Make good use of tools in options trading

Volatility Analysis: Volatility Term Structure、Volatility Smile

When trading an option strategy that involves multiple options, consider analyzing the differences between their implied volatility.

Find volatility analysis of multiple option contracts on Futubull

Step 1: Tap on a stock > Options > Analysis

Step 2: On the Options Analysis page, scroll down and find Volatility Term Structure / Volatility Smile

① Analyzing the Volatility Term Structure can be a useful tool when developing investment strategies.

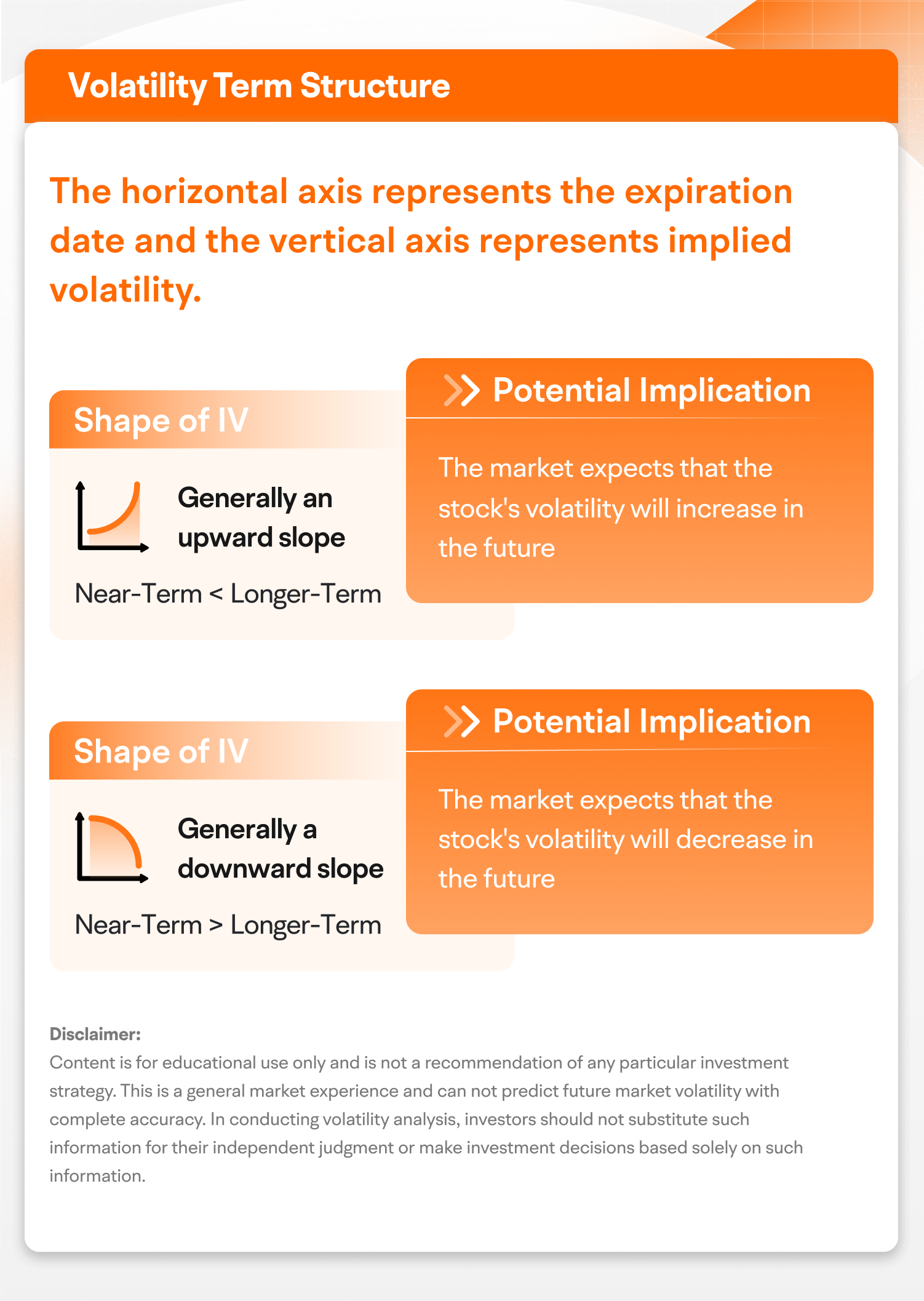

The volatility term structure refers to the different implied volatility of options on the same underlying asset but with different expiration dates, usually expressed as a curve.

There are two types of volatility term structures.

One is the contango structure, shown as the curve sloping upward. This structure suggests that the implied volatility of near-term options is lower than that of longer-term options. In other words, this structure implies that the market expects volatility to rise in the future.

The other type is the backwardation structure, shown as the curve sloping downward. This structure suggests that the implied volatility of near-term options is higher than that of longer-term options. In other words, the backwardation structure implies that the market expects volatility to fall in the future.

After analyzing the volatility term structure, you might identify a noticeable difference between the implied volatility of options with the same strike price but different expiration dates.

Thus, it could inform potential option strategies, such as calendar spreads, that align with anticipated changes in implied volatility over time.

② Analyzing the Volatility Smile Pattern can be a useful tool when developing investment strategies

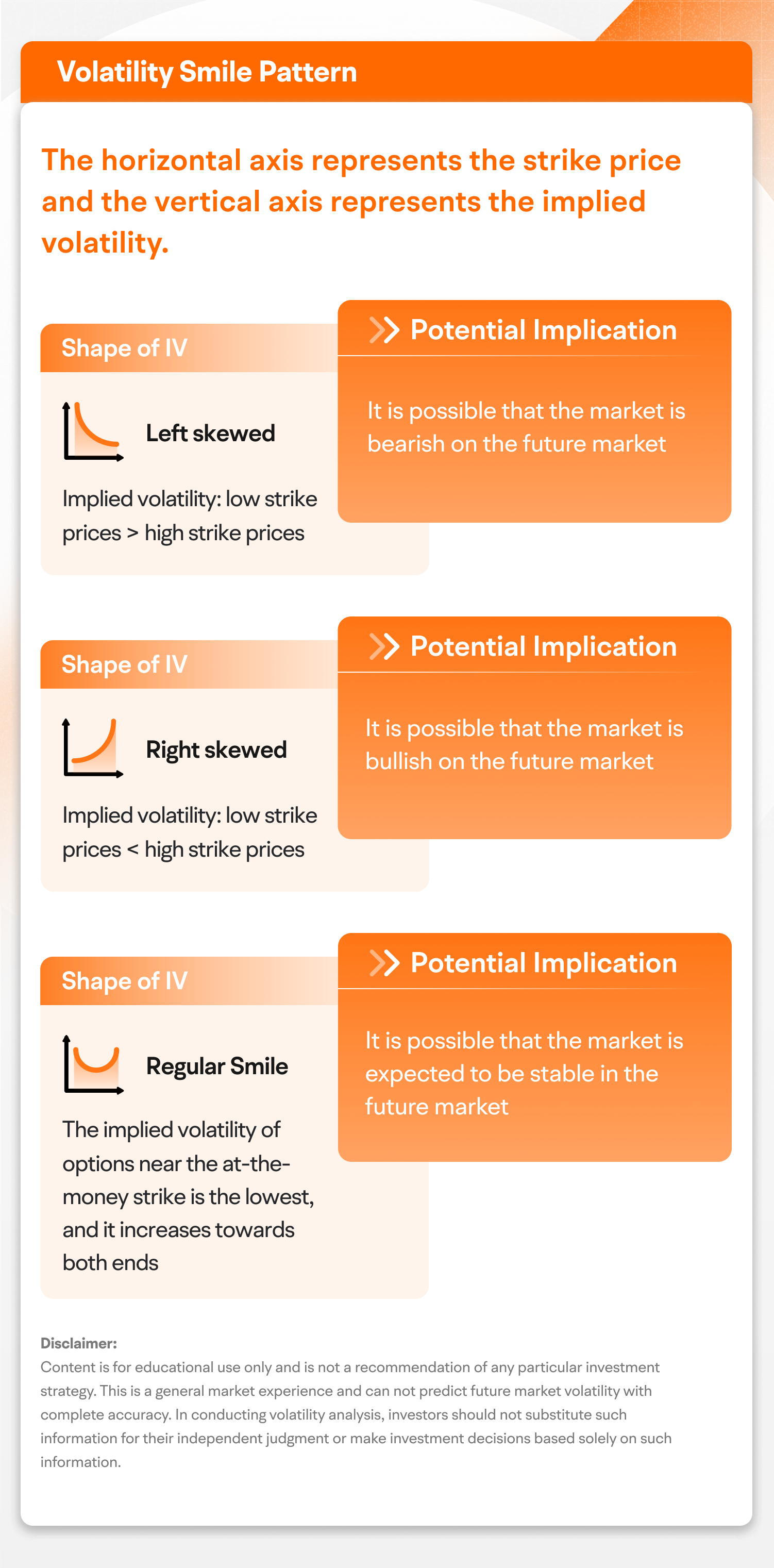

Volatility Smile refers to the implied volatility curve of options on the same expiration date.

The implied volatility corresponding to different strike prices are different, showing a smile-like shape.

Generally speaking, one of the major reasons for the formation of the volatility smile is the supply and demand of options with different strike prices in the market.

There are three types of implied volatility smile patterns: left skew, right skew, and smile.

By examining the implied volatility levels of options with different strike prices but the same expiration date, you could construct a vertical spread strategy that aligns with your outlook.

That's what today's lesson is all about. If you want to learn more about options, please follow [Futubull Options Sir] for timely updates!