of considerations. Here are the 7 indicators that are focused on the Fed directly listed for everyone:

Labor involvement

(1) Unemployment rate

(2) Labor force participation

Labor changes

(3) Addition of non-agricultural employment

(4) Number of Unemployed Persons Claiming for the First Time

Employment Environment and Payroll

(5) Vacancy

(6) Hiring commission

(7) Weekly salary increase

Non-farm vs. ADP Non-Farming

Many investors analyze labor market data will find that there are two indicators of “non-farm payrolls”, so what is the difference between the two, which data is more informative?

● Coverage difference: Non-farm is a survey by the Bureau of Labor for U.S. commercial and government agencies, while the ADP Non-Farm ADP Research Institute is only for commercial institutions (excluding government) surveys.

● Release time difference: Non-Farms are released on the first Friday of each month, and ADP Nonfarm announced two days before NFP. ADP NFP can allow the market to anticipate the formation of NFP in advance, so it is called “small non-farm” by market traders.

● trend difference: non-agricultural and ADP non-farm from the long-term dimension of the trend consistent, but the short-term two often divergence; more in the labor market turmoil period, the more likely to have differences between the two survey results.

● Conclusion: Market participants and Fed officials pay more attention to non-farm employment data, so non-farm data will be more authoritative and more important.

Timely tracking of economic indicators:

Open the Futubull APP, discover→information→calendar→economic data, click to add to the calendar so you can immediately subscribe to the important economic data once.

How do investors observe and establish an analytical framework?

There is a key element in the labor market to fully understand — when indicators were published.

Why do you need to know about time? The answer is two words familiar to us: expected!

Markets tend to fluctuate before and after key metrics are released, so when you realize that an indicator is about to be released, you can lay out ahead of market expectations.

Here is a detailed definition of the top 7 indicators that the Fed is most concerned about

Once you know the release time, you can start the analysis officially.

We follow a few steps below:

First, determine the position of the US economic cycle and grasp the implementation of the Fed's monetary policy.

I'm sure most students understand the Fed's two core goals: price stability and full employment. Depending on the current state of the economy, the Fed will typically adopt measures such as adjusting interest rates, monitoring macroeconomic indicators, and implementing quantitative easing policies to de-balance price and employment goals.

Secondly, as an investor, you may have realized that the COVID-19 pandemic has also changed the structure of the labor market. After the epidemic, many people “fired” off their bosses looking for a higher salary, even if they can't find their next home for a while, and rely on subsidies to maintain their lives for a period of time.

“During the pandemic, many workplace rules were subverted, some permanent,” said U.S. News & World Report magazine. By the end of 2022, if every unemployed person could find a job and there were about 4 million vacancies in the United States, employment was too “hot”. But the reason behind the “hot job” analysis is that millions of experienced employees choose to retire early.

So after understanding the causes of the current labor market, we need to slightly change its analytical logic.

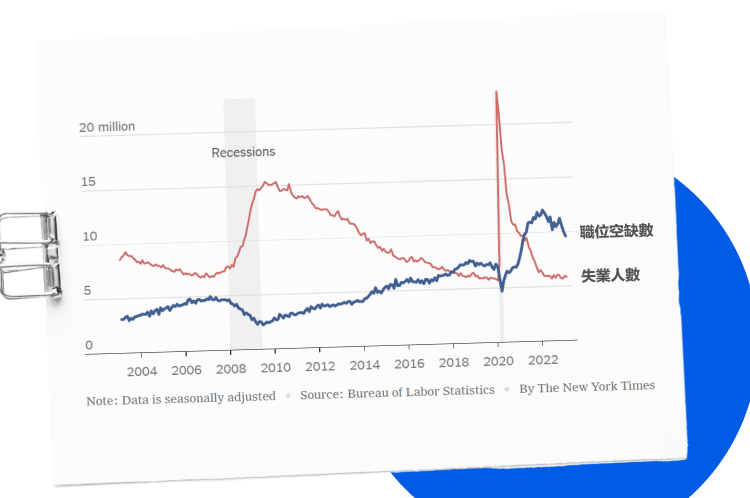

Previously, we could compare the same types of metrics. For example, a sharp decline in the number of vacancies would be accompanied by rising layoffs and unemployment rates, so economists could judge that the US economy would be “hard landing” when it happened.

However, this approach may no longer work as the unemployment rate has remained low despite a significant drop in vacancies since 2023.

Now analysing the market should probably “ignore history”, we can use trend analysis, that is, pay more attention to the changes in the data.

At the same time, a comprehensive judgment on the relationship between the labor market and other macro indicators, such as salary growth and inflation, high inflation, salary growth certainly will not slow.

Finally, it is necessary to refer to the employment expectations given by the market, as the stock market is more of a change in anticipation.

In fact, the relationship between a lot of employment indicators and the stock market is inextricably upholstered. Now let's sort it out in detail.

Analyzing the correspondence between employment and stock market is not simply positive or negative, it is important to clear the background of the US macroeconomic cycle.

For example, in normal times, strong job growth and wage increases would be considered good news, but a strong job market will just cause a big drop in the market during the Fed governs inflation.

Why? As the market believes strong employment will lead to a more aggressive rate hike, which is bad for the stock market, in early October 2022, the market reacted in the same day after the September non-farm payrolls was released.

On the contrary, employment and more stock markets are relevant as Wall Street predicts that the US economy is about to enter a recession.

In early June 2023, the market after the announcement of May non-farm employment in line with this law, the US stock market rose a factor that day was “confidence brought by a strong job market”, because the data alleviated concerns about the recession, investors believe that the US economy remains strong momentum, growth driven by Still exists.

If you get the January 2023 employment data, how to analyze it?

1. First, look for the US economic position: January 2023 is still in the beginning of the interest rate hike cycle in 2022.

2. Secondly, analyzing the Fed's attitude: Powell's attitude was “cooling the labor market to help curb inflation.” This means that if the labor market is seen cooling down, the big odds will see the Fed stop rate hike and US stocks rose on the day it was released.

3. Finally, does the actual data match the direction of the Fed? In fact, January employment was very strong and even surpassed market expectations, which showed that the Fed would not stop rate hike, so the market fell after the report was released.

Small knot

To return to the problem of “labor market analysis”, we can follow the steps below to think:

If you have learned to analyze the labor market from this course, we may wish to pay attention to our macro interpretation of the “advanced” column, predicting market trends from the latest data now!