Guide to selecting thematic funds.

Make good use of thematic funds to increase the potential return on investment

KEY KEY POINTS:

● Thematic funds are suitable for investors who are optimistic about and understand a certain topic or industry, and are willing to withstand high fluctuations and seek potentially high returns.

● Generally speaking, thematic funds can invest across industries, while industry funds only invest in a single industry.

● When constructing a portfolio, using a thematic fund to replace some stocks is a more common and less risky method, while as a portfolio core, the potential return is high but the risk is also high.

● Some thematic funds may be subject to risks such as high volatility, hype, and possible poor liquidity.

What if you're optimistic about the prospects of a certain industry, but don't have the energy to do in-depth research to select individual stocks? What if you think the IMF's yield is relatively low and is willing to withstand more fluctuations and seek higher potential returns? Then the answer points to thematic investing.

Thematic investment refers to focusing on long-term trends and being limited to a specific company or sector. When a theme performs prominently in economic development, investors can expect to reap benefits. And one of the common ways to implement thematic investments is through thematic funds.

The same differences between thematic funds and industry-themed funds

First, we need to understand the differences between thematic funds (thematic funds) and sector funds (sector funds).

Generally speaking, thematic funds invest in companies in specific economic sectors such as healthcare, energy, or information technology in the same way as industry funds, but thematic funds can also invest across industries for set goals. For example, pension funds may include companies in different industries such as medical care and consumer goods, but health care sector funds generally select companies in this industry.

According to the global industry classification standards, there are 11 major industries: communication services, non-essential consumer goods, consumer necessities, energy, finance, health care, industry, information technology, materials, real estate, and facilities.

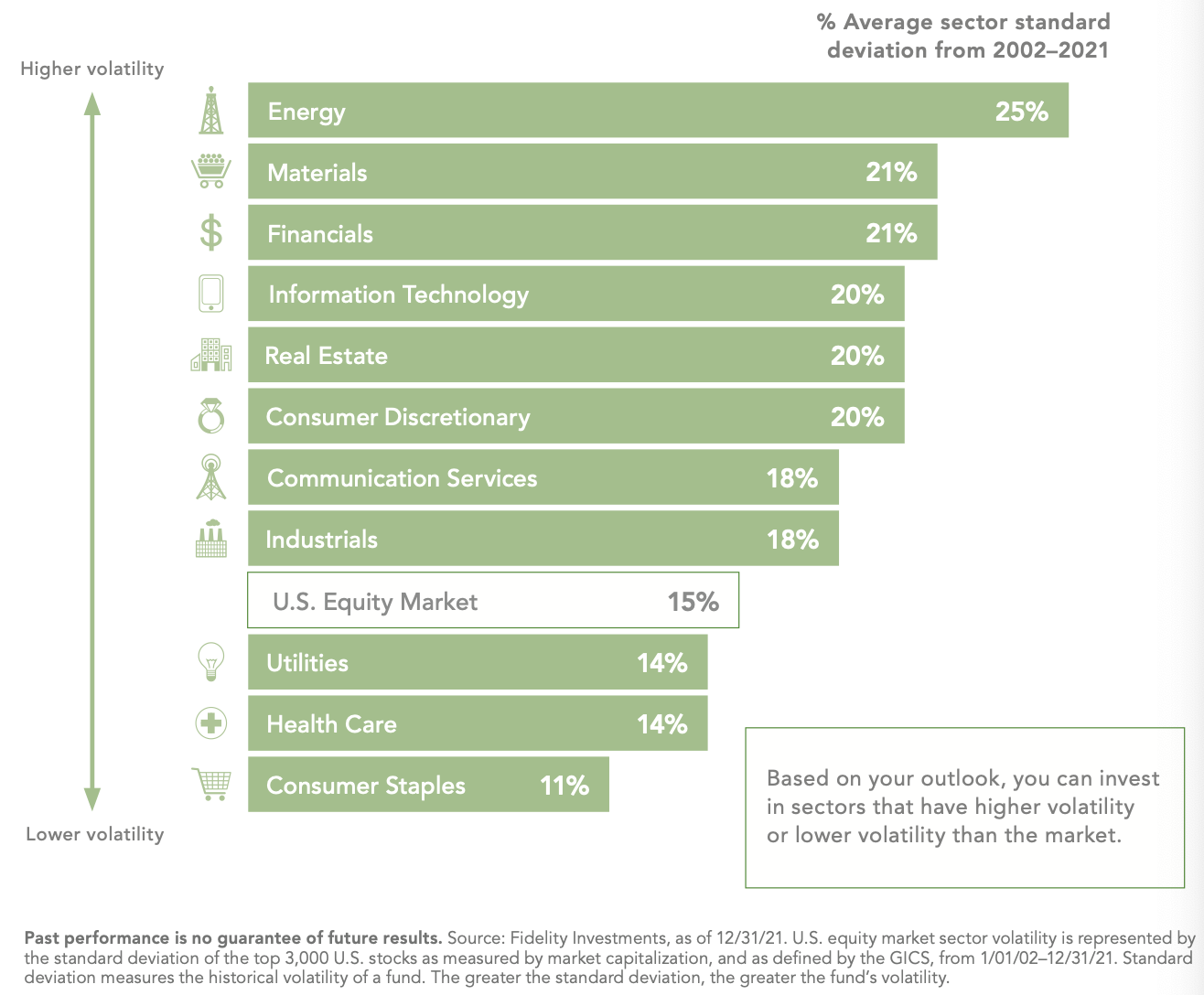

Fidelity found that from January 1, 2002 to December 31, 2021, there may be a 15% change in the US market, and different industries may have different levels of volatility. According to the analysis data, the energy industry fluctuates the most, while the consumer necessities industry has the least fluctuation, which means that the energy industry is more economically sensitive than the consumer necessities industry.

At different stages of the economy, different industries performed differently. For example, the consumer, healthcare, and facilities industries may perform better than other industries during an economic downturn.

Therefore, if they are optimistic about thematic funds, especially industry-themed funds, investors need to have an understanding of economic development and choose funds within risk tolerance.

Are thematic funds the protagonists or supporting roles in the portfolio?

BlackRock believes there are three main ways for investors to use thematic funds to build portfolios:

1.The core satellite.Most of the core portfolio consists of traditional diversified stock and bond funds, while also selecting thematic funds as satellites — mainly investing in stocks.

2.Use thematic strategies to invest in some stocks or all of the world's stocks.BlackRock believes this is the most common practice as it is best suited for investors structuring their portfolios by region. This method is the first step in trying to incorporate thematic investments into the portfolio, making minimal changes to the portfolio design and construction process.

3.Thematic investments are at the core.Investors can define the long-term strategic allocation of their portfolios according to the elements they value most. This type of portfolio structure allows investors to actively manage risk, and also makes portfolios more suited to individual needs.

The Morningstar study found that thematic funds are usually used to increase returns during the investment period, but their risk is usually higher, and they are best used to supplement rather than replace existing core holdings.

What are the risks of investing in thematic funds?

Although thematic funds have the appeal of increasing investment returns, investors should also be aware of their risks.

Trend changes and fluctuations:It is particularly popular in the market and favors economically sensitive topics. When the trend of the theme changes and investors flock out, the thematic funds will fluctuate greatly.

Hype risk:In order to pursue social issues that have received attention, the themes set by some funds may be just a gimmick, and the individual stocks they actually invest in do not match the theme.

Liquidity risk:Some particularly niche thematic funds may be less liquid because there are too few investors, or because the stocks they buy themselves have fewer investors.