What is the Russell Index?

Key Points

The Russell index is currently the most widely covered index in the capital markets.

The Russell index is based on the U.S. market as the original benchmark, focusing mainly on U.S. listed companies.

The Russell index is compiled using a market capitalization weighted average method, which is one of the best tools to measure the stock prices of small businesses.

Concept Explanation

The Russell index mainly refers to the U.S. index series launched by the American company Frank Russell in 1984 to measure the U.S. market and track the performance of large and small U.S. stocks.

As the index compilation gradually expands, the combination of the Russell U.S. index and the Russell style index now covers approximately 10,000 stocks from 63 countries worldwide, encompassing 98% of the investable market.

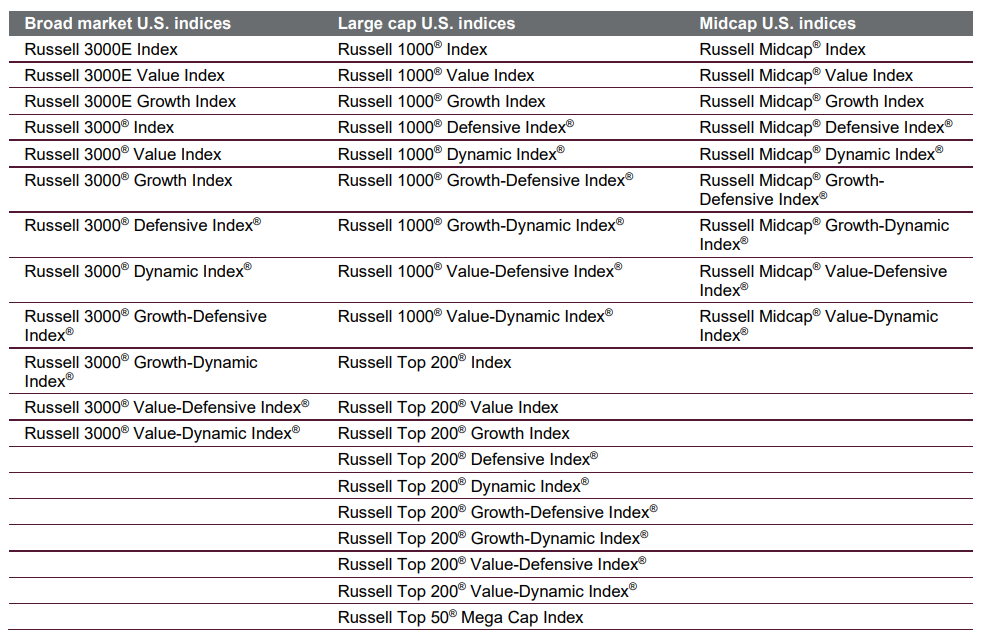

According to indicators such as country, region, industry, and size, the Russell index has over 300 sub indices, with the most important ones being the Russell 1000 index, Russell 2000 index, Russell 3000 index, among others.

In 2015, London Stock Exchange Group (LSEG) subsidiary FTSE Group and Frank Russell Company jointly launched the FTSE Russell Index trademark, with the Russell Index belonging to the FTSE Russell Index system.

Index Characteristics

Compared with the traditional three major US stock indexes, the Russell Index can better reflect the overall market.

Specifically, the Russell Index has the following three major characteristics:

First, the core of the Russell US Index is of 'American nationality'. Since the inception of the Russell Index, it has used the US market as the original benchmark, focusing on US domestic listed companies.

Second, the Russell Index does not rely on the subjective judgment of index institutions, but strictly adheres to market capitalization as the basis for decision-making, determining the position of stocks in the index through a weighted average method, making it one of the best tools for measuring small business stock prices.

Third, the Russell Index has derived Russell Value Index, Russell Growth Index, Russell Defensive Index, and so on based on market styles, starting to cover listed companies globally, with significant differences in stock selection styles.

Index Performance

The Russell index can reflect the performance benchmarks of various types of companies and is widely adopted by many fund companies and financial institutions globally as a reference benchmark. Therefore, it often serves as the basis for index-linked products, including various index tracking funds, derivatives, and ETFs.

Taking the Russell 1000 index as an example.

The Russell 1000 index is compiled by taking the stocks of the top 1000 companies by market capitalization from the Russell 3000 index, weighting them on average, and reconstituting the components annually to ensure a true reflection of the basic situation of the largest publicly traded companies in the USA.

From January 1, 2000 to the present, the trend of the Russell 1000 index is as shown in the graph:

Since 2022, the Russell 1000 index has dropped by 18.94%, falling between the Nasdaq (down 27.42%) and the Dow Jones (down 13.97%).

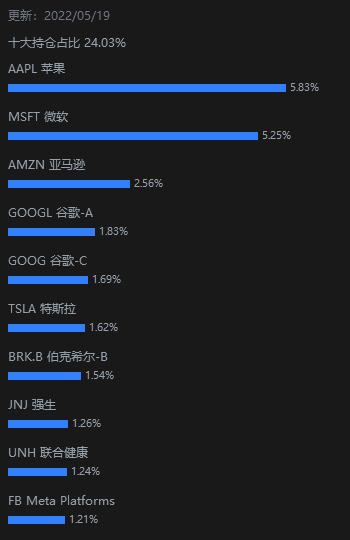

The main ETF tracking the Russell 1000 Index is IWB (iShares Russell 1000 Index ETF).

The top ten heavy-weighted stocks as of May 19, 2022 are as follows: