What are support levels and pressure levels?

Key takeaways

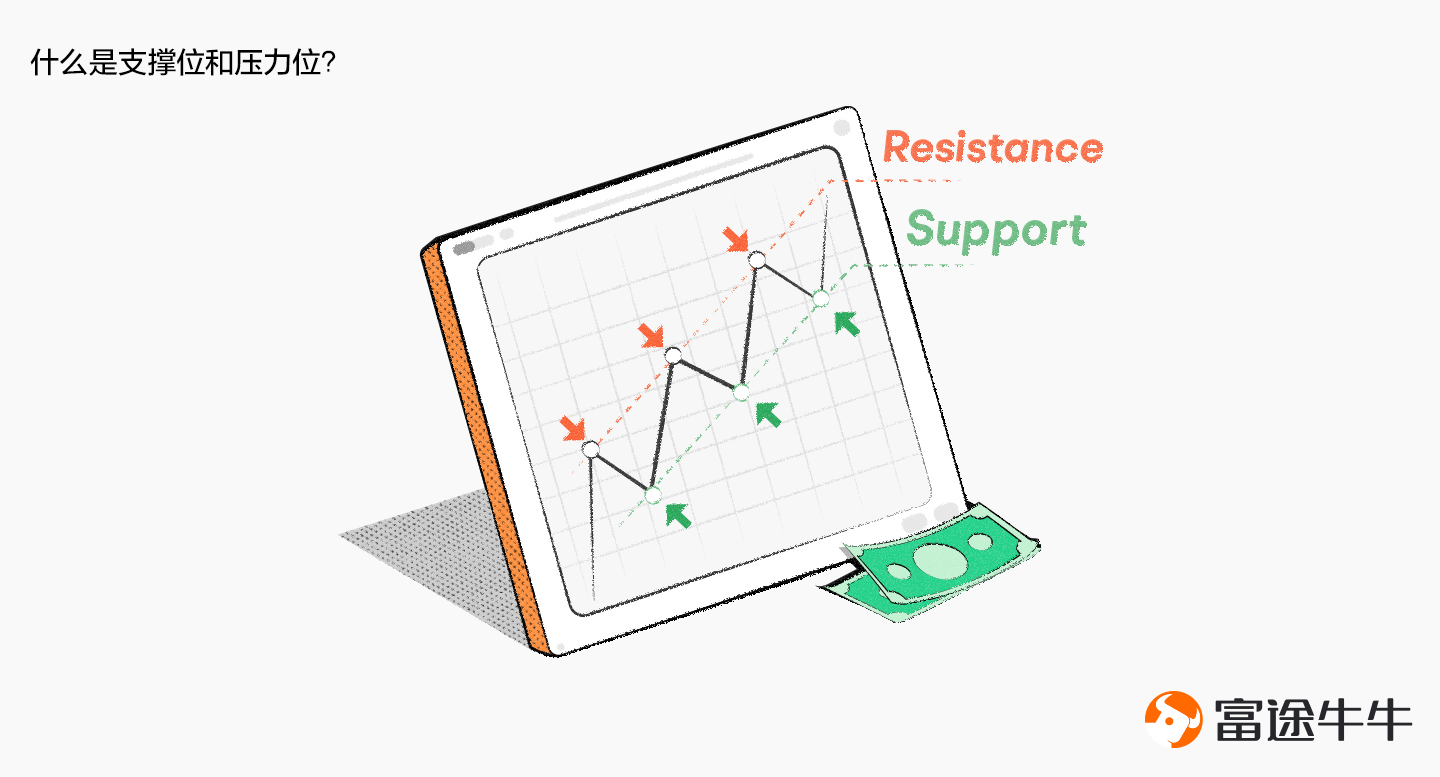

Support level refers to the potential support encountered during the stock price decline process, leading to the price stabilizing and rebounding.

Resistance level refers to the resistance encountered during the stock price rise process, leading to price reversal and decline.

Determining support and resistance levels can be based on three factors: historical price data, previous support and resistance levels, and technical indicators.

Conceptual Understanding

Support and resistance levels are commonly used concepts in stock market technical analysis.

Support level is the potential support encountered during the stock price decline process, leading to the price stabilizing and rebounding.

Resistance level, also known as resistance level, refers to the resistance encountered during the stock price rise process, leading to price reversal and decline.

Support and resistance levels generally have the following situations:

First, in the moving average system, such as the upper resistance level and lower support level in the arrangement of 5-day moving average, 10-day moving average, 20-day moving average;

Second, analyzing the intraday trend, the high and low points of the day's market form the upper resistance level and lower support level;

Third, the appearance of a gap, with upward and downward gaps forming support and resistance for gap filling;

Fourth, when an upward or downward channel has been formed, there are upper resistance levels and lower support levels.

How to determine support and resistance levels

When determining support and resistance levels, there are several factors that can be used as references: first, historical price data, second, the previous positions of support and resistance levels, third, technical indicators.

In the moving average system, the closest moving average above the highest price of a candlestick is the short-term resistance level of a stock, and the closest moving average below the lowest price of a candlestick is the short-term support level. Breaking through the resistance level with volume indicates strength, while breaking through the support level with volume indicates weakness.

In the intraday trend, the opening price, closing price, highest price, and lowest price will all form corresponding short-term support and resistance. For intraday traders, adjusting the observation period to the minute level can determine the corresponding resistance and support levels.

If a gap appears, both the upper and lower edges of the gap will form a certain support and resistance.

In the trend where an ascending channel or descending channel has been formed, the connecting lines of the phase high points and phase low points can be considered as resistance or support levels.

Summary:

Support and resistance analysis is one of the basic operations of stock market entry strategies, which can be used for managing profit-taking and stop-loss settings, determining entry and exit points, etc. However, there are many factors affecting stock price changes, and support and resistance levels are often breached. Therefore, when determining their effectiveness, it is necessary to combine specific market analysis with the overall market situation.

To learn more, you can click on the following course:"Seeking Support and Resistance: How to Improve Trading Success?"。