Explore investment opportunities from 13F

Understand the investment strategy of the organization

In the previous section, we introduced what 13F is.

Investors can use the 13F report to observe the portfolios of top Wall Street institutions and the changes in their positions from quarter to quarter, so as to gain some investment inspiration and learn the investment strategies of investment masters.

However, thousands of institutions submit 13F reports to the SEC every quarter. Which reports deserve our attention?

First of all, we need to understand the investment strategy of the organization.

Institutions have different investment strategies, and they trade stocks and build portfolios in different ways.

The top 20 hedge funds under management are listed above, full of star institutions we are familiar with, such as Dario's Bridge Water Fund and Simmons's Renaissance Fund.

So shall we just follow them to buy it?

Of course not. The reason is simple. There are many kinds of hedge funds, and their investment strategies are completely different.

Here are some common hedge fund investment strategies:

● stock long-short strategy (Long/Short Equity): long and short different stocks at the same time. Or hold net long or net short at the same time.

● stock market neutrality (Market Neutral): buy undervalued stocks and sell overvalued stocks at the same time, profiting from market failures.

● event-driven strategy (Event Driven): captures price fluctuations caused by events that are expected to occur.

● Global Macro (Global Macro): capture investment opportunities by analyzing the impact of macroeconomic trends on interest rates, currencies, commodities and stocks around the world.

● quantitative strategy (Quantitative): through mathematical models to establish investment strategies, so as to capture investment opportunities.

Only by understanding the investment strategy of the organization can we better analyze the 13F report.

Due to the different investment strategies used by institutions, the information in their 13F reports is not necessarily valuable.

As we mentioned earlier, there are two deficiencies in the 13F report:

1. Lack of information: 13F report only includes long positions of institutions, such as stocks and Call/Put options. But short positions are not included in the report. Therefore, 13F can not reflect the overall investment strategy of the organization.

2. Time lag: because the deadline for submitting 13F reports is 45 days after the end of each quarter, and many institutions do not submit reports until the due date in order to prevent the market from snooping into their positions, the data are lagging behind.

These two factors lead to the fact that not all 13F position reports are referential and sometimes even misleading.

For example, the Renaissance Fund just mentioned is famous for its quantitative transactions. One of the characteristics of quantitative funds is that the frequency of trading stocks is higher than that of value-based funds.

In other words, the 13F report of a quantitative fund is usually lagging behind, and by the time you see the Renaissance stock position, it may have already been sold.

So are there any techniques that can help investors pick reports that are worth watching?

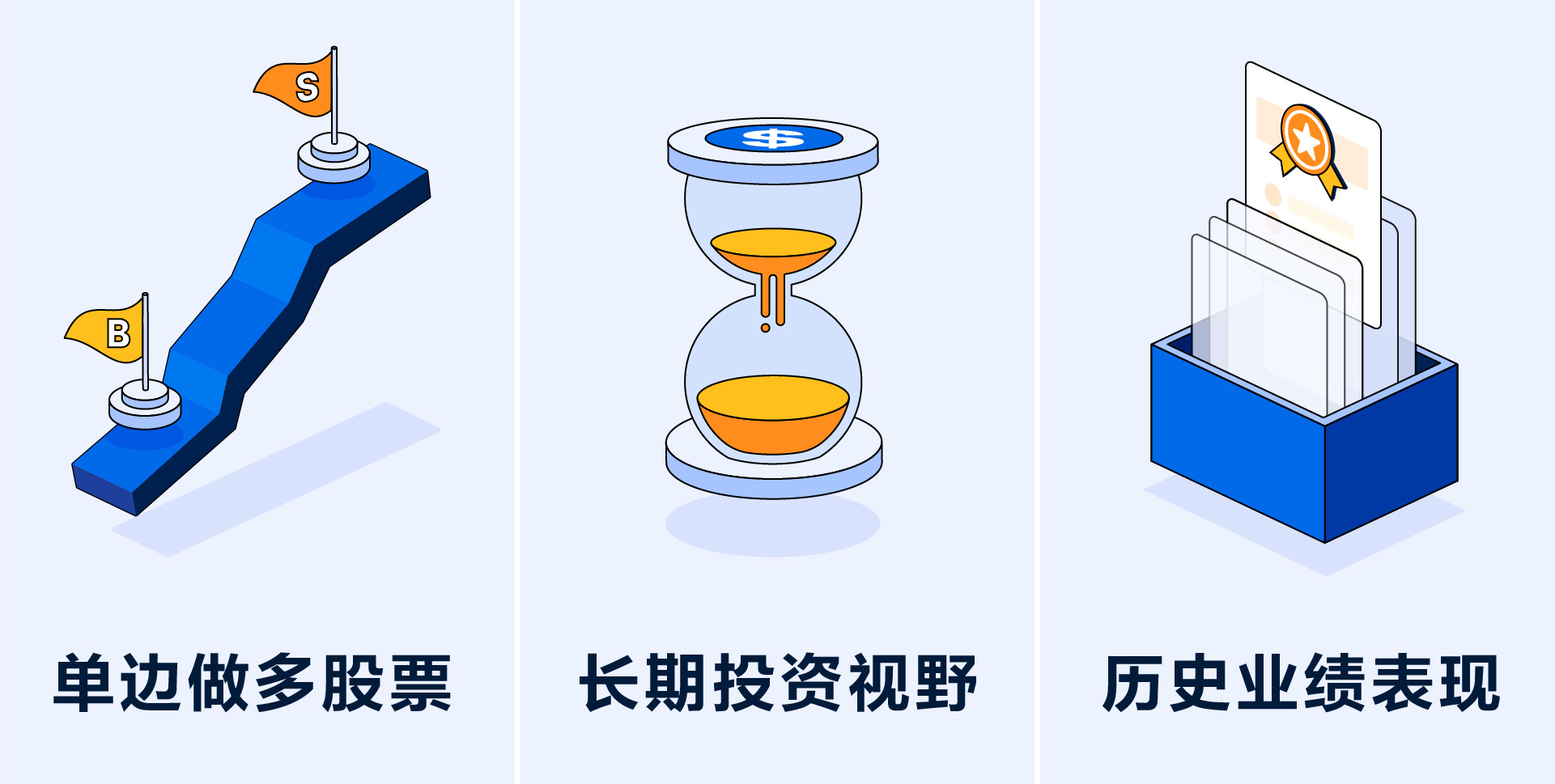

To find 13F reports of research value, you can focus on institutions with the following three characteristics:

● long stocks: institutions that use this investment strategy rely on their long positions for investment returns, so even if they do not disclose their short positions, it does not affect the research value of their long positions.

● long-term investment vision: such institutions are characterized by relatively long positions, usually 5 to 10 years, or more. As a result, they trade stocks very frequently, solving the problem of lag in 13F data.

● historical performance: focus on institutions with good performance for many years. If an institution goes through a bull-bear cycle and can maintain a good performance, it shows that its investment strategy has been relatively successful in the past and is worth learning from.

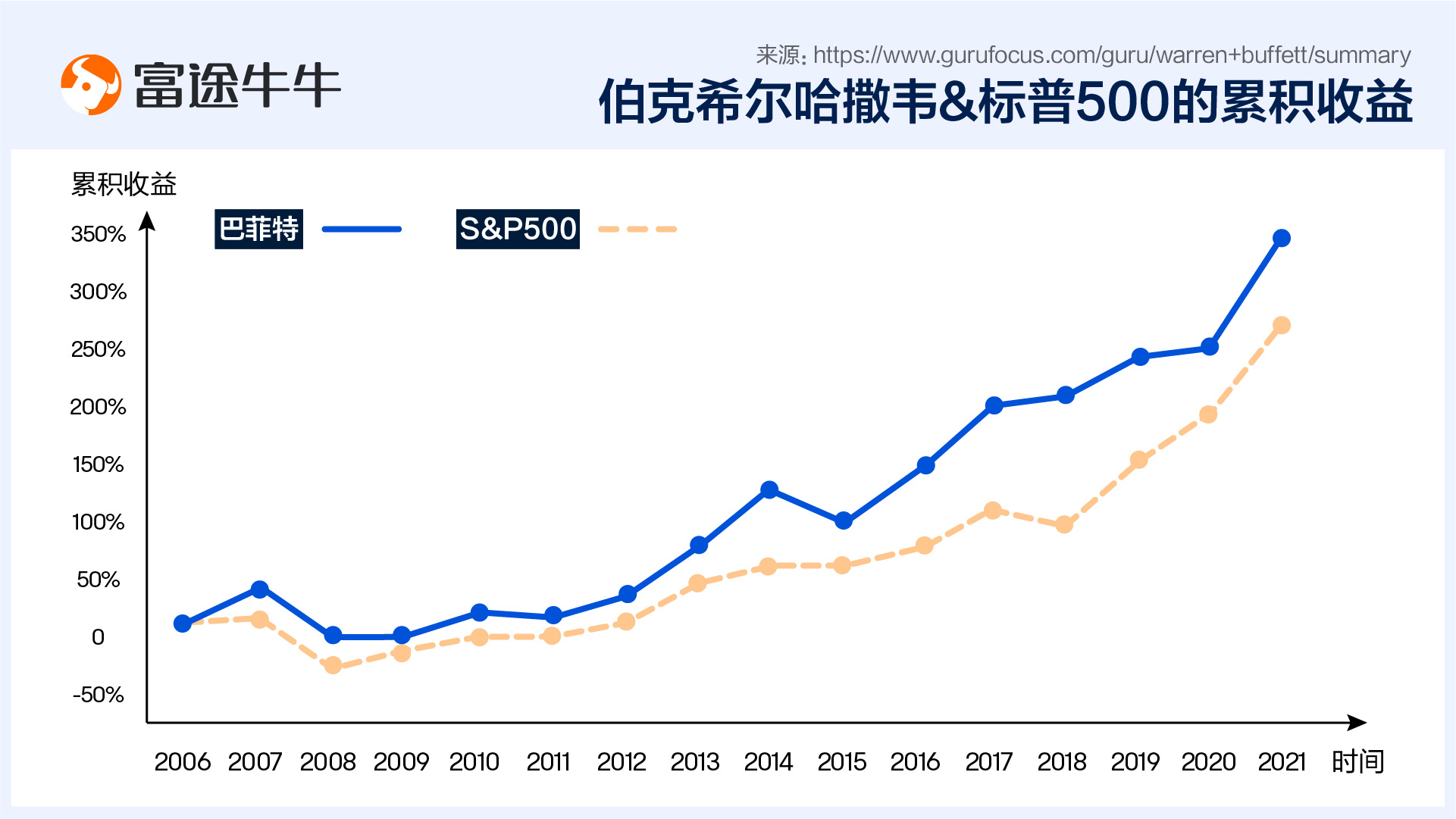

Which institutions meet the above three characteristics? Buffett's Berkshire Hathaway may be a good example.

Buffett is a famous value investor whose investment strategy is to find good undervalued companies, buy and hold them for a long time. Therefore, his organization meets the characteristics of unilateral long-term and long-term vision.

In terms of historical performance, Berkshire Hathaway's cumulative return of 309 per cent (9.85 per cent annualised) over the past 15 years (2007-2021) is higher than the 236 per cent annualised return of the S & P 500 (8.41 per cent). This shows that Buffett has outperformed the market in the past 15 years.

If you are a value investor and advocate long-term holdings, you should be interested in Buffett's portfolio positions.

Finally, it is important to emphasize that even the best fund managers make mistakes. So don't copy their portfolios directly. Instead, you should take an in-depth study of their portfolio of stocks and the fundamentals of the company, and then decide whether they are worth buying.

Summary

Before analyzing the 13F report, you should first understand the investment strategy of the organization.

You can give priority to institutions with the following three characteristics, namely, long-term, long-term vision and good performance.

We already know how to find reports with research value, so how should we analyze them?

Let's continue our conversation in the next section.