What is the net profit margin?

Key Points

Net margin shows the percentage ratio of profit after deducting all costs, expenses, and corporate income tax to sales income.

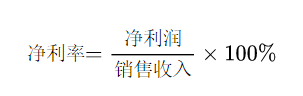

Net margin = net income / sales revenue × 100%

Net margin is an important indicator to measure a company's profit-making ability, but it may be influenced by one-time items like asset sales.

Concept Explanation

Net margin shows the percentage ratio of profit after deducting all costs, expenses, and corporate income tax to sales income (also known as revenue).

Net margin is an important indicator to measure a company's profit-making ability. Net margin can be used to assess whether a company generates enough profit from its sales and whether it has reasonable sales and indirect costs.

Generally, the higher the net margin, the better. Ideally, investors would like to see a stable growth in a company's net margin.

Net margin has its limitations. Firstly, it may be affected by one-time projects. For example, the sale of assets by a company may increase its net margin at that time, but it is only temporary.

Secondly, net margin also cannot reflect the growth of sales or revenue. For instance, a company's revenue may be growing, but if the growth rate of its costs and expenses (such as operating costs) is faster than the revenue, its net margin will shrink.

Cases of net margin

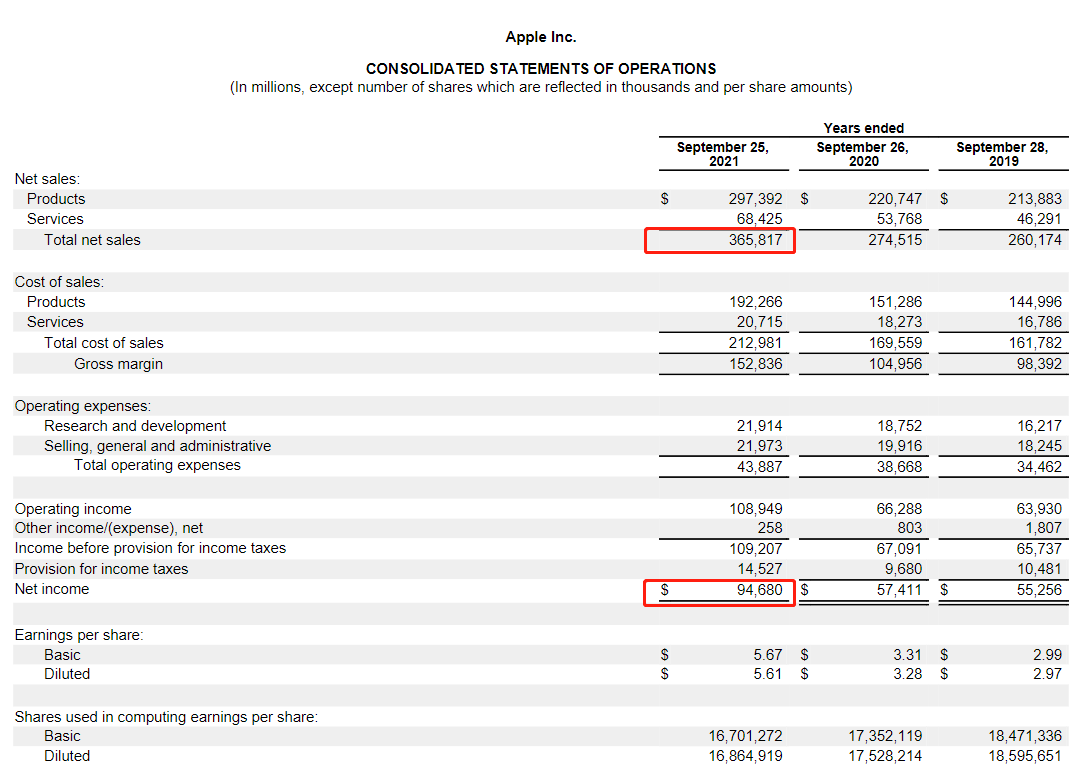

The following is the income statement of Apple Inc. as of the fiscal year 2021 in the annual report of 2021:

The annual report shows:

Apple's net income for fiscal year 2021 was $94.68 billion;

Apple's revenue for fiscal year 2021 was $365.817 billion.

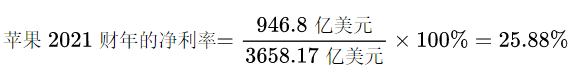

It can be concluded