What is margin trading?

Core points

Margin trading refers to financing or margin trading from brokers with financable securities or cash in the account as collateral.

Margin trading uses leverage, which magnifies the gains or losses of investments.

When conducting margin trading, investors must deposit a certain initial margin and meet the maintenance margin requirements.

Detailed explanation of concept

Margin trading refers to the transaction in which the parties to securities trading only pay a certain margin (or securities) to the securities company when buying and selling securities, and the securities company provides financing or margin trading. Margin refers to the amount that needs to be deposited with a broker when borrowing money to buy securities.

When conducting margin transactions, investors use financable securities or cash in their brokerage accounts as collateral to guarantee loans. Interest rates on mortgages will be calculated and charged on a regular basis.

For example, if your broker has an initial margin requirement of 60% for a stock and you want to buy a stock worth $10000, your margin will be $6000 and the remaining $4000 will be lent to you by the broker.

If investors want to trade on margin, they need a margin account, not a regular cash account. A margin account is a standard brokerage account that allows investors to use cash or securities in their accounts as collateral for loans. Each broker has different requirements for the qualification of margin transactions and provides different terms of service. Brokers can set their own margin ratio requirements and interest rate charging terms.

Because investors use leverage in margin trading, both losses and gains are magnified.

Advantages and disadvantages of margin trading

Advantages:

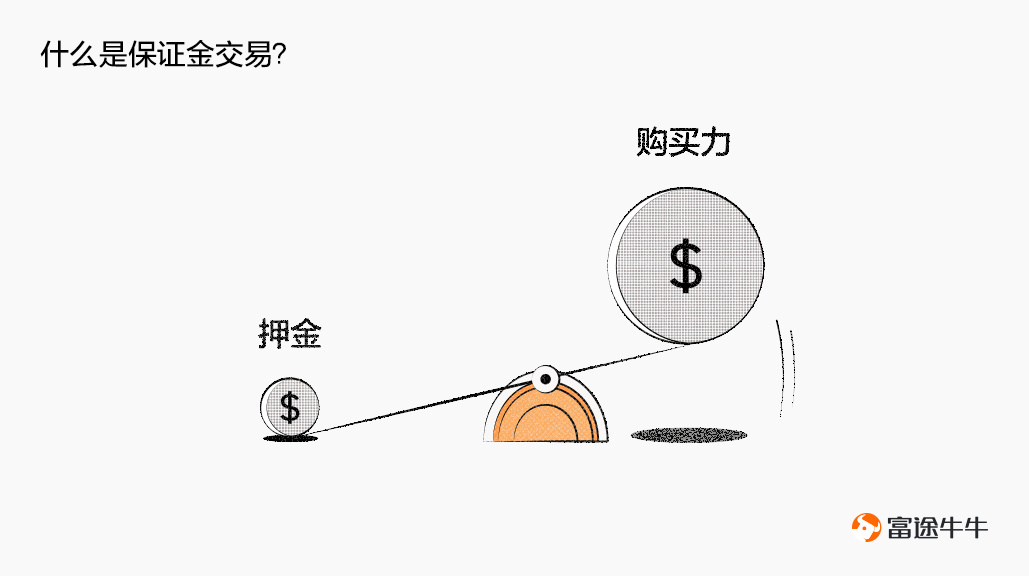

1. Increase in purchasing power

The most obvious benefit of margin trading is that it amplifies the purchasing power of investors. Margin trading allows you to borrow money for trading, so investors can buy more shares than they usually use cash accounts.

2. Higher potential returns

Margin trading makes use of capital leverage and magnifies the potential profit margins of investors.

Disadvantages:

1. Higher risk

It is risky to borrow money to invest. Regardless of whether the securities purchased appreciate or depreciate, investors must repay the amount borrowed.

2. Interest expenses

Borrowing money is not free. When using margin to invest, the investor must pay the corresponding interest according to the amount borrowed. Before making margin investments, investors should consider their costs-fixed interest charges. Even if the shares bought by investors maintain their value, the cost of borrowing money will lead to losses.

3. Margin requirement

When investors want to make margin transactions, they must deposit a certain initial margin, usually as a percentage of the transaction amount. Once the deposit is paid, it will be deposited into the margin account of the clearing house. The initial margin can be used as a guarantee to prevent the investor from failing to perform the contract due to any adverse change in price.

After the margin trading takes place, the ratio of the amount of margin to the market value of the securities purchased will change with the fluctuation of the market, and investors need to ensure that this ratio is above the minimum level set by a broker.

According to the Regulation T of the Federal Reserve, the standard initial margin requirement for stocks is at least 50%, and the maintenance margin requirement is 25%. Brokers may set different margin requirements according to specific securities.

If the investor fails to meet the maintenance margin requirement, a margin call may be triggered, informing the investor that additional funds must be deposited. If the investor fails to meet the margin requirement within the prescribed time limit, the securities company may forcibly close its position.