Learn Premium

Cutting interest rate investment package

With the impending interest rate cut, how should we invest in biotechnology stocks that are sensitive to interest rates?

Recently, the US economy and inflation data have weakened, and the expectation of a Fed rate cut has risen again.

According to the CME rate observation tool, as of July 19th, the market expects that there is more than a 90% probability that the Fed will cut interest rates by 25 basis points to 5%-5.25% in September.

In addition, the market expects two more rate cuts in the second half of the year, and year-end interest rates may fall to around 4.5%. If it develops as expected, this will be the first turning point since entering the interest rate hike cycle in 2022.

Standing at the door of the rate cut channel, industries suppressed in a high-interest rate environment are expected to see the sun again, and the biotech industry is one of them.

Learning benefit: if you want to track real-time investment strategies under the expectation of interest rate cuts, you can unlock and join.Futubull official communication group There is a professional analyst available for 1-on-1 investment inquiries and professional mooers to share investment logic in real-time.![]()

Interest rate-sensitive sectors

The performance of the biotech sector is highly correlated with macroeconomics, especially Fed interest rate policies.

Taking the SPDR S&P Biotech ETF ($SPDR S&P Biotech ETF(XBI.US)$) as an example, after the outbreak of the epidemic, the Fed cut its policy rate to 0, and XBI also experienced a wave of rise. After 2021, the Fed entered an interest rate hike cycle, and XBI experienced a decline of more than 60%.

In the second half of 2022, the Fed entered the "Higher for Longer" phase, slowing down the pace of rate hikes while maintaining high interest rates for longer.

The trend of the biotech index has also turned into a volatile market, fluctuating between 60 and 100 for about two years, with the trend during this period being greatly affected by the US interest rate environment.

For example, in October 2023, there was a setback in the anti-inflation process, and the market even expected that the Fed would further raise interest rates to suppress inflation. The yield on 10-year US Treasuries also briefly exceeded 5% during this period, reaching the highest level since the interest rate hike cycle; the XBI index continued to fall during the same period, experiencing a double bottom.

After inflation eased, the market's expectations for Fed action gradually shifted from rate hikes to maintaining stability and then to preparing for rate cuts, and XBI also experienced a rebound. However, even so, it failed to achieve effective breakthroughs, and high interest rates, like an invisible hand, suppressed the sector's performance.

Data source: Futubull. The data is as of the closing on July 19, 2024. The case is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why would a rate cut be good for the biotech sector?

Biotech combines both pharmaceutical and technological properties, and Merck & Co ($Merck & Co(MRK.US)$) and Eli Lilly and Co ($Eli Lilly and Co(LLY.US)$Companies such as Nvidia, Microsoft and others are unafraid of constantly changing interest rates, leading the entire market with the technology sector in the lead. Why do biotechnology companies, represented by the combination of two industries, have to pay close attention to interest rates?

Different from pharmaceutical companies with larger scale and stable cash flow, biotech companies are mostly small and medium-sized enterprises (SMEs). Biotech companies' business is easily impacted by the development of a single drug and can fluctuate dramatically. Cash flow is also unstable. Developing new drugs requires huge amounts of funding and time, and the probability of failure is high. Historical data shows that about 90% of new drugs fail to receive approval.

During this period, biotech companies may not be profitable for a long time and rely heavily on venture capital funds or going public on stock exchanges (IPOs) to obtain financial support.

It can be seen that funds are the lifeblood of biotech companies. Once the inflow of funds is lost, bioech companies often fall into difficulties. Interest rates are the key factor affecting the cost of funds.

In periods of low interest rates, financing and mergers and acquisitions in the field of biotech are often very active, and companies can maintain daily operations even without external financing by borrowing at lower costs. However, once entering a high interest rate era, everything is reversed.

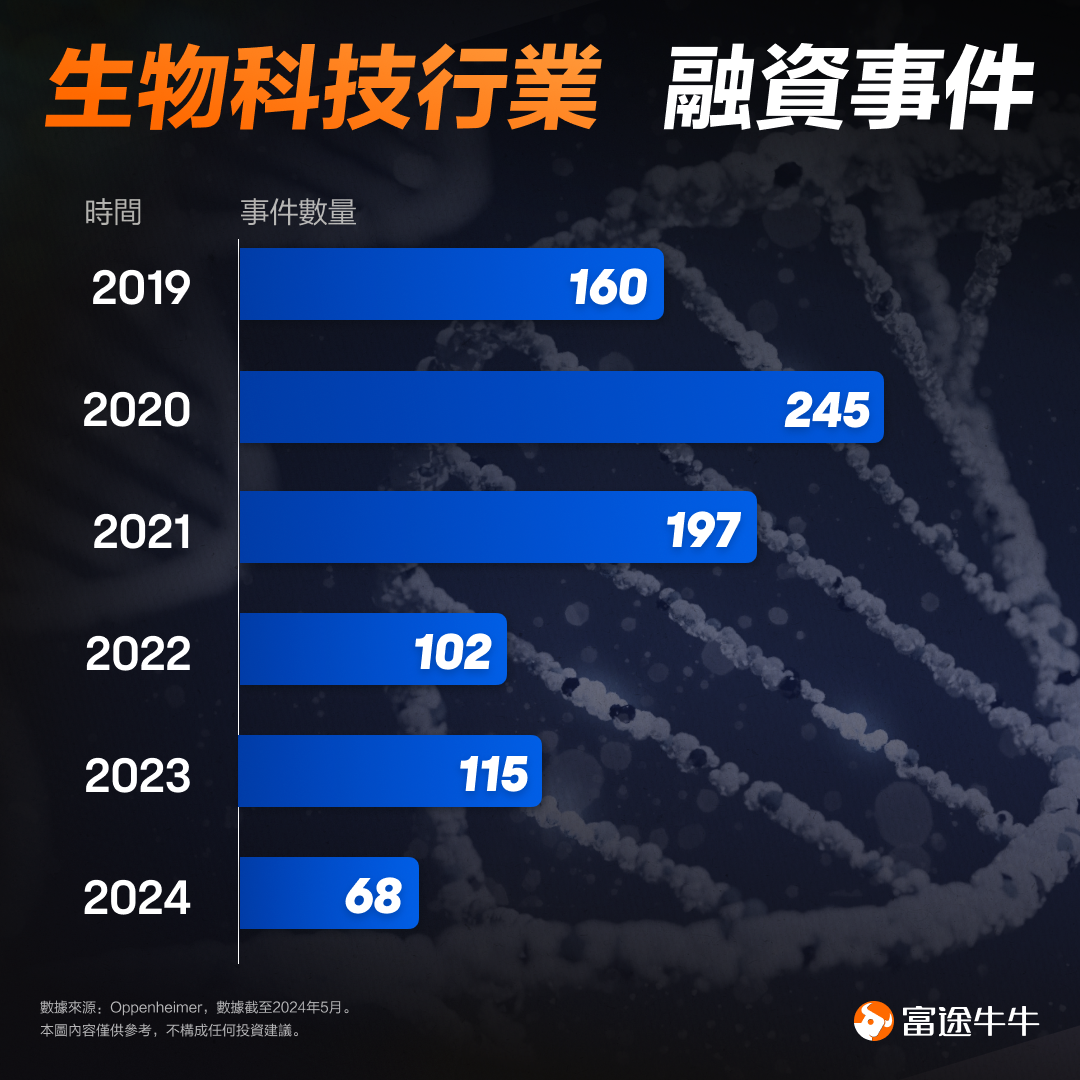

According to research institution Oppenheimer's statistics, in 2020, when interest rates were most loose, there were 245 financing events in the biotech industry, and there were nearly 200 in 2021 when inflation began to emerge. When the Federal Reserve began to raise interest rates in 2022, biotech financing was directly cut to around 100. Although it has recovered somewhat in the following two years, it has not been able to recover to previous levels under the influence of high interest rates.

How to invest in biotech stocks?

The so-called 'Spring River Warm Duck Prophet', biotech companies that are highly sensitive to interest rate changes often perform well before and after the rate cut cycle begins.

Morgan Stanley tallied the relationship between biotech and rate cuts in a recent report. In the months leading up to the first rate cut, the biotech sector consistently outperforms the market, but after the first rate cut lands, it underperforms for about a month. After consolidating, biotech companies will start to rise again and will generally rise by about 20% to 30% within 6 to 12 months after the first rate cut.

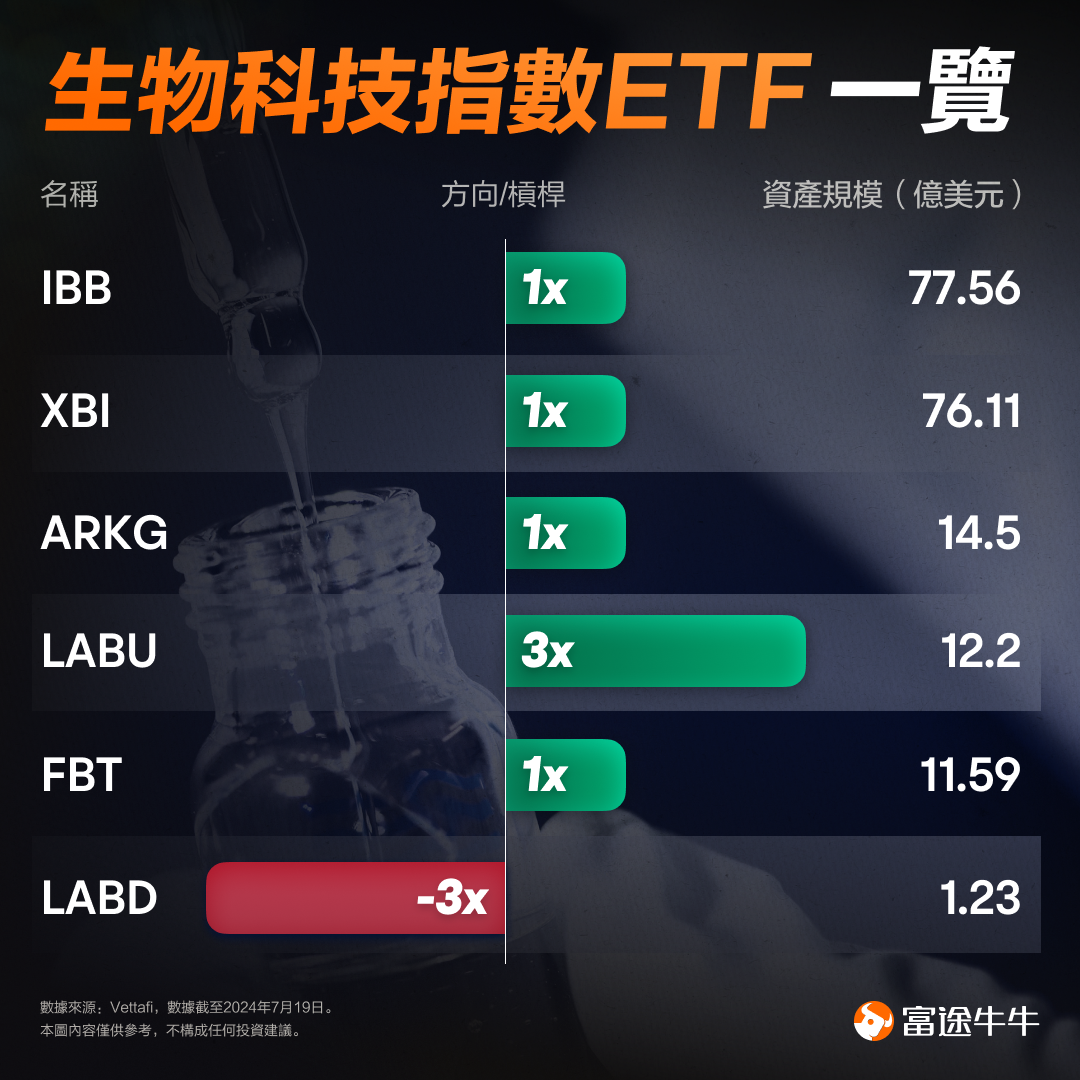

Biotech stocks are generally smaller in scale, with many companies involved in the sector, and drug development processes are complex. Company stock prices often fluctuate significantly due to a single drug. Therefore, for ordinary investors, industry-related ETFs may be a better choice. Here are a few representative ETFs for your reference:

IBB ($iShares Biotechnology ETF(IBB.US)$) and XBI (SPDR S&P Biotech ETF (XBI.US)) are larger in size, both close to $8 billion. ARKG ($ARK Genomic Revolution ETF(ARKG.US)$) is an actively managed ETF under "Sister Wood" Cathie Wood. LABU ($Direxion Daily S&P Biotech Bull 3x Shares ETF(LABU.US)$) and LABD ($Direxion Daily S&P Biotech Bear 3x Shares ETF(LABD.US)$) are leveraged ETFs, with three times long/short respectively. It should be noted that, although leveraged ETFs can achieve excess returns, losses can also be magnified, and the losses incurred during operation should also be noted.

Related risks

Interest rates fail to decline as scheduled: Although the market seems to have already made up its mind about Fed rate cuts, there is a possibility that inflation may rebound again in the next few months, causing the Fed to postpone action, and the biotech sector may continue to return to a turbulent market. The Fed will hold a FOMC meeting at the end of July and announce the rate decision on the afternoon of July 31st, and investors should keep an eye on it.

High volatility: R&D and clinical trial results, regulatory approvals, market competition, and investor sentiment all affect the performance of biotech companies. The overall market capitalization of companies in the sector is relatively small, and overall volatility is higher.

Risk disclosure: This content does not constitute a research report, is for reference only, and should not be used as a basis for any investment decisions. The information involved in this article is not a comprehensive description of the securities, markets, or developments mentioned. Although the information source is considered reliable, the accuracy or completeness of the above content is not guaranteed. In addition, no guarantee is given for any statements, opinions, or forecasts provided in this article.