Make good use of tools in options trading

Options Unusual Activity: monitoring the moves of institutional investors

For options traders, tracking unusual activity may provide useful insights.

Futubull 's upgraded 'Options Unusual Activity' feature helps you monitor the moves of large institutions and potentially identify possible new investment opportunities.

![]() In-depth data: Gain key insights behind potentially significant transactions so you are able to make more informed trading decisions.

In-depth data: Gain key insights behind potentially significant transactions so you are able to make more informed trading decisions.

![]() Filter and subscribe: Customize your filters to focus on what matters to you most, providing you ready access to relevant information.

Filter and subscribe: Customize your filters to focus on what matters to you most, providing you ready access to relevant information.

![]() Follow trades easily: With just one click, you can copy trades and use simulated return analysis to support your investment strategies.

Follow trades easily: With just one click, you can copy trades and use simulated return analysis to support your investment strategies.

Explore how this tool can help you make investment decisions on options trading.

I. What is Options Unusual Activity?

Options Unusual Activity refers to a sudden and significant increase in the trading volume or turnover of a particular option. This may indicate the expectations of some investors, which may include large institutional investors.

Such investors usually have the following advantages:

● Liquidity: Institutional investors have significant buying and selling power, helping them to potentially take advantage of trading opportunities in the options market.

● Access to Information: Financial institutions usually know much more information about the companies they invest in than individual investors.

● Advanced tools: Financial institutions can use more advanced tools and hire professional traders, which may allow them to make more informed decisions.

Important consideration: For Options Unusual Activity, upstream data doesn't indicate whether positions are being opened or closed, so the indicators are not always right and for reference only.

II. How to access Options Unusual Activity on futubull

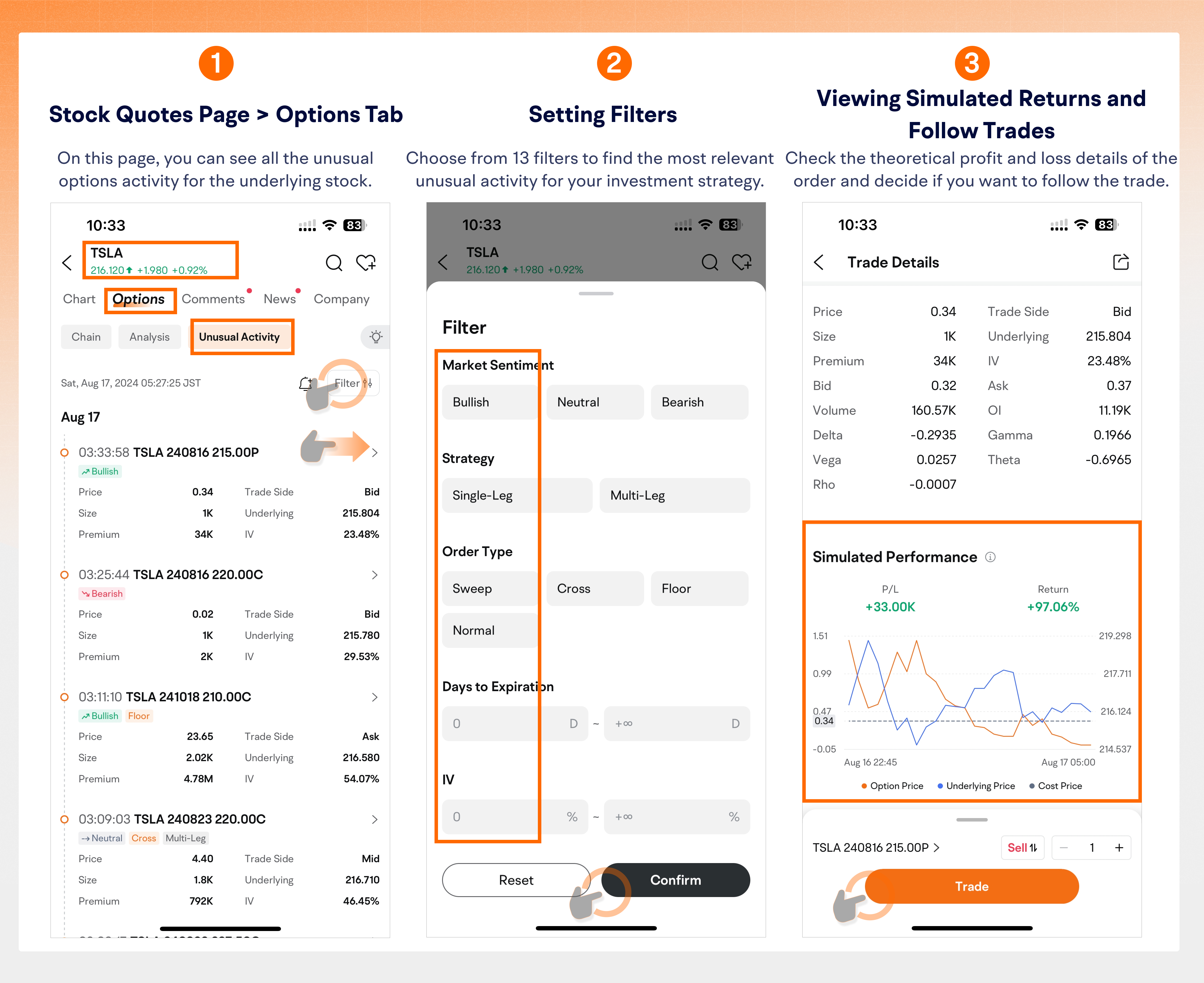

Path 1: Viewing Options Unusual Activity for a specific stock

If you wish to track the options unusual activity for a particular stock, such as Tesla (TSLA), you can navigate to Tesla's Detailed Quotes> Options> Options Unusual Activity. Use Filters to find trades that meet your conditions. Filters include market sentiment, order type, implied volatility, transaction amount, and more.

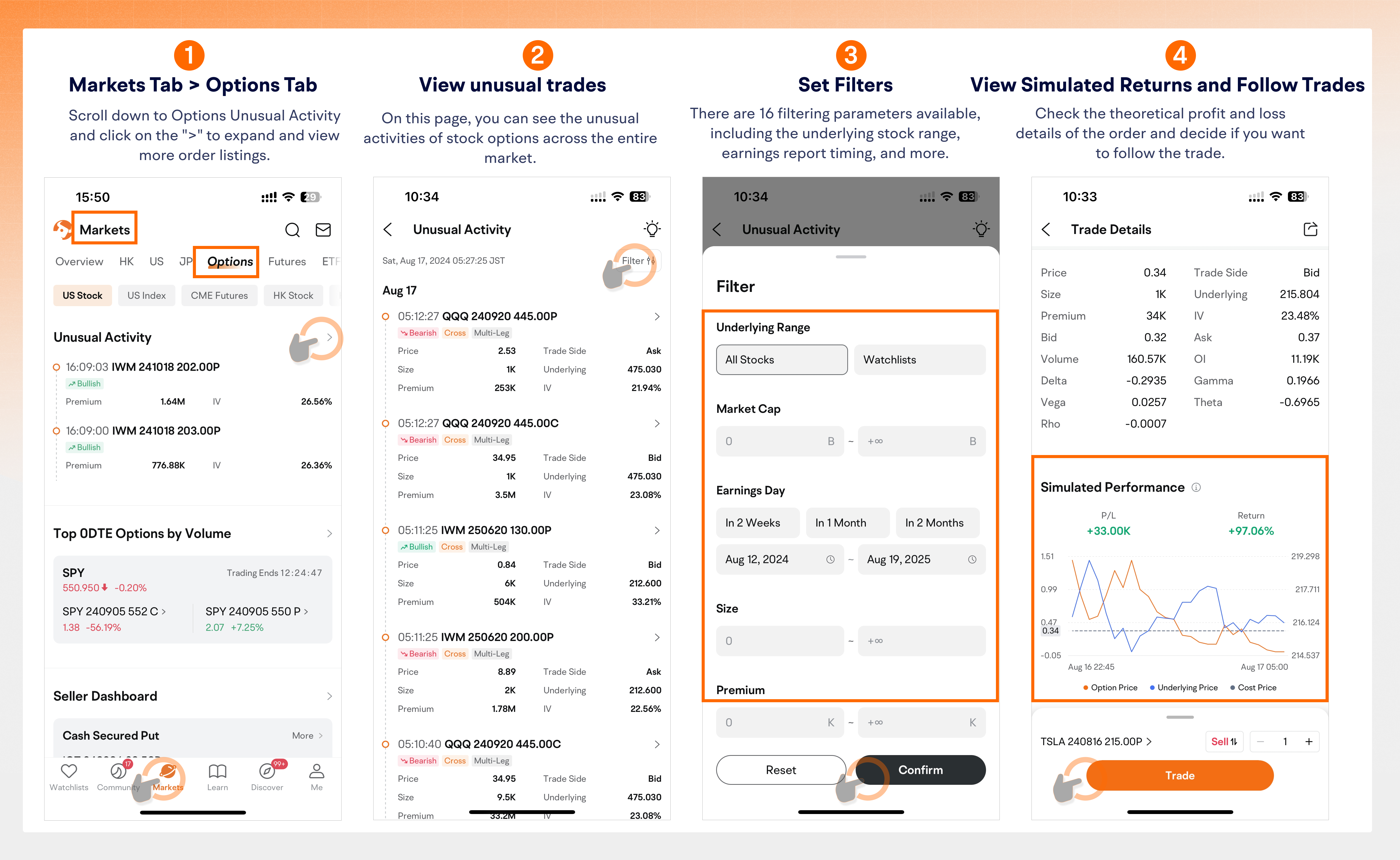

Path 2: Viewing Options Unusual Activity across the market

If you want to track options unusual activity for multiple stocks, you can do so by navigating to Markets > Options and scrolling down to the Options Unusual Activity section. Here, you can see the unusual activities of stock options across the entire market. By using Filters, you can set conditions and find the trades which satisfy your investment objectives.

Next, we will demonstrate how to use this tool with several examples.

III. Case Study

1) Follow the move of big institutions

If you're confident about market trends but unsure which options to choose, unusual activity can be a useful reference.

For instance, look for options with an "E" tag in the unusual activity list if you plan to trade around earnings reports. This tag indicates that the option expires close to the company's earnings release date, suggesting that the investor is looking to profit from stock price volatility around that time.

Example:

On 19 April, 2023, TSLA reported an operating profit decline in the first quarter, and the stock price subsequently fell nearly 10% after the financial report was released.

Though industry investors generally had a negative view of TSLA, Cathy Duddy Wood, CEO of Ark Investment Management LLC., firmly believed TSLA had a good prospects. Such mixed market sentiment might lead to an increase in volatility in the short term.

If you also anticipate significant volatility in Tesla stock, you might consider setting up a Long Straddle, which could benefit from an appreciable upward or downward movement in the stock. Learn more:Long Straddle.

However, with so many choices on the options chain, you might be uncertain about which strike price and expiration date to choose.

At this point, you can check the options' unusual activity rankings to see the moves of big institutions.

If you're interested in this two-part strategy and want to follow suit, you can directly click on these unusual activities to proceed.

Futubull supports a one-click follow trade feature and provides an estimated theoretical profit and loss graph for the strategy.

1.Click on the unusual activity card:

This will take you to the details page, where you can view more data about this order.

2.View Simulated Performance:

By looking at Simulated Performance, you can assess whether the potential return on that particular trade could meet your expectations.

3.Click Trade to set up the same strategy:

Pull up the trade bar to view the current profit and loss analysis chart for the trade, and click on Trade to execute the order.

Note: The Simulated Performance feature is for informational use only, not a recommendation, and should not be solely relied upon to make a trading decision. The feature performs calculations based on model assumptions. The projections or other information generated by this feature regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

2)Providing insights into market sentiment

Futubull provides comprehensive data to help you understand the psychology behind large capital movements.

On the Unusual Activity page, you can view key information for each order. Use filters and technical analysis to focus on the unusual activity that interests you.

For example, you can determine:

Market sentiment (bullish or bearish)

Strategy composition (single-legged or multi-legged)

Trade side (active buy or active sell)

Order type (regular trade or cross-market sweep)

Market Sentiment can help you potentially identify investors' outlooks on the future trend of the underlying stock behind the transaction.

Market Sentiment | |

Bullish | refers to actively buying call options and actively selling put options. |

Neutral | refers to neutral transactions involving both call and put options. |

Bearish | refers to actively selling call options and actively buying put options. |

Trade Side means whether the trade price is closer to the ask price or the bid price, which can help you potentially analyze the willingness of the trade.

Trade Side | |

Ask | Active buying: The price is closer to the selling price and the willingness to buy may be stronger. |

Mid | Neutral transaction: The price is just between the buying price and selling price, and there is no obvious willingness to buy or sell. |

Bid | Active selling: The price is closer to the buying price and the willingness to sell may be stronger. |

Order Type can help you analyze how the trade was placed in order to help you gauge who placed it.

Order Type | |

Cross | refers to the matching of buy and sell orders between different customer accounts by brokers, targeting the same security. These trades usually cannot reflect market trends or directions. |

Floor | refers to the trading conducted by experienced professional traders on the exchange floor. These traders usually use various strategies to trade options, and have research and reference value. |

Sweep | refers to larger-scale trades that "scan" different exchanges to find the best price and maximum available liquidity, thus achieving fast execution. This usually indicates that investors have a clear view and strategy on the price trend of the underlying asset of the options. |

Strategy Composition can help you evaluate complex trading strategies and potentially gauge investor intent.

Order Composition | |

Single Option | Only involves one type of contract/s |

Multi-Leg | Involves multiple contracts placed simultaneously to create a strategy |

Simulated performance displays a chart of the theoretical profit and loss as the underlying stock price and option price change.

Simulated performance: The tool simulates the theoretical P/L data following an option trade and illustrates how fluctuations in the underlying price and premium could impact the P/L and return. Note: If an option trade is filled at the mid-price, P/L data will not be available. Calculations P/L = Fill Amount * Return Buy Trade (refers to ask side trade): Return = (Last Price − Fill Price) / Fill Price * 100% Sell Trade (refers to bid side trade): Return = (Fill Price − Last Price) / Fill Price * 100% |

Option Indicators can help you uncover strategy details.

By analyzing the buy/sell direction, expiration date, and strike price, you can try to infer the investor's stock price expectations.

For example, purchasing an out of the money call option with a strike price of 100 expiring in three months suggests an expectation that the stock will rise above 100 within that period.

However, for options unusual activity, upstream data doesn't indicate whether positions are being opened or closed. To make an educated guess, compare the trade volume of the unusual activity with the overall option chain's volume and open interest.

If Volume of the Unusual Activity Order > Current Open Interest + Total Volume − Volume of the Unusual Activity Order, it likely indicates an opening order for a new position.

Note: You can find Volume of the Unusual Activity Order via Unusual Activity> Trade Details and Total Volume via Options Chain> Analysis> Trade Stats

Keep in mind that data from the Options Unusual Activity feature should not be solely relied upon to make a trading decision. The data should be used in conjunction with other fundamental and technical analysis within the decision making process.

3) Providing signals for entry into the underlying stock

If you're looking to trade in underlying stocks, it may be beneficial to monitor the options market first. Changes in options can often signal potential future stock price movements before the stocks themselves.

Large fund flows, especially from well-informed and analytically adept investors, typically reflect their expectations for future stock price movements in advance.

By observing unusual activities in the options market, it can help you decipher market signals, gauge industry leaders' sentiment, and better align with the market to evaluate potential investment opportunities.

For example:

The earnings season for US stocks kicked off in mid-April 2023. JPMorgan Chase and other large banks announced their financial reports, most of which exceeded consensus expectations. Bank stocks rose afterward.

$JPMorgan (JPM.US)$ rose more than 7% on 14 April, with a Q1 net revenue of $38.349 billion, up 25% year-on-year and exceeding market expectations by $2.53 billion.

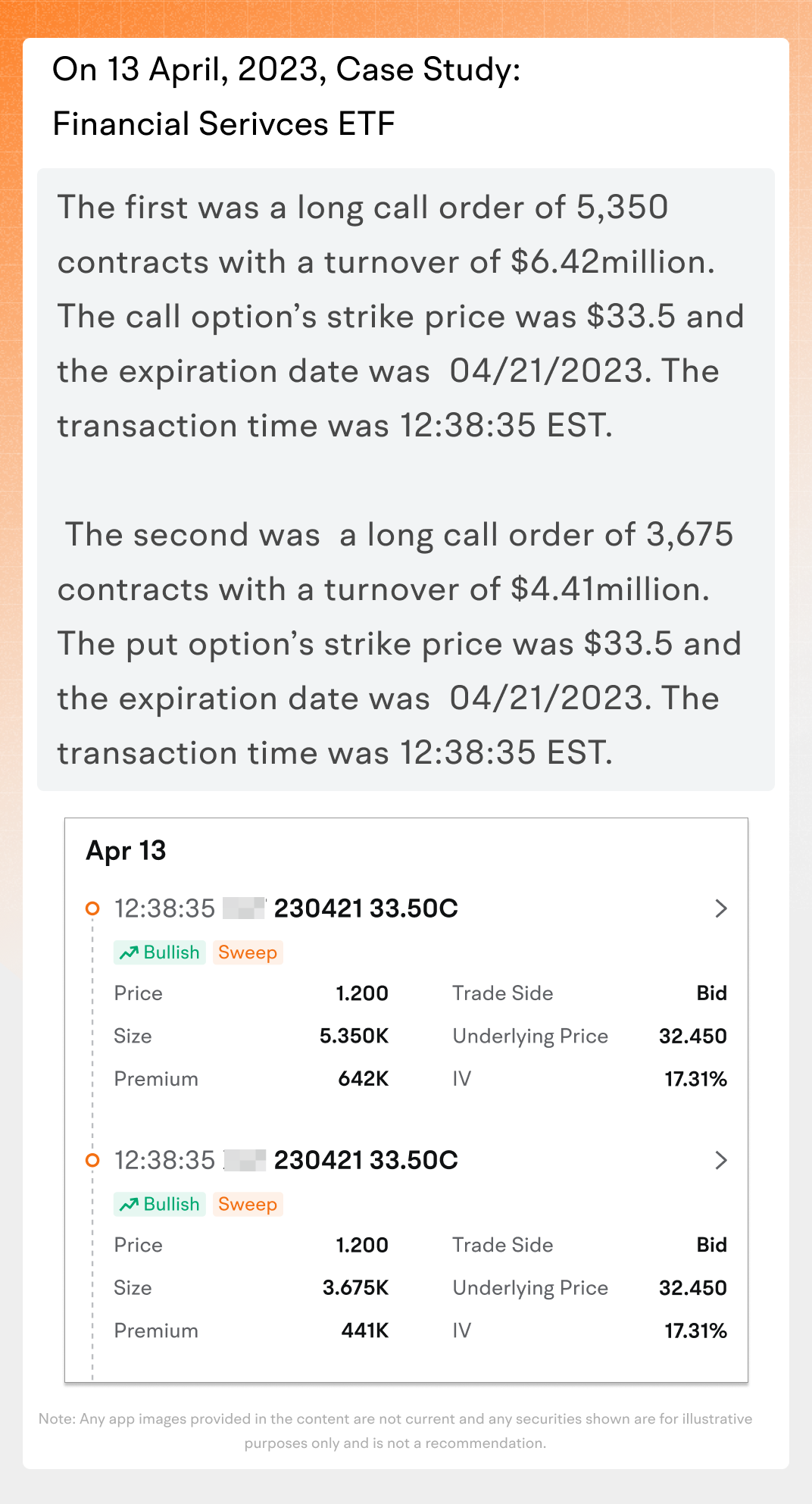

On 13 April, 2023, a day before $JPMorgan (JPM.US)$ released its financial reports, several large-volume options orders were recorded on the Options Unusual Activity page on Futubull. They covered almost 10,000 near-term contracts for a financial services ETF that would expire next week.

This ETF is an option associated with financial services, which tracks the financial sector of the S&P 500 index $Financial Select Sector SPDR Fund (XLF.US)$ , covering banks, insurance companies, and investment firms.

We have noticed that both orders have been marked as "Bullish" and "Sweep."

Bullish: refers to actively buying call options and actively selling put options

Sweep: refers to larger-scale trades that "scan" different exchanges to find the best price and maximum available liquidity, thus achieving fast execution. This usually indicates that investors have a clear view and strategy on the price trend of the underlying asset of the options.

Based on this information, assuming this was an opening order, we can infer that the large cash flow anticipated positive financial reports for the industry and positioned themselves accordingly. By noticing this unusual activity you could have considered establishing a position and potentially profited if the bank announced favorable earnings. And note that they also could have lost if earnings were below expectations. Although large scale institutional activity may provide insights, it is by no means guarantees a successful trade/investment.

IV. Disclaimer

Options unusual activity data can provide references for your investment decisions, but should be carefully considered in conjunction with your individual investment strategy. It is important to note that the historical performance indicated by options unusual activity does not guarantee future results, as investment value is always subject to fluctuations.

The examples provided above are mainly for the purpose of analyzing methods used to interpret options unusual activity; they do not constitute any investment or operational advice, nor do they represent any actual results or specific investments. We cannot verify the actual intentions of the investors behind the unusual activity.

When analyzing options unusual activity, investors should continue to follow their independent judgment and not make investment decisions based solely on a single source of information. Futbull will not bear any responsibility for any losses incurred by investors who invest based on this content.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.moomoo.com/017y9J) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Futubull does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.