What is the volume weighted average indicator?

Key Points

- VWAP, the volume-weighted average price indicator, is used to measure the weighted average price by quantity.

- The VWAP indicator is usually used together with intraday charts.

- If the stock price is running above VWAP, it indicates that the current stock price is in an upward trend.

Conceptual Understanding

The Volume-Weighted Average Price (VWAP) is a technical analysis tool used to measure the weighted average price by quantity.

How to Calculate VWAP

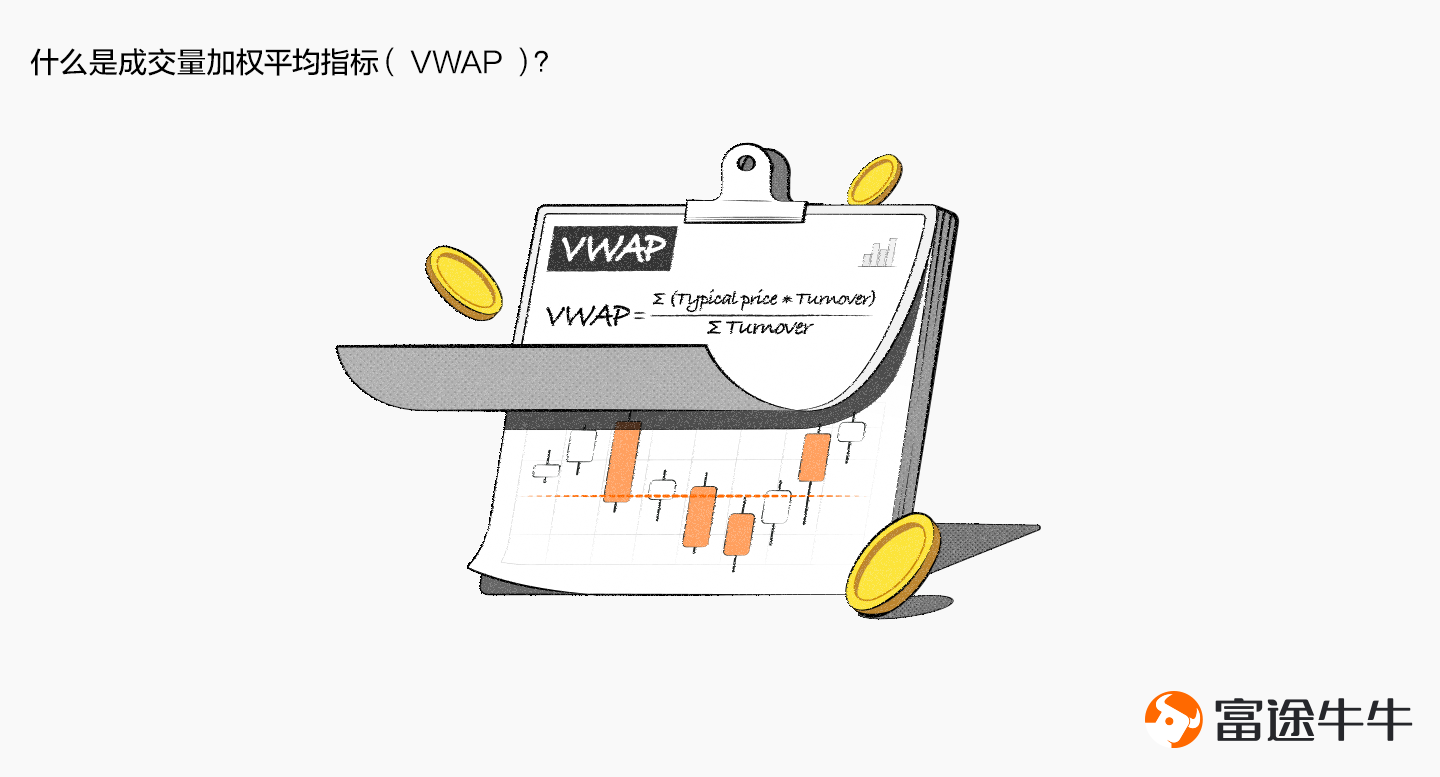

The basic formula for calculating VWAP is as follows:

VWAP = ∑ (typical price * volume) / ∑ volume

where the typical price = (high + low + close) / 3

How to Use VWAP

The VWAP indicator is usually used together with intraday charts to confirm the basic trend of intraday prices.

The volume-weighted average price indicator is similar to a moving average line.

If the stock price is running above VWAP, it indicates that the current stock price is in an upward trend; if the stock price falls below VWAP and runs below it, it indicates that the current stock price is in a downward trend.

Conclusion

The VWAP indicator can show the average price of assets relative to the trading volume during a specific period. However, VWAP is a lagging indicator, meaning it does not have predictive power over prices. Therefore, many investors use it as a tool for intraday analysis.