What is fund rsp?

Key Points

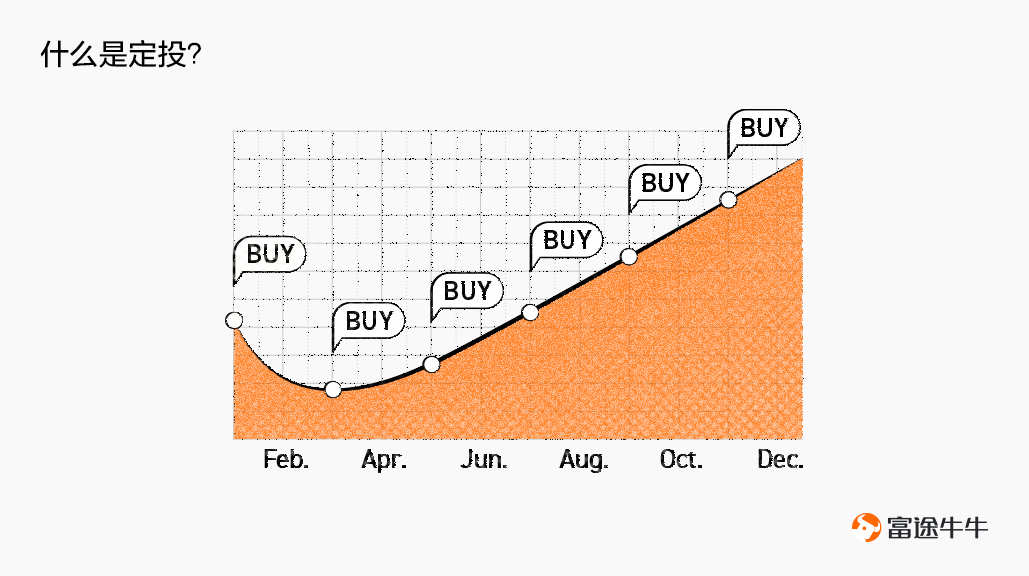

Fund regular investment refers to investing a fixed amount into a fixed fund at a fixed frequency.

Regular investments are suitable for moonlighters, office workers, novice investors, those with low risk preferences, or those with future special financial needs.

Regular investments can average out costs, smooth risks, alleviate timing worries, but are more suitable for downturns and volatile market conditions.

Not all funds are suitable for regular investments, planning, long-term investment, utilizing strategies, and learning when to take profits are necessary for regular investments.

Concept Explanation

What is regular investment? It is to regularly invest a fixed amount into fixed assets, paying social security contributions is a form of regular investment. What about fund Regular Investment? It refers to investing a fixed amount into a fixed fund at a fixed frequency.

Regular investments can help moonlighters accumulate wealth, save time and effort for office workers, and help novice investors control emotions like greed and fear.

Because rsp can smooth out risks and pursue average returns, it is also suitable for people with lower risk preferences and those with specific financial needs in the future, such as retirement.

Rsp smoothes out risks.

"It's harder to accurately time the market than to catch a falling knife in mid-air." Everyone wants to buy low and sell high, but no one can accurately predict the highs and lows.

To avoid stepping in at the wrong time with a lump sum investment, you can use rsp to average out costs and smooth risks. Moreover, when the fund is down, the same amount can buy more units, and vice versa when it goes up, so rsp can automatically sell high and buy low.

Therefore, as long as the selected funds grow overall, investors can achieve relatively average returns, reducing the worries of market timing. But rsp does not necessarily make more money, it performs better in downturns and volatile markets.

If there is a dip followed by a rise in rsp, it will form a "smile curve". In this scenario, assuming Investor A only invests 40,000 yuan at the beginning, while Investor B invests in 4 installments, each time investing 10,000 yuan. In the end, Investor A may not make a profit, while Investor B may reap significant gains.

Investment Tips

① Not all funds are suitable for rsp

Bonds, funds with stable performance, are more suitable for lump sum investment. RSP is suitable for funds with higher long-term returns but greater volatility, such as stock funds and equity-oriented hybrid funds, with index funds being a good choice among them.

2. Make a good plan

Before starting regular investment, you must set your investment goals, review your financial situation, and then make a regular investment plan based on your risk preferences, including specific funds, start time, frequency, amount, duration, etc.

For example, you can start regular investment when the price is below the value; the amount of regular investment should be based on future additional income; for regular investment over 5 years, it's okay to choose funds with slightly higher volatility when selecting funds.

Plans are not set in stone; they need to be adjusted according to personal circumstances and change, so adjust the plan promptly. However, it does not mean that it should be constantly changed; most of the time, you still need to stick to the plan.

3. Long-term investment

If the investment period is too short, the role of regular investment in smoothing risks is minimal. So once you start regular investment, do not be concerned about short-term ups and downs; do not stop regular investment casually, or switch products frequently; it is important to adhere to long-term investment.

4. Make use of strategies

Utilizing strategies on top of regular rsp may lead to better results.

For example, investing irregular amounts regularly, referencing moving averages, market cap, or valuation, and buying more as prices drop. Taking valuation as an example, investing more when undervalued and vice versa when overvalued. You can also consider diversified rsp, combining funds with different styles based on cross-industry, cross-market perspectives.

⑤ Learn to take profits.

"One who knows how to buy is a disciple, one who knows how to sell is a master." There are many ways to take profits, such as taking profits at a certain rate of return, taking profits during overvaluation, or taking profits at maturity, the best way is what suits oneself.