Become the strongest newcomer to draw new shares in Hong Kong stocks

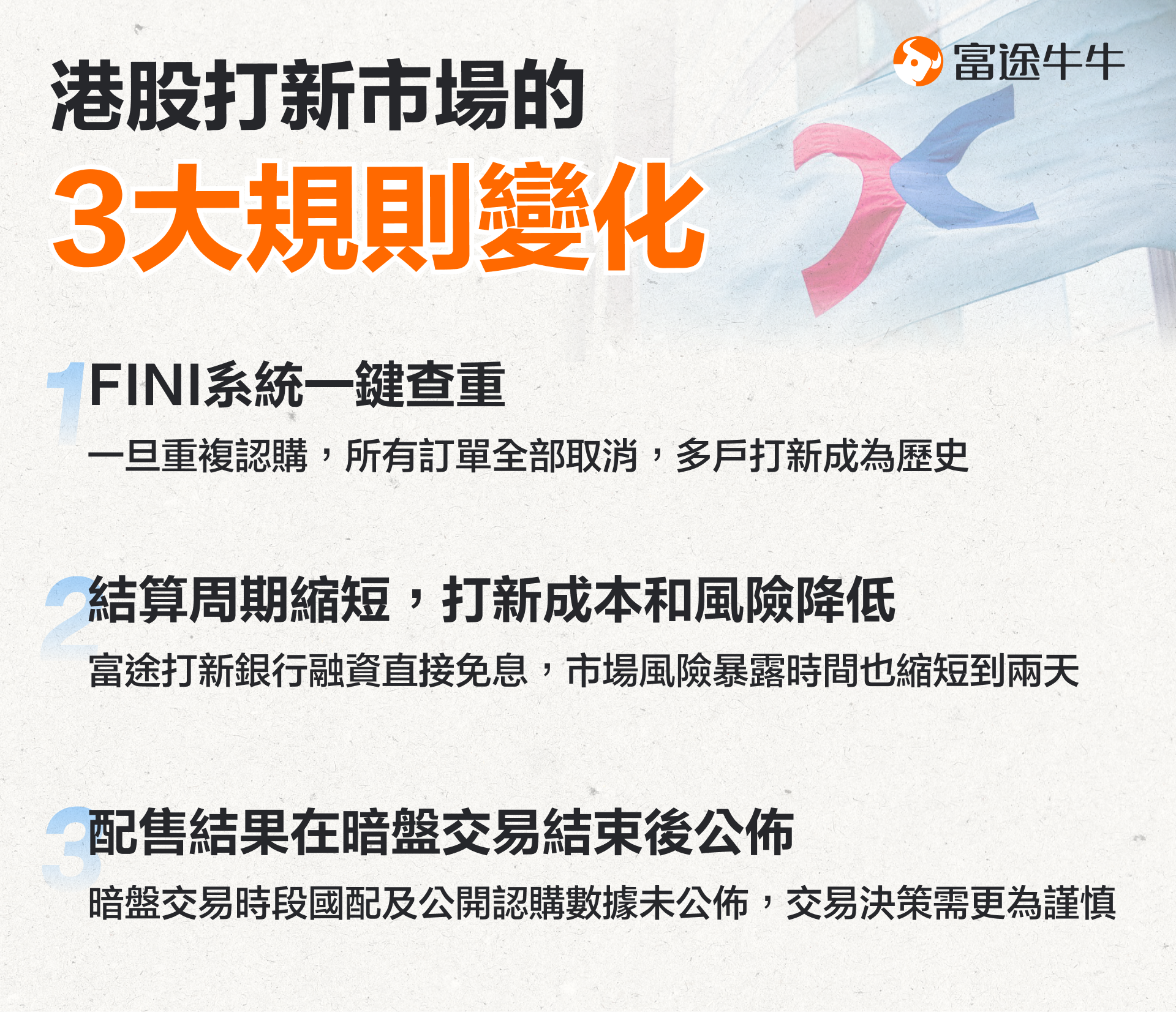

The return of the Hong Kong stock market's new stock lottery for making money is here! Do you know all these three important rule changes?

Since entering 2024, the Hong Kong stock market's new listing market has clearly warmed up. Out of the 21 new listings in the first five months of 2024, most have risen, with an average increase of 23.6%.

UBS Holding, which went public in early June, has further fueled the enthusiasm of Hong Kong's new listing market to a new high. As the first GEM new stock to be listed on the Hong Kong Stock Exchange in three years, it has been extremely popular with market funds, with an oversubscription ratio of up to 2503 times, becoming the "over-subscription king" of Hong Kong's new listing market in nearly three years. Its market performance has also lived up to expectations, as Futu's dark pool opened at one point surged to 160%.

The profitability effect of the Hong Kong stock market's new listings market is evident, allowing many seasoned new listing investors to reopen long-lost memories of the bull market in new listings, and enticing many novice investors to eagerly join the ranks of new listings.

I know you may be in a hurry, but don't rush just yet. There have been three important rule changes in the Hong Kong new listing market, which even some seasoned new listing investors may not fully know. However, it is very necessary for you to understand them clearly, otherwise falling into pitfalls and losing money could be a matter of minutes. What are these three changes?

The first point is the historical exit of multiple account new listings.

If investors apply for the same new stock through different brokerages, that is considered multiple account new listings. Multiple account new listings have never been allowed in the past, but checking for duplicates in multiple applications was technically challenging. Therefore, just like how traffic lights cannot completely prevent pedestrians from running red lights, multiple account new listings objectively existed in the past.

However, in November 2023, the Hong Kong Stock Exchange launched the New Stock Issue Electronic Settlement System (FINI system), which made checking for duplicates in multiple accounts very simple. Because it can ensure that all duplicate subscription orders do not enter the new stock draw and settlement process.

In other words, regardless of how many brokerages investors subscribe to the same new stock, all subscription orders will be declared invalid, note that it is 【all】, without keeping any of the orders for investors, so don't be hoping for luck.

This means that the involvement of multiple accounts in new share subscription has actually exited the historical stage.

Secondly, the shortened settlement period reduces the cost of new share subscription and market risks.

The FINI system not only eliminates multi-account participation technically, but also significantly shortens the new stock settlement process. Previously, from the end of Hong Kong IPO subscription to listing, it took 5 trading days. During this time, the subscription funds of new share subscribers were not only occupied, but also had to endure up to 5 days of market fluctuations, thus increasing the risk of new share subscription. However, after the FINI system went online, this process was shortened to two trading days as shown in the specific diagram below.

However, after the FINI system went online, this process was shortened to two trading days as shown in the specific diagram below.

(1) The IPO subscription period remains unchanged, usually still 3.5 working days.

(2) Before the new stock pricing was generally on the day the subscription ended, it is now changed to the day after the subscription deadline (T-1), and the pricing date is defined as T day.

(3) The day after the pricing date, which is one working day after T day, is the grey market, and the next working day, T+2, is the official listing day.

The shortened IPO settlement process brings two major benefits.

The first benefit is a significant saving on bank financing interest. Previously, investors who financed new shares needed to pay interest for about 6 days, with an average interest cost of over 3000 Hong Kong dollars when applying for a group B lot.

Now, due to the shorter settlement period, the interest calculation period can be as short as one day. Futu even offers customers a special policy of interest-free bank financing, meaning that when customers subscribe to new shares through Futu, even for a large amount of tens of millions or even hundreds of millions through bank financing, they do not have to pay a penny in interest! It can be said to be the ceiling of saving money when subscribing for new shares.

The second benefit is to reduce the risk of subscribing for new shares. This is easy to understand; from the closing time of the IPO to the time when grey market trading is available, the period has been reduced from the previous 5 trading days to two trading days, significantly reducing market risk exposure by half. Investors can focus more on the risk of the new shares themselves, rather than market risks.

The third point, grey market trading comes with the attribute of a blind box.

Before the FINI system was launched, the allocation results of new shares were usually announced early in the morning of the grey market trading day. The allocation results contain some important information that greatly affects the grey market performance of new shares and investors' trading decisions.

This information mainly includes the public offering subscription multiple, winning rate and number of applicants in each subscription tier; international allocation subscription multiple, details of additional shares (greenshoe) allocation, and so on.

For example, if the international allocation is very hot, or there are a large number of subscribers for the top lot, it means that institutions or large fund investors are very bullish on the new shares, which in turn is bullish for the grey market performance of the new shares.

After the FINI system was launched, the announcement of new share allocation results changed to the evening of the grey market trading closing day. As for the public offering multiple and winning rate, investors can still infer from the brokerage's early announcement of the winning results, which is more or less the same. However, for crucial information like the international allocation subscription situation, investors can no longer obtain this information in advance from public sources, it's a bit like opening a blind box.

Taking the example of Chabadao, a new stock listed at the end of April 2024, this new stock dropped by about 13% in the dark market on April 22nd. Some investors may believe that the over-allotment option will support the stock on the first day of listing, thereby reducing the initial drop. Therefore, these investors may tend to buy on the dip in the dark market.

However, in reality, the allocation results announced on the evening of Chabadao's dark trading show that its domestic allocation multiple is only 1.11 times, with an excess stock ratio of only about 2.1%. The Bid support from the overallotment option is very limited. On the first day of listing, April 23rd, Chabadao's decline further expanded on the basis of the dark market, with the maximum intraday decline reaching 38% and closing down by about 27%. Investors who bet on the over-allotment option in the dark market may suffer significant losses.

Therefore, since the allocation results were not disclosed in advance, investors may need to be more cautious when making decisions in dark trading.

In conclusion,

Currently, the Hong Kong IPO market has rebounded significantly, with a noticeable effect on earnings. However, investors need to pay attention to three major changes in rules before entering the market.

Firstly, multiple subscriptions will be cross-referenced. Investors should not harbor any illusions to avoid missing potential lottery wins and profit opportunities, as well as wasting interest and handling fees.

Secondly, the settlement period has been shortened, significantly reducing interest costs for new share subscriptions and market risks. Futu's new share bank financing is interest-free, while the waiting time from IPO to dark market trading has been reduced to two trading days.

Thirdly, allocation results are only disclosed after the dark market trading ends. Missing some important domestic allocation and public subscription data in dark market trading requires more cautious decision-making in trading.