Investment guru “step by step” teaches you to choose stocks

What is the successful stock selection method for the author of “Walking Wall Street”?

Burton G. Malkiel's experiences and ideas

Have you heard of the book “Walking Wall Street”? It was first published in 1973. Following Benjamin Graham's “The Smart Investor,” it is another very classic and best-selling introduction to financial investment. It is also used as a must-read bibliography and teaching book for some colleges.

This book covers investment categories such as money markets, funds, stocks, bonds, gold, derivatives, etc., and talks about famous investment bubbles and speculative frenzy in history. It also explains fundamental analysis and technical analysis methods, and provides comprehensive investment strategies, as well as content and guidelines on behavioral finance, portfolio construction, and life cycle investment. The coverage is very broad, and the text is in-depth, combining theory with practice.

The author of this book is Burton G. Malkiel (Burton G. Malkiel), and he's not easy!

Burton is not only an investment celebrity and investment master, but also an accomplished scholar and a famous economics professor in the US. After completing his undergraduate degree and MBA at Harvard University, he began a trip to Wall Street and went to work in an investment bank. However, due to his interest in academic research, he later obtained a doctorate degree in economics from Princeton University and stayed at the university to teach.

Therefore, whether in the investment industry or academia, he has a very prominent figure. In the investment industry, he was the chairman of the American Finance Association and received lifetime achievement awards from professional investment organizations. He also served on the US President's Economic Advisory Committee and the boards of directors of various companies (including Prudential Life and Pioneer Group). In academia, he has worked at various universities, was the chairman of the Princeton University Financial Research Center, dean of the Yale School of Management, and is currently a professor at Princeton University.

What kind of investment philosophy does Burton, who has a dual role, experience, and aura, have?

He supports the random walk theory (Random Walk) and believes that short-term fluctuations in stock prices cannot be predicted. Not only is there a fundamental analysis, but there is no technical strategy that can stand the test of the market all the time.

As for how to walk around Wall Street, he thinks there are three ways: the “easy walking method”, the “hands-on walking method”, and the “walking method using a stand-in.”

The first method is to buy a broad range of index funds. This is the strategy he is most willing to recommend because he doesn't believe that personal active investment can beat the average index.

The second method is to select stocks himself. Although he feels that he personally cannot beat the market, he also understands everyone's “can't stop” winning the market and the hobbies he experienced in it, so for the second method, he also shared the 4 rules for successful stock selection (which will be explained below) to help investors reduce risk.

The third method is to choose a professional investment manager to invest for you. This is a relatively compromise method.

Burton G. Malkiel's stock selection rules

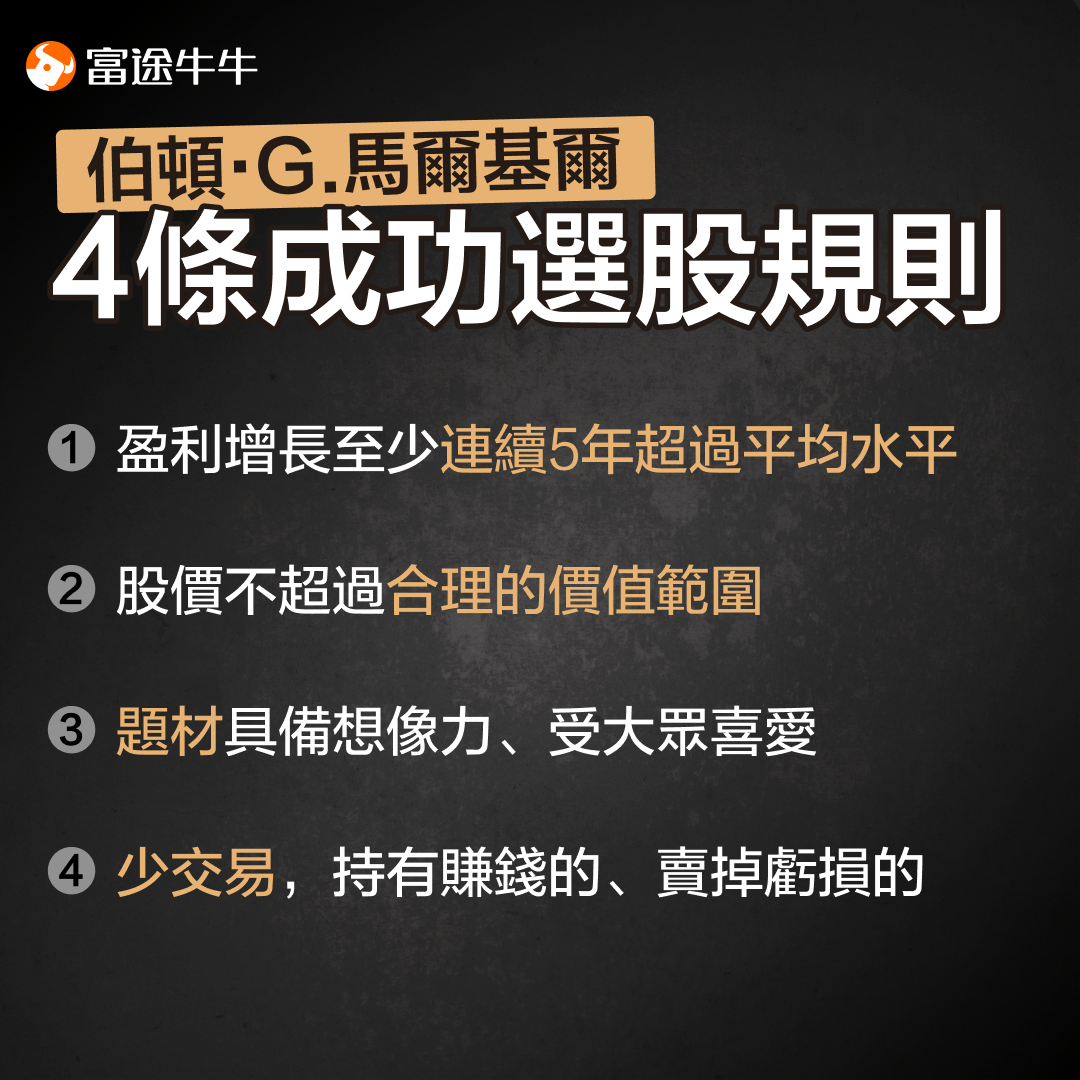

As mentioned earlier, Burton shared 4 rules for successful stock selection in response to the “Personal Walking Method,” but what exactly are they?

1. Profit growth has been above average for at least 5 consecutive years.

Such companies are hard to find, but not only are they growing rapidly in terms of profit, but the price-earnings ratio that the market is willing to accept is also likely to increase.

2. The price of a stock does not exceed what can reasonably be explained by its solid underlying value.

You should buy stocks with a price-earnings ratio equal to or slightly higher than the price-earnings ratio of the entire market. Of course, this is not absolute. If the company's future profit growth far exceeds the average, then it is reasonable for the price-earnings ratio to be slightly higher than the market average. At the same time, it is also necessary to look for promising stocks that have not been discovered by the market, so their prices have not been pushed up. In other words, this refers to growth stocks that have relatively low price-earnings ratios and have not been discovered by the public.

3. Investors can build a skyscraper on top of their anticipated growth story.

It sounds a bit obscene; in fact, I'm talking about whether the subject and story of this stock is imaginative and whether it is loved by the public. Because investors are also emotional animals and are driven by their own emotions, shareholders' psychological factors play a very important role in stock prices.

4. Trade as few as possible.

Malkiel recommended not to exchange shares frequently, as it would increase your own tax burden. He is in favor of “continuing to hold profitable stocks and discard stocks that have lost money”, especially when decisive action brings tax benefits, and that loss-making stocks should be sold. Of course, this is an exception if growth stocks that are already floating and profitable are priced too high and weigh too much in the portfolio.

Summarizing, these four Malkiel rules relate to the company's profitability and growth, market valuation level, conceptual subject matter, and transaction frequency.

Regarding the frequency of trading, it's actually more like position management advice rather than stock selection criteria, but I'm guessing that Malkiel might think this is about choosing what stocks to buy or sell, so he also listed it here.

If stocks are selected according to the first three rules, the selected stocks are probably those that are relatively growing, reasonably priced, and have room for imagination and market popularity.

How do we apply these rules?

So how are these Marquille's stock selection rules helpful to our practical application? Let's first try quantifying the first two rules.

1. Regarding profit growth, it is difficult for us to compare data on the surplus growth rate for 5 consecutive years in the initial screening stage, but here we will try to make some adjustments. For example, we can at least see which companies meet an annual net profit growth rate of ≥0. Of course, this is much weaker than his rules, and the stricter rules can be applied in the next screening.

2. Regarding the price-earnings ratio, according to Malkiel's rules, there is no specific numerical limit; it is more about comparing it horizontally with the market and comparing it with one's own profit growth.

In comparison with the market, for example, we can select companies with PE (price-earnings ratio) ranking 1-100 in the industry.

In comparison to its own profit growth, there is one indicator that may help; it is PEG. PEG = price-earnings ratio/annualized profit growth rate. Regarding this indicator, the common saying is that PEG ≤ 1 is usually better.

The specific quantification above only provides an example, is for teaching purposes only, and does not represent any investment advice. Everyone can quantify according to their own circumstances and with their own standards.

What else can be done in specific practical terms?

OK, so how do we practice using the Futubull and Bull Stock Selector?

Of the above three criteria, we can directly use the first two for screening, and the last one we can't use directly yet, so let's try to adjust it again.

For example, if we look at valuation scores, it's also a way to compare ourselves. For example, we can select stocks with a valuation score of less than 70% in the past 3 years. Of course, this is just an example; you can make other adjustments as well.

After the previous three steps, we selected more than 7,000 US stocks to the remaining 1,056 (according to data from August 30, 2023). Of course, this amount is not small.

At this time, don't forget Burton's third rule on conceptual topics. This can be directly screened on the Futubull and Bull Stock Selector. I'm not going to use an example here, because it has to do with your imaginative, beloved understanding and judgment of what subject matter you have.

If you value two or three of these concepts in particular, then in fact, the number of individual shares obtained after screening may be very small. On this basis, plus some of your own standards on fundamentals, technology, capital, etc., it should not be difficult to select the individual stocks you want.

*Note: The images displayed on the screen are for illustrative purposes only and do not constitute any investment offer or guarantee.

Today's content isn't meant to be investment advice, but I hope it will inspire you. Do you have any thoughts after reading it? Welcome to leave a message and share.