Practical tools guide, helping you invest efficiently.

Performance exceeds expectations: identifying high-quality companies one step ahead.

What is performance exceeding expectations?

Before the performance season arrives, the market is usually filled with various analyses and discussions about performance data. Professional financial analysts use various factors, such as the company's historical performance, disclosed performance guidance, market trends, and industry dynamics, to predict the performance data of some popular companies, forming market expectations.

When a company's performance is released, if its data exceeds analysts' expectations, it is called "performance exceeding expectations". Conversely, if it is lower than analysts' expectations, it is called "below expectations". During the performance season, these two situations are important factors that affect stock prices in the short term, which may have positive or negative effects on stock prices and are among the messages that investors need to pay attention to.

What are the benefits for investors?

Identify high-quality companies: help investors quickly find companies with excellent performance during the performance season, thus seizing investment opportunities.

Seize market volatility opportunities: use the market volatility opportunities brought by performance exceeding expectations to improve investment decision-making and increase investment return on investment.

How to use the performance exceeding expectations function on Futubull?

Usage process:

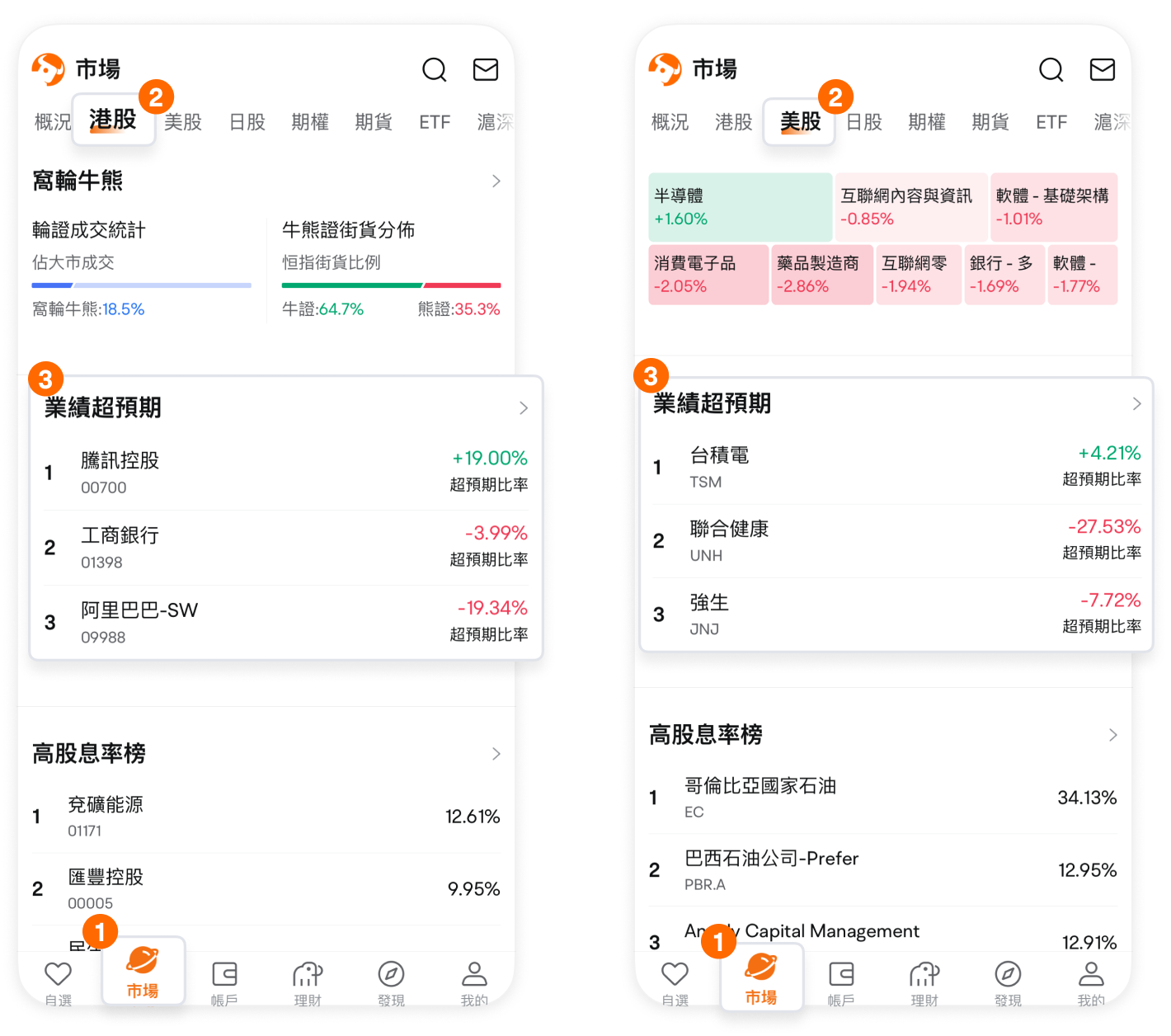

Markets> market tabs such as HK and US > Earnings Beat. The performance exceeding expectations data under each market tag only displays stocks of that market.

On the overview page, the performance exceeding expectations percentage of the top 3 market cap stocks in the current market is displayed first. If the percentage is a positive number, it indicates the percentage exceeding expectations; if the percentage is a negative number, it indicates the percentage below expectations. After each new performance release, the exceeding expectations data will be updated immediately.

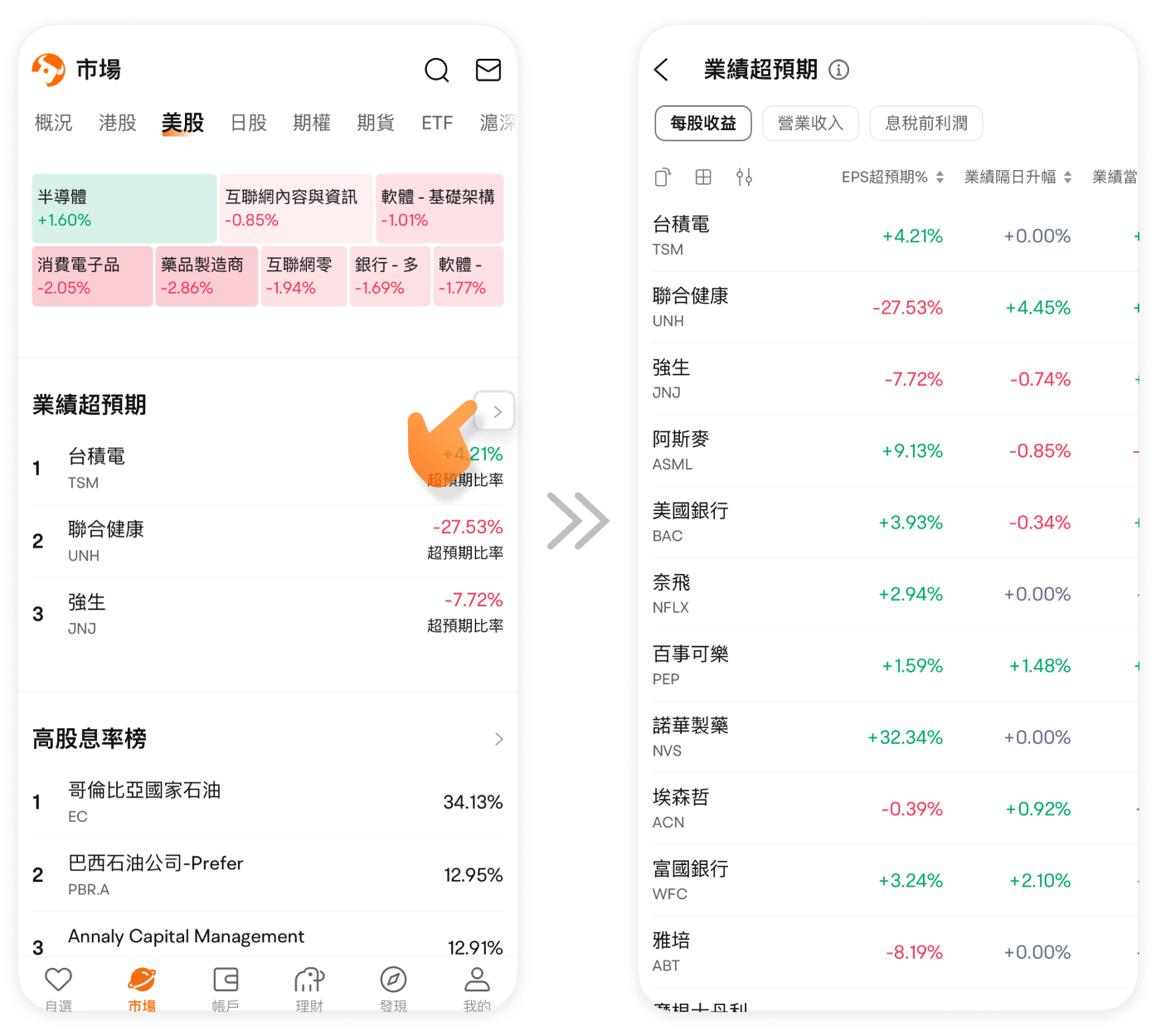

Click on the right arrow icon to enter the details page and view more individual stock lists. The individual stock list is sorted by market cap by default. Click on the small triangle symbol next to the corresponding column to reorder (the performance cycle column does not support sorting).

Interpretation page:

After entering the details page, there are three options at the top of the page: earnings per share (EPS), Revenue, and earnings before interest and taxes (EBIT). Click the corresponding option to view the exceeding expectations data.

In addition to the exceeding expectations ratio, Futubull also provides rich data for your reference. Swipe left and right or use landscape mode to view more data to help you gain more comprehensive understanding and comparison. For example, you can view Release Day Chg/Next Day Chg to grasp the percentage changes in stock prices on the day and the next day of the performance release, where positive number indicates an increase, and a negative number indicates a decrease.

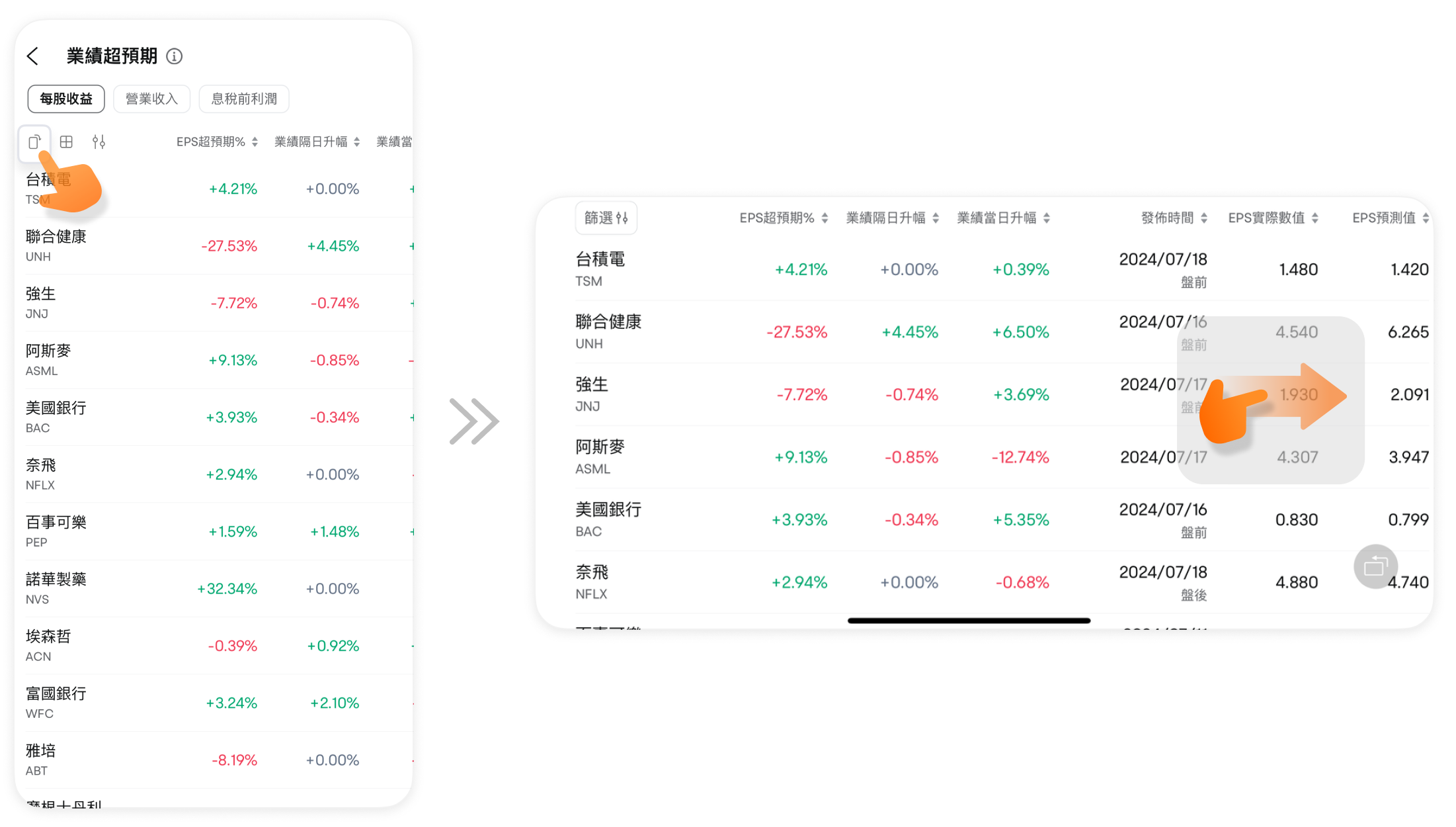

Multiple stocks in parallel:

Support viewing the data such as the tick chart of multiple stocks on the same interface. By comparing the trends of multiple stocks on the same interface, you can have a clearer understanding of the differences between different stocks.

Filter function:

Click on the filter to pop up multiple filter options, including Release Date, Earnings Period, Market Cap, Price, P/E TTM, Beat%. You can narrow the viewing range by setting the filter options to more effectively locate the individual stock performance data you need.

Case study

We will use a case study to learn how to use this function.

In performance data, what the market often focuses on first is earnings per share (EPS), as it represents the company's level of net profit. When a company's EPS is far higher than the market's expectations, it usually indicates strong business performance, often driving short-term stock price increases and boosting long-term investor confidence. To quickly see which high-quality stocks have EPS that exceed expectations in the market, you can use the Better-than-Expected feature.

Enter the Earnings Beat>EPS interface. To search more effectively, we use the filter directly and filter based on the following criteria as an example:

1. Select companies that have released earnings in the past 30 days.

2. If you only want to see high-priced stocks, you can set the market cap range to between 10 billion and 100 billion US dollars.

3. Choose quarterly reports as the cycle.

4. Set the Beat% to be greater than 50%.

Other options can be kept at their default settings. After setting is done, click the 'Confirm' button and the system will filter out a list of stocks whose EPS far exceeds expectations.

It should be noted that sometimes even if a company publishes outstanding performance, its stock price may still fall. This is often because investors consider not only revenue, but also other factors. Therefore, it is necessary to combine fundamental analysis, technical analysis, and other various data to make more wise investment decisions.