What is the volume-price relationship?

Key Points

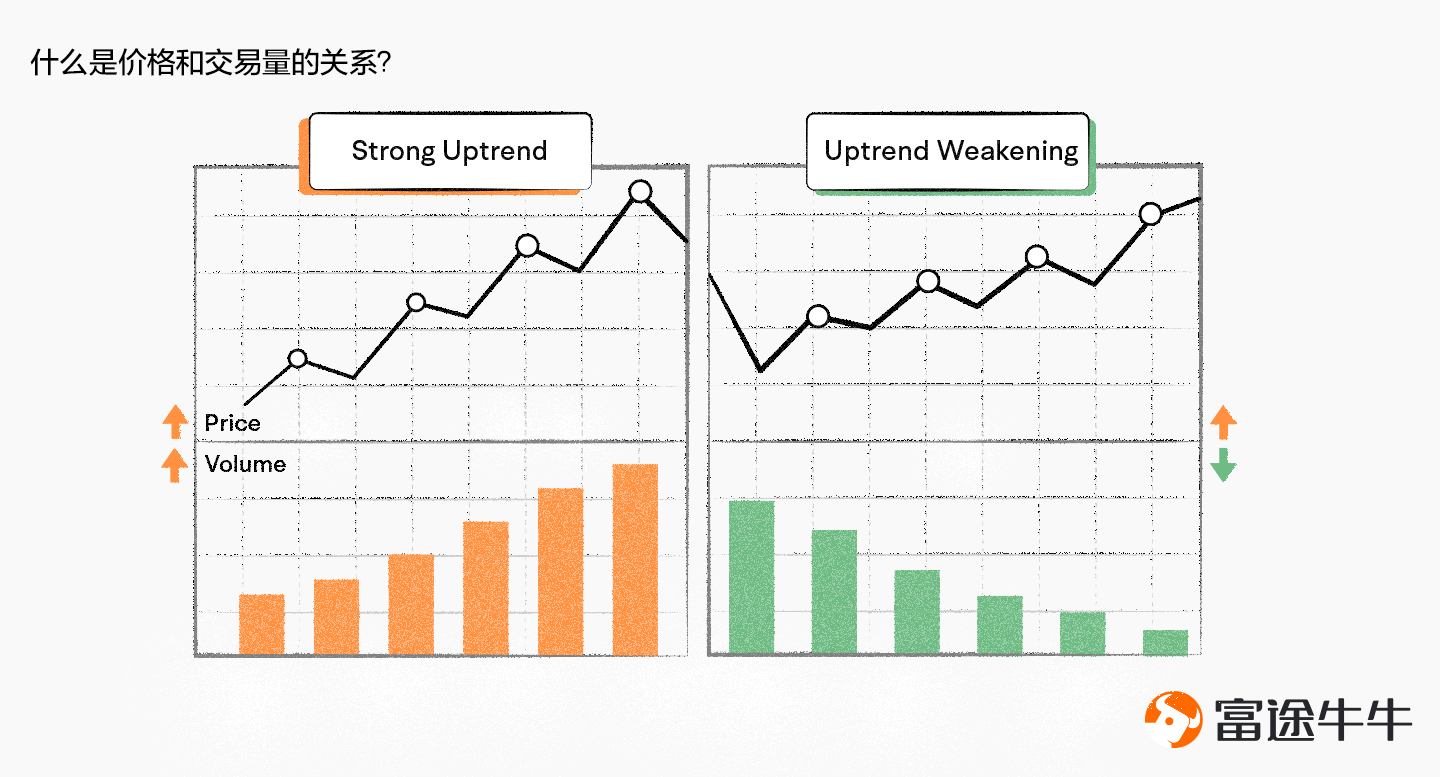

The interactive relationship between trading volume and stock price is a very important observation indicator in the stock market.

When observing the index, trading volume generally refers to the total turnover; when observing individual stocks, trading volume can refer to both the number of shares traded and the turnover.

The volume-price relationship mainly includes eight situations.

Conceptual Understanding

Volume-price relationship is a term in the stock market.

Volume generally refers to the trading volume of a large-cap index or a single stock in a unit of time, including minute volume, daily volume, monthly volume, annual volume, and so on. When observing the index, trading volume generally refers to the total turnover in a unit of time; when observing individual stocks, trading volume can refer to both the number of shares traded and the turnover.

Price refers to the price of a large-cap index or individual stocks within a unit of time, mainly referring to the closing price, including the opening price, highest price, lowest price, etc.

In the securities market, there is a certain relationship between the high and low points of the index, or the rise and fall of individual stock prices, and the size of the trading volume at that time, which is called the volume-price relationship.

The volume-price relationship is an important reference indicator for investors to determine the future trend.

How to use the volume-price relationship indicators

Investors often say things like 'large volume, high price' or 'small volume, low price,' which are actually judgments of the stock market trend based on different volume-price relationship situations.

Generally, we divide the volume-price relationship into eight scenarios for analysis.

First, volume increases while price remains stable. Gradually increasing trading volume with stable prices indicates exhaustion of downward momentum in a downtrend, accumulating rebound momentum at the bottom; in an uptrend or sideways trend, increasing trading volume with stable prices indicates resistance to the rebound, but as long as the upward trend is not significantly disrupted, the market is expected to continue.

Second, volume increases while price rises. Matching volume and price is a short to medium-term buying signal, with continuously increasing trading volume and obvious stock price increase.

Third, volume remains steady while price rises. The trading volume remains relatively stable without significant expansion, with stock prices continuing to rise, indicating that the uptrend has entered a stable period.

Fourth, volume decreases as prices rise. The decrease in volume while the stock price continues to rise indicates that the uptrend is nearing its end.

Fifth, volume decreases as prices stabilize. With a significant decrease in volume after a sharp increase in stock prices, a sideways consolidation appears, which is a sell signal. If there is a sudden surge in large bullish or bearish candles at this stage, regardless of the news, one should decisively sell.

Sixth, volume decreases as prices fall. Continuous decrease in volume accompanied by a drop in stock prices is a sell signal.

Seventh, volume stabilizes as prices fall. When the volume stops decreasing but stock prices continue to decline, this indicates a continued sell signal.

Eighth, volume increases as prices fall. While the stock price continues to fall, an increase in volume signals a potential reversal at the bottom in the later stage.

Summary:

Usually, volume is not easily manipulated by block orders, so it is often regarded as an indicator that truly reflects the flow of funds. By combining the interactive relationship between volume and price, using volume-price analysis effectively can help determine the current high and low levels of stock prices.